I've been waiting for months to sell NTBR:Northern Bear, which although I'm sure is a great company, is doing nothing and going nowhere and incredibly illiquid thanks to the tiny number of shares in circulation. Last time I attempted to sell I couldn't get a price. This time I did, and sold for a £57.54 loss, but liberated £1,344 to buy more OPTI:Optibiotix at these crazy bargain prices.

I bought 2,044 shares at 65.89p costing £1,355.74. Given my ISA holdings cost 86.49p each and my SIPP holdings 77.1p these are so, so cheap. Unfortunately, with the bid price now 65p my total holding is losing £1,389.68 retaining it's nemesis share status. However, I am absolutely confident this will be £1 a share before too long, at which point it will be up by £1,744. It just needs a few partnership announcements and then the floating of Skinbiotix. It does mean that Optibiotix now constitutes 12.6% of my combined portfolios.

Meanwhile, worst performer this week was AMYT:Amryt Pharma dropping 15%, my second biggest holding at 8.9% of my portfolio. Somewhat devastating given each 1p loses me £272. CRL:Creightons dropped 12% but I think this is profit taking after a long run upwards. TLOU:Tlou Energy also had a bad week after a recent good run, falling 10%. You could almost believe that any AIM share that goes on a run is doomed to plummet shortly afterwards.

At the good end of the performance spectrum, RED:RedT Energy reversed it's recent post-climb drop to increase 12% and is one of my best performaing shares. Share of the Week was IOG:Independent Oil & Gas which has recovered from discovering tar, bought the Vulcan gas fields and the share price promptly climbed 33% taking this back into a 17% profit.

Here's the ISA and share account performance after week 64

| Weekly Change | |||

| Portfolio cost | £41,334.88 | -£46.15 | |

| Portfolio sell value (bid price - commission) | £36,921.62 | (-10.7%) | -£854.09 |

| Potential profits | £2,563.48 | -£167.13 | |

| Yr 2 Dividends | £140.67 | +£8.31 | |

| Yr 2 Profit from sales | £2,338.74 | -£57.54 | |

| Yr 2 Average monthly cash profit | £892.53 | -£100.55 | |

| Yr 2 Avg annual % of current portfolio cost | 25.9% | ||

| Total Dividends | £808.60 | +£8.31 | |

| Total Profit from sales | £6,179.00 | -£57.54 | |

| Average monthly cash profit | £468.53 | -£10.82 | |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Avg annual % of current portfolio cost | 13.6% |

The portfolio cost dropped slightly due to the loss when selling NTBR:Northern Bear. Sell value plummeted in a most disasterous fashion, but potential profits only down by £167 so most of this is deepening loss, and mainly OPTI:Optibiotix, AFG:Aquatic Food and AMYT:Amryt Pharma. One day they will turn around!

There was a small dividend from CMCL:Caledonia Mining which pays out a quarterly dividend. Unfortunately that wasn't enough to make up for the damage of the sale loss in reducing average monthly profit by £10.82 a month.

I'm getting really fed up with this graph. This is now the most consistently bad performance since I started, and all the more frustrating given the great performance just before it started going wrong. I think the reason is the high percentage of volatile high-risk shares in my portfolio. It does mean that if I've called it right, something very interecting could happen in the next few months.

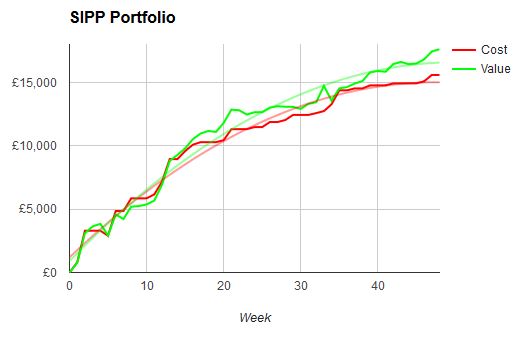

The SIPP looks like this after week 48

| Weekly Change | |||

| Portfolio cost | £15,593.67 | +£0 | |

| Portfolio sell value (bid price - commission) | £17,625.12 | (+13%) | +£174.62 |

| Potential profits | £2,689.64 | +£194.15 | |

| Dividends | £413.19 | +£122.40 | |

| Profit from sales | £2,349.86 | +£0 | |

| Average monthly cash profit | £245.49 | +£6.07 | |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Avg annual % of current portfolio cost | 18.9% |

The pension fund has a much lower risk profile than the other portfolios, and it certainly shows. Yet another steady rise taking the paper value 13% higher than cost. Not only that, the £122.40 dividend was a very nice surprise. If I'd realised it was coming, I would have held fire for a week to get BMN:Bushveld Minerals. £5.03 came from JLG:John Laing Group and £117.37 came from CAML:Central Asia Metals. Did I mention this is the best run company in my portfolio? I will be getting more of these if the price dips again, as in just over 12 months I've had £260.33 dividends and they're up by £537.29 above purchase price, although they do make up 6% of my portfolio. The dividend is enough to push up the projected average monthly profit by £6 a month despite there being no sales this month.

And so the graph continues to improve week after week.

Here's the trading account after week 14

| Weekly Change | |||

| Portfolio cost | £499.95 | +£0 | |

| Cash | £0.05 | +£0 | |

| Portfolio sell value (bid price - commission) | £471.63 | (-5.7%) | +£26.86 |

| Potential profits | £0 | +£0 | |

| Dividends | £0 | +£0 | |

| Profit from sales | £0 | +£0 | |

| Average monthly cash profit | £0 | +£0 | |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Avg annual % of current portfolio cost | 0% |

Could it really be? Could SLP:Sylvania Platinum really be heading towards profit? Will next week allow me to sell them and do something exciting with a short term basket case stock? Actually no, as I'll be off on holiday for a few weeks after next weekend so reckon I'll leave this and give it a chance to grow so I can have more fun with it just before Christmas.

Ooooh - it's so close to crossing the line - the long wait may almost be over!

That's it for Week 64. All eyes are now on OPTI:Optibiotix. I've committed myself massively to the success of this company because I believe in the story, the approach, the fact that lots of deals have been done but wrapped in non disclosure agreements, and that there will soon be a load of free shares in Skinbiotix which could become a multi-billion dollar company. Call me nieve, but when I'm so utterly convinced I have to go with it, and woe betide if I get this one wrong!