Worst performer was the disastrous holding company for my CWR:Ceres Power proceeds. I put it all into C4XD:C4X Discovery Holdings and it was looking good at first, but now they have dropped to an all-time low and fell 8% this week. Meanwhile CWR is getting towards where I want to buy back in, but I don't have the funds available to do it unless I take a loss and wipe out my profits from the initial sale. Note to self - never do this again!

Next worst performer was TLOU:Tlou Energy which fell 6%. I'm a bit confused with this one, as they seem to be in a far better place than they were when the shares were 16p yet they have more than halved to 6p. My holding is down 32% and losing £863 but my confidence hasn't been shaken. It's a sector I've decided not to invest in any more due to environmental concerns for climate, but my principles don't stretch to making a loss.

Nice that there were very few big fallers this week. However there were very few big risers too. VRS:Versarien recovered from last week's drop and climbed 6% to go back into the black. They are only 2% up but that's better than most of my shares. They actually got an order for some graphene which will help rather a lot.

IQE:IQE was bound to have a small recovery after the disaster last week. My SIPP holding climbed 5%, trading account climbed 6% and ISA holding which I bought at a much lower price climbed 9%.

Share of the Week goes to OPTI:Optibiotix which climbed 10p or 15% and reversed the slide of the last few weeks. When this climbs it climbs quick. The rise accounted for £8,290 of this week's gains, which is nearly all of them. My portfolio performance it totally dependent on this one company. Not terribly balanced, but with £12,961 potential profits when things haven't even got started yet, I may not need any other shares. The increase was down to two significant announcements. The first was a manufacturing and distribution deal with Agropur for North America and the second was the appointment of Goetzpartners Securities Limited to provide financial advisory services, including sector specific equity research and investor support services. This should make up for the chronic inadequacies of the broker Finncap in encouraging investment, especially with planned spin-off of Probiotics and the sale of SBTX:SkinBioTherapeutics shares so they can pay us our long awaited dividend.

I went through my accounts and added all my cash injections as this chart wasn't really different enough from the other one. Now it shows the difference between the cash I put in and the cost of the shares. It reveals I'm doing ok, but given the cost and injection lines are almost identical in shape, suggests all my profits were made a long time ago and I've been treading water for the last 12 months.

Back above the trend line and nearly back into the black.

Here's the performance of the ISA and share accounts

| Weekly Change | |||

| Cash | £23.23 | +£0 | |

| Portfolio cost | £57,827.12 | +£0 | |

| Portfolio sell value (bid price-commission) | £55,008.64 | (-4.9%) | +£5,108.82 |

| Potential profits | £8,331.17 | +£5,055.88 | |

| Yr 4 Dividends | £88.07 | +£0 | |

| Yr 4 Profit from sales | £1,606.13 | +£0 | |

| Yr 4 Average monthly cash profit | £152.75 | (3.2%) | -£3.32 |

| Total Dividends | £1,326.40 | +£0 | |

| Total Profit from sales | £20,303.25 | +£0 | |

| Average monthly cash profit | £457.79 | (9.5%) | -£2.26 |

| (Sold stocks profit + Dividends - Fees / Months) |

All increase in potential profits was thanks to OPTI:Optibiotix and that left a £50 improvement in losses across the rest of the portfolio. You could say it was a flat week everywhere except OPTI:Optibiotix.

The new injection line shows that nothing has been added to the account for 12 months whereas there has been a slight increase in costs from re-invested profits, but not a lot.

Back above the trend line and I think the mountain is well and truly factored in now, so in a couple of months the line should flatten , but will be remarkably close to the £0 line.

The SIPP looks like this after week 187

| Weekly Change | |||

| Cash | £84.80 | +£0 | |

| Portfolio cost | £41,248.68 | +£0 | |

| Portfolio sell value (bid price - commission) | £42,401.74 | (2.8%) | +£3,284.90 |

| Potential profits | £5,679.12 | +£3,072.33 | |

| Yr 4 Dividends | £361.99 | +£0 | |

| Yr 4 Interest | £0.07 | +£0 | |

| Yr 4 Profit from sales | £732.65 | +£0 | |

| Yr 4 Average monthly cash profit | £140.22 | (4.1%) | -£4.67 |

| Total Dividends | £1,704.24 | +£0 | |

| Total Interest | £0.10 | +£0 | |

| Total Profit from sales | £11,277.57 | +£0 | |

| Average monthly cash profit | £292.17 | (8.5%) | -£1.57 |

| (Sold stocks profit + Dividends - Fees / Months) |

Almost the same story as the ISA, but losses reducing by £200 is better, and the best news is that we're back in the black and 4 of the 9 holdings are in profit.

