There were still loads of shares in the red this week, with small drops being hidden by the big rise in OPTI:Optibiotix.

CAML:Central Asia Metals had an utterly disastrous week. I expected a dip on ex-dividend day, but there was selling into the dividend as people took the profits from the gains prior to the drop on ex-date, but then more people sold just after they qualified for the dividend, which was a mistake as the price had fallen so much more than the dividend is worth. My holding fell by 19% of the original purchase price, so a share that I recently had to top-slice to get down to 10% of my portfolio is only making up 7.9% of it. Last time it dropped to this level was early February, but it reached a new high a month later, so I'm confident when things settle down this will be back up around 340p.

LION:Lionsgold was rubbish again this week and dropped 11%. The less said about this massive mistake the better!

VRS:Versarien had a really good week and climbed 7%, putting it back into profit albeit only £39. Hopefully the recent blip is out of the way and this can slowly but steadily climb from here. That's never going to happen though. This one's going to be manipulated and traded for a long time yet.

SBTX:SkinBioTherapeutics followed on from last week's amazing performance with another 7% rise, and is only 12% down on my purchase price 20 seconds after the IPO launch. Looking at the number of shares held by OPTI:Optibiotix, there's an outside chance I could get up tp 30,000 of these if they offer one share for each two OPTI:Optibiotix shares. That would be nice!

Share of the Week OPTI:Optibiotix climbed 9p this week which was around 14%. With my enlarged holding, 9p is worth £5,697 so it would have been a negative week without this contribution. My holding is now making a loss of £768 so no longer Nemesis Share. There's a big question mark over whether this rise will hold though. Look at the chart and you can see we've been here before, but the traders start selling as soon as there's a spike. Without firm revenue predictions to bring in the institutions, this will carry on and we'll be back at 56p before long. One day it will stop, and that day is coming closer!

Nice tick up almost halving the deficit

Here's the ISA and share accounts performance

| Weekly Change | |||

| Cash | £10.86 | +£0 | |

| Portfolio cost | £51,874.49 | +£0 | |

| Portfolio sell value (bid price - commission) | £45,126.95 | (-13%) | +£3,594.21 |

| Potential profits | £260.12 | -£74.44 | |

| Yr 3 Dividends | £44.15 | +£0 | |

| Yr 3 Profit from sales | £8,033.77 | +£0 | |

| Yr 3 Average monthly cash profit | £917.75 | (21.2%) | -£24.80 |

| Total Dividends | £1,223.20 | +£0 | |

| Total Profit from sales | £14,746.27 | +£0 | |

| Average monthly cash profit | £483.20 | (11.2%) | -£3.43 |

| (Sold stocks profit + Dividends - Fees / Months) |

Potential profits are actually down thanks to the 4% drop in MTFB:Motif Bio. However sell value is massively up thanks to OPTI:Optibiotix. Average monthly profit will tick down at 0.1% a week now so I have at least 12 weeks buffer before I go back below my 10% target. This might accelerate if the portfolio value goes up - I should hope!

Still a long way to go, but nice to see it heading in the right direction.

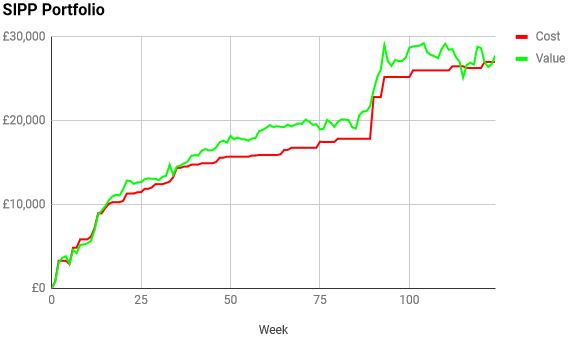

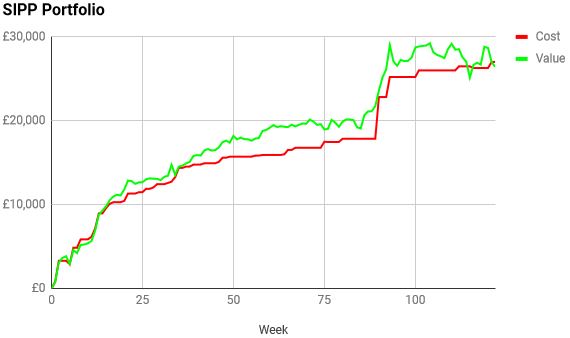

The SIPP looks like this after week 126

| Weekly Change | |||

| Cash | £19.97 | +£0 | |

| Portfolio cost | £27,016.24 | +£0 | |

| Portfolio sell value (bid price - commission) | £27,897.06 | (3.3%) | +£1,442.87 |

| Potential profits | £2,765.78 | -£721.46 | |

| Yr 3 Dividends | £0 | +£0 | |

| Yr 3 Profit from sales | £1,023.84 | +£0 | |

| Yr 3 Average monthly cash profit | £191.53 | (8.5%) | -£9.12 |

| Total Dividends | £916.10 | +£0 | |

| Total Profit from sales | £9,949.03 | +£0 | |

| Average monthly cash profit | £366.82 | (16.3%) | -£2.93 |

| (Sold stocks profit + Dividends - Fees / Months) |

Potential profits were crippled thanks to a dreadful week for CAML:Central Asia Metals and a drop for LGEN:Legal & General following dividend ex-date. No matter, as they will both bounce back quickly, and OPTI:Optibiotix climbed enough to offset that and still finish up £1,442 better off. At the current rate of decline for the average monthly profit, I won't need to sell a share for 63 weeks and still be above my 10% target. I somewhat doubt that's going to happen though!

Back in the black!

The trading account was looking more optimistic after week 91. That's not the case after week 92!

| Weekly Change | |||

| Cash | £0.03 | +£0 | |

| Portfolio cost | £345.65 | +£0 | |

| Portfolio sell value (bid price - commission) | £269.13 | (-51.1%) | -£37.67 |

| Potential profits | £0 | +£0 | |

| Year 2 Dividends | £0 | +£0 | |

| Year 2 Profit | -£218.50 | +£0 | |

| Yr 2 Average monthly cash profit | -£23.67 | (-82.2%) | +£0.61 |

| Dividends | £1.15 | +£0 | |

| Profit from sales | -£241.35 | +£0 | |

| Average monthly cash profit | -£11.31 | (-39.3%) | +£0.13 |

| (Sold stocks profit + Dividends - Fees / Months) |

Back down to a 50% loss and unlikely to be going anywhere upwards soon. The only slight ray of hope is that if i had been watching this share in anticipation of a pump, I probably would be buying around now, but selling at the price I originally bought them - doh!

Hopeless.

Next week will reveal whether OPTI:Optibiotix can continue the upward momentum and get into profit, or whether we'll return to the cycle of traders selling out and forcing down the price. If the traders are circling then I only hope this time they let the price rise a bit more before they start. I'd much rather be trapped in a 70p-80p range than a 50p-60p range, as all I can think of is how many people are arriving late on the scene and buying in cheaper then me! Does that make be a bad person?

I'm expecting CAML:Central Asia Metals and LGEN:Legal & General to recover from their blip so the SIPP should have a good week next week. KIBO:Kibo Mining must surely be near the signing of their Power Purchase Agreement which could see an epic rise back into profit. I don't think any other news is expected, so maybe we'll have a nice quiet week...