JLP:Jubilee Metals was the worst performer dropping 14% of my purchase price, but it was a relatively small percentage of the current price.

IQE:IQE gave a trading statement that was effectively a profit warning, and

despite all the chip manufacturers gaining massively due to chip shortages,

IQE is managing to do even worse than usual and fell 10% this week.

I'll cover all the gold mines together as they all dropped early in the week,

but failed to catch up after the price of gold went back above $1,800. PAF:Pan

African Resources dropped 12%, Blackrock World Gold Fund dropped 7%,

CEY:Centamin dropped 6% and POLY:Polymetal also dropped 6%.

DDDD:4D Pharma is my 2nd biggest holding and the lack of news coupled

with a forced large seller saw the price drop 8% making these worth half

what I bought them for.

My largest holding OPTI:Optibiotix dropped 5% to the lowest they have

been for a long time. News is expected before Christmas, but at this

rate it's only going to lift us back to the 50p range and will still be

losing money.

There's no Share of the Week because nobody deserved it. My highest

risers were CAML:Central Asia Metals and IGG:IG Group, but they both

climbed by less than 1% so there's absolutely no silver lining to my

cloud of misery.

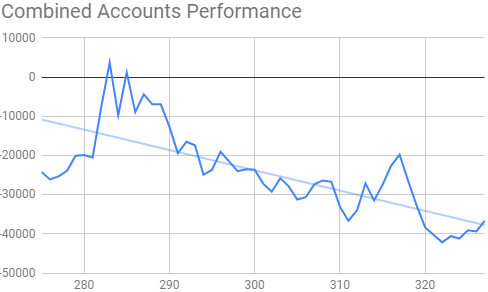

Getting dangerously close to the injection line

It's very difficult to keep one's pecker up when the relentless decline has been going on for almost a year.

Here's the ISA and shares portfolio after week 17 of year 7.

Massive losses and potential profits down £150 as JLP:Jubilee Metals dropped. The only ray of light is that my long term performance is above 10% target, but it's hard to get enthused when your portfolio is down by 31%.

Plunging towards the injection line

After getting so close to crossing the trend line, now we're well below it.

| Weekly Change | |||

| Cash | £10.15 |

+£0 | |

| Portfolio cost | £71,348.76 | +£0 | |

| Portfolio sell value (bid price-commission) | £48,700.05 | (-31.7%) | -£3,560.53 |

| Potential profits | £2,875.09 | -£150.00 | |

| Yr 7 Dividends | £22.16 | +£0 | |

| Yr 7 Profit from sales | £3,095.94 | +£0 | |

| Yr 7 projected avg monthly profit | £791.94 | (21.6%) | -£49.50 |

| Total Dividends | £1,365.31 | +£0 | |

| Total Profit from sales | £27,219.88 | +£0 | |

| Average monthly cash profit |

£372.65 |

(10.2%) | -£1.13 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Compound performance | 64% | +0% |

Massive losses and potential profits down £150 as JLP:Jubilee Metals dropped. The only ray of light is that my long term performance is above 10% target, but it's hard to get enthused when your portfolio is down by 31%.

Plunging towards the injection line

After getting so close to crossing the trend line, now we're well below it.

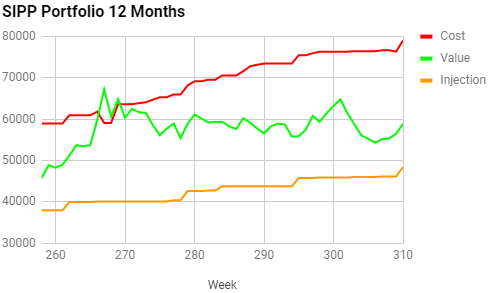

The SIPP looks like this after week 313 overall and week 1 of year 7.

The portfolio cost went up £30 because rather annoyingly Hargreaves Lansdown keeps automatically investing my tax rebate, so given the same thing will happen next month there's no point in me selling the gold fund yet. The £30 bought another 1.26 units of Blackrock World Gold fund at 2380.95238p so the good news was that the purchase was made just after the gold price dropped.

| Weekly Change | ||||

| Cash | £174.89 | +£0 | ||

| Portfolio cost | £79,867.72 | +£30.00 | ||

|

Portfolio sell value (bid price - commission) |

£54,665.46 | (-31.6%) | -£3,899.75 | |

| Potential profits | £346.76 | -£146.49 | ||

| Yr 7 Dividends | £0 | +£0 | ||

| Yr 7 Interest | £0 | +£0 | ||

| Yr 7 Profit from sales | £0 | +£0 | ||

| Yr 7 projected avg monthly profit | £0 | (0%) | +£0 | |

| Total Dividends | £3,204.39 | +£0 | ||

| Total Interest | £0.20 | +£0 | ||

| Total Profit from sales | £23,724.63 | +£0 | ||

| Average monthly cash profit | £361.44 | (8.8%) | -£1.16 | |

|

(Sold stocks profit + Dividends - Fees / Months) |

||||

| Compound performance | 53% | +0% |

The portfolio cost went up £30 because rather annoyingly Hargreaves Lansdown keeps automatically investing my tax rebate, so given the same thing will happen next month there's no point in me selling the gold fund yet. The £30 bought another 1.26 units of Blackrock World Gold fund at 2380.95238p so the good news was that the purchase was made just after the gold price dropped.

This is the first week of year 7 so all the annual stats have been set to

zero. Potential profits dropped but not by as much as I feared, but massive drop in

value across the board.

This would be less depressing if the cost line wasn't going up so much. The next chart will be more revealing

Crashing back below the trend line. What an utterly rubbish year!

This would be less depressing if the cost line wasn't going up so much. The next chart will be more revealing

Crashing back below the trend line. What an utterly rubbish year!

The trading account looks like this after week 279 overall and week 19 of year 6.

One of the biggest ever weekly drops. Was it really just a few weeks ago I was suggesting my DDDD:4D Pharma holding might get into profit soon?

I'll have to adjust the chart to show a lower value next week if we drop any further

A brief dalliance above the trend line didn't last long.

| Weekly Change | |||

| Cash | £259.74 | +£0 | |

| Portfolio cost | £2,374.14 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,009.91 | (-57.5%) | -£147.65 |

| Potential profits | £0.00 | +£0 | |

| Year 6 Dividends | £0.00 | +£0 | |

| Year 6 Profit | £0.00 | +£0 | |

| Yr 6 projected avg monthly profit | £0.00 | (0%) | +£0 |

| Dividends | £60.10 | +£0 | |

| Profit from sales | £937.88 | +£0 | |

| Average monthly cash profit | £15.50 | (7.8%) | -£0.06 |

|

(Sold stocks profit + Dividends - Fees / Months) |

One of the biggest ever weekly drops. Was it really just a few weeks ago I was suggesting my DDDD:4D Pharma holding might get into profit soon?

I'll have to adjust the chart to show a lower value next week if we drop any further

A brief dalliance above the trend line didn't last long.

I'm too miserable to write any more.