The injections are more regular in this account as I transfer out of my work pension every time it gets more than £2,000. The next injection will be the end of July when I should be able to transfer around £2,200. If prices stay as they are I'll be putting it all into CAML:Central Asia Metals and really wish I had spare cash to top up now.

Back above the trend line and keeping the end of the line in the black

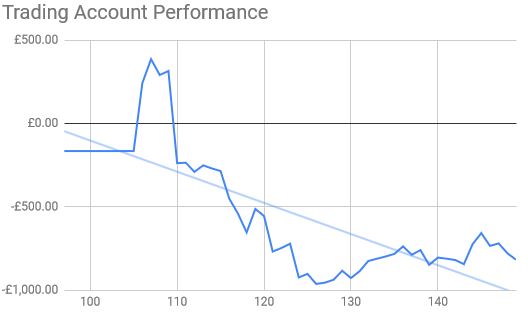

The trading account looks like this after week 153

| Weekly Change | |||

| Cash | £35.04 | +£0 | |

| Portfolio cost | £2,321.29 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,448.05 | (-37.6%) | +£43.33 |

| Potential profits | £0 | +£0 | |

| Year 3 Dividends | £33.57 | +£0 | |

| Year 3 Profit | £177.06 | +£0 | |

| Yr 3 Average monthly cash profit | £18.63 | (9.6%) | -£0.39 |

| Dividends | £34.72 | +£0 | |

| Profit from sales | -£64.29 | +£0 | |

| Average monthly cash profit | -£0.84 | (-0.4%) | +£0 |

| (Sold stocks profit + Dividends - Fees / Months) |

A positive week, but only clawing back 30% of last week's losses. The nearest share to being in profit is CAML:Central Asia Metals and it may not be long before a production update. That ought to see a significant re-rate as revenues and profits should be double what they were last year and the P/E ratio is already less than 10. People forget that this is a very low cost producer, so the low metal prices don't impact the profits so much. Granted they get more if the prices are higher, but they still comfortably earn enough for a spectacular dividend when the prices are low.

I'm quite looking forward to losing the pre-£2000 lines so I can re-scale the graph. My ambition to get the injection line down to £0 as I take money out hasn't really worked. I was meant to be paying off the interest free loan with those profits. Instead I'm having to use my own money. Not a great investment move, but it will pay for itself in education and experience if I finally get the hang of it.

Still a long way to go, and if LION:Lionsgold never re-lists it will take years to get into the black with this account. There is some hope though, as the ticker TALY has been reserved and intentions to re-launch as TALY:Tally have been published, so we'll wait and see.

So where are we at with my cunning attempt at trading in my ISA? I sold SBTX:SkinBioTherapeutics at 23.2p and they have dropped to offer price of 20.5p. My intention was to buy back as soon as they fell below 20p. However like a complete idiot I decided IQE:IQE dropping to 75p was a brilliant opportunity for short term gain, so I tied up all the cash in there and they've dropped to 60p so I'm buggered. Genius move - why can't I hold cash? Such a plank.

My second attempt mentioned in the blog intro involved selling CWR:Ceres Power at 184.1p and those have dropped to offer price of 169.5p so still a way to go to my target 150p, mainly due to the announcement of a supply contract which reversed the decline. In my most cunning plank-like tradition I put the money into C4XD:C4X Discovery Holdings at 48p and they are now 45p to sell, so another disaster meaning if CWR do fall I won't be able to take advantage.

What have I learnt from this? I've learnt I'm an idiot who doesn't learn from his mistakes and can't resist buying shares even when it's the wrong thing to do. I should really do what Graham and Buffett recommend and always have 10% of my holding in cash, but can I really bring myself to do that? I'm chronically lacking in discipline and get way too excited by the next shiny share.

Even in this blog I've discussed putting my £2,200 pension transfer into CAML:Central Asia Metals when I should be targeting a cash holding of £4,000 in that account. I wouldn't mind, but it pays a reasonable rate of interest too. Even if I did end up with that much as cash, the very first "bargain" that came along and I'd be buying it - I'd end up with the cash part of the account being a trading fund until I lock it up into some loser for 2 years.

OK - this time I'm really going to do it - when the pension transfer comes through I'm going to leave it as cash. What are the odds of me holding to that?