OPTI:Optibiotix was joint worst performer, dropping 15% to the placing price. It wasn't the only 15% fall, with AFC:AFC Energy also dropping heavily and going from 3% profit to 12% loss. This one is going to be very volatile!

Fortunately they were the only poor performers, and there were great gains elsewhere.

All my gold miners did really well. CEY:Centamin went up 6% and is now 4% in profit, PAF:Pan African Resources climbed 9% and are now 30% and 26% up. EDV:Endeavour Mining had the best week, climbing 10%, but they are still down by 20%.

Share of the Week is SBTX:SkinBioTherapeutics which went up an amazing 56%, and nobody knows why. It might be people closing shorts, but there is no reason for the rise in this week's news. I'm not complaining, and took the opportunity to offload some, as I consider this holding too high risk for my liking now.

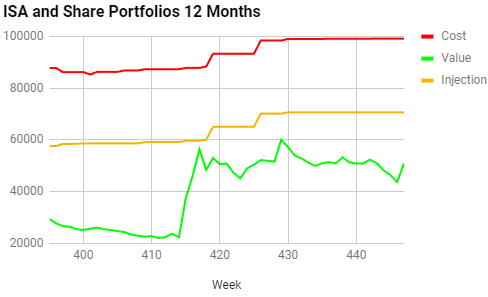

Here's the ISA and shares portfolio after week 35 of year 9.

| Weekly Change | |||

| Cash | £43.96 | -£15.68 | |

| Portfolio cost | £101,005.32 | +£1,161.88 | |

| Portfolio sell value (bid price-commission) | £44,608.25 | (-55.8%) | -£2,712.19 |

| Potential profits | £946.65 | -£731.96 | |

| Yr 9 Dividends | £215.92 | +£0 | |

| Yr 9 Interest | £3.77 | +£0 | |

| Yr 9 Profit from sales | £262.11 | +£146.20 | |

| Yr 9 proj avg monthly profit | £52.69 | (0.9%) | +£17.08 |

| Total Dividends | £12,127.35 | +£0 | |

| Total Interest | £5.70 | +£0 | |

| Total Profit from sales | £17,560.64 | +£146.20 | |

| Average monthly cash profit | £281.13 | (4.7%) | +£0.78 |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Compound performance | 41% | +0% |

Portfolio cost went up by over £1,000 as I cashed in some premium bonds to buy some more OPTI:Optibiotix in my ISA. My plan is to sell the ones in my SIPP if they get into profit, but I want to stay above 200k shares, so need to stock up in my ISA as a buffer, I have enough to sell my cheapest 3 OPTI holdings in my SIPP if they get to around 50p. I bought 4,719 shares at 21.19p costing £1,009.91

I then sold 9,190 of my SBTX:SkinBioTherapeutics shares for 13.025p making £146.21 (13.9%) profit and used the proceeds to buy 5,603 shares in OPTI:Optibiotix at 21.04p costing £1,190.82. I still have loads of SBTX but they worry me, so the opportunity to reduce my risk was much appreciated.

Both potential profits and portfolio value were hammered and we're back to one of my OPTI:Optibiotix holdings being the only share in profit, and that is very much reduced.

Long slow decline for almost 6 months.

I think we're now lower than the low of a few weeks ago.

Not much happened here, apart from the same big drop in value, but potential profit went up by £661 mainly thanks to my gold mines, CAML:Central Asia Metals and III:3i Group. I also got a £16 dividend from EDV:Endeavour Mining.

A lot flatter looking than the ISA.

Less flat looking. I guess the injections disguise the fall in the other chart.

The trading account looks like this after week 401 overall and week 37 of year 8.

JLP:Jubilee Metals stayed flat, so the £90 improvement is all thanks to SBTX:SkinBioTherapeutics, which is only 15% down now, so another week like this means I could sell.

Long slow decline for almost 6 months.

I think we're now lower than the low of a few weeks ago.

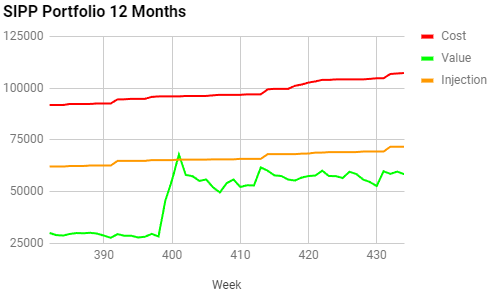

The SIPP looks like this after week 435 overall and week 19 of year 9.

| Weekly Change | ||||

| Cash | £162.54 | +£16.35 | ||

| Portfolio cost | £107,351.61 | +£0 | ||

| Portfolio sell value (bid price - commission) | £55,605.54 | (-48.2%) | -£2,618.32 | |

| Potential profits | £2,553.64 | +£661.81 | ||

| Yr 9 Dividends | £235.57 | +£16.35 | ||

| Yr 9 Interest | £1.54 | +£0 | ||

| Yr 9 Profit from sales | £3,506.75 | +£0 | ||

| Yr 9 proj avg monthly profit | £837.05 | (14.0%) | -£42.57 | |

| Total Dividends | £14,870.45 | +£16.35 | ||

| Total Interest | £7.47 | +£0 | ||

| Total Profit from sales | £14,342.65 | +£0 | ||

| Average monthly cash profit | £278.82 | (4.7%) | -£0.48 | |

| (Sold stocks profit + Dividends - Fees / Months) | ||||

| Compound performance | 39% | +0% |

Not much happened here, apart from the same big drop in value, but potential profit went up by £661 mainly thanks to my gold mines, CAML:Central Asia Metals and III:3i Group. I also got a £16 dividend from EDV:Endeavour Mining.

A lot flatter looking than the ISA.

Less flat looking. I guess the injections disguise the fall in the other chart.

The trading account looks like this after week 401 overall and week 37 of year 8.

| Weekly Change | |||

| Cash | £46.59 | +£0 | |

| Portfolio cost | £2,073.87 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,263.99 | (-39.1%) | +£90.14 |

| Potential profits | £0 | +£0 | |

| Year 8 Dividends | £8.56 | +£0 | |

| Year 8 Interest | £0 | +£0 | |

| Year 8 Profit | £328.15 | +£0 | |

| Yr 8 proj avg monthly profit | £39.43 | (+22.8%) | -£1.10 |

| Dividends | £68.66 | +£0 | |

| Interest | £0.03 | +£0 | |

| Profit from sales | -£602.54 | +£0 | |

| Average monthly cash profit | -£5.77 | (-3.3%) | +£0.01 |

| (Sold stocks profit + Dividends - Fees / Months) |

JLP:Jubilee Metals stayed flat, so the £90 improvement is all thanks to SBTX:SkinBioTherapeutics, which is only 15% down now, so another week like this means I could sell.

Nice little tick up.

Big bounce back to the trend line, Just need to get above it.

There are a few seeds of hope at the moment, and it was good to swap some of my SBTX:SkinBioTherapeutics shares into OPTI:Optibiotix. I think exposure to them via my OPTI holding is a lot safer than owning the shares given the recent death spiral funding which removed all trust I have for the SBTX CEO.