It's been a frustrating week, with small drops in value of the majority of my holdings. Somehow the week ended up in the black as the rises in

CWR:Ceres Power,

IQE:IQE and

JLP:Jubilee Platinum were just enough to counter all the drops.

Worst performer was

RED:RedT Energy. This has been doing well lately, but has fallen back to loss dropping 12% this week. It's only 5% down so could yo-yo between profit and loss until the next big news.

RDT:Rosslyn Data feels like it's dying a slow death, dropping another 7% and now losing 70%. That will teach me to buy shares in a startup tech company without doing enough research and spotting that the board members with the commercial nous had left the company. Never mind, I only invested £375 as a feeler with the aim of topping up as the story unfolded, which it didn't.

SBTX:SkinBioTherapeutics dropped another 6% and is now losing 32% which is very annoying given the trouble I went to buy shares on IPO day. I reckon it could be a year until these break even as it's going to take a while to get to the point where deals can be made, but I suppose there's the promise of a load of free shares from

OPTI:Optibiotix which would automatically put this in profit when they arrive.

AMYT:Amryt Pharma was over £1,000 in profit a few months ago. This week it dropped by 3% and is now at a loss. Deeply upsetting watching all that money vanish, but I still prefer long-term holding rather than trying to sell and buy back. I've demonstrated how bad I am at doing that with my trading account!

Precious little good news this week. As mentioned in the intro,

JLP:Jubilee Platinum rose by 3% which was a healthy contribution, and

CWR:Ceres Power Holdings climbed 6% to go 53% up. I think this is in anticipation of some big deal either for data centres or electric cars - we shall see.

Share of the Week is

IQE:IQE which only climbed 4% in my SIPP but 16% in my ISA to take it 397% up on purchase price. At one point it was over 400% up, but dropped off on Friday. Huge demand for the iPhone X will no doubt help in the short term, but there are much more exciting developments ahead.

For the first week in ages

OPTI:Optibiotix had no impact on the portfolio performance as is stayed the same price despite announcing a massive contract with a subsidiary of Premier Foods. How this is being held back I really do not know. Deals with Sacco, Tata, Nutrilinea, HLH BioPharma, Cereal Ingredients Inc among others and now Premier Foods will put

OPTI:Optibiotix ingredients in products that sell all over the globe.

Stable

Here's the performance of the ISA and share accounts

|

|

|

Weekly Change |

| Cash |

£49.93 |

|

+£0 |

| Portfolio cost |

£44,426.84 |

|

+£0 |

| Portfolio sell value (bid price - commission) |

£49,093.18 |

(+10.5%) |

-£68.59 |

| Potential profits |

£9,684.19 |

|

+£138.94 |

| Yr 3 Dividends |

£10.34 |

|

+£0 |

| Yr 3 Profit from sales |

£585.38 |

|

+£0 |

| Yr 3 Average monthly cash profit |

£181.06 |

(4.9%) |

-£15.09 |

| Total Dividends |

£1,189.39 |

|

+£0 |

| Total Profit from sales |

£7,297.85 |

|

+£0 |

| Average monthly cash profit |

£310.16 |

(8.4%) |

-£2.68 |

| (Sold stocks profit + Dividends - Fees / Months) |

Potential profits were up thanks the the shares mentioned in the intro, but losses deepened by more, not helped by both

RED:RedT Enegy and

AMYT:Amryt Pharma going from profit to loss.

It looks flat so I'll just make believe it didn't go down

The SIPP looks like this after week 101

|

|

|

Weekly Change |

| Cash |

£30.19 |

|

-£788.51 |

| Portfolio cost |

£26,007.03 |

|

+£788.52 |

| Portfolio sell value (bid price - commission) |

£28,830.69 |

(10.9%) |

+£130.95 |

| Potential profits |

£4,181.17 |

|

+£111.30 |

| Yr 2 Dividends |

£502.91 |

|

+£0 |

| Yr 2 Profit from sales |

£6,575.33 |

|

+£0 |

| Yr 2 Average monthly cash profit |

£618.35 |

(28.5%) |

-£12.88 |

| Total Dividends |

£916.10 |

|

+£0 |

| Total Profit from sales |

£8,925.19 |

|

+£0 |

| Average monthly cash profit |

£416.36 |

(19.2%) |

-£4.16 |

| (Sold stocks profit + Dividends - Fees / Months) |

I invested the tax rebate and

CAML:Central Asia Metals dividend in

OPTI:Optibiotix on Monday, so the cash value went down and the portfolio cost went up. The 1p difference must be a cumulative rounding error from adding 73.33p times 1,059 to the price per share, bringing it up to 65.04464p.

Profits were mainly up thanks to

IQE:IQE but tiny rises in

LGEN:Legal & General and

CAML:Central Asia Metals helped offset the small dip caused by the spread from buying

OPTI:Optibiotix.

Looking at the average monthly profits now the SIPP is almost 2 years old and the other accounts are past 2 years has made me realise that combined profits from sales and dividends average £725 a month. Given that both main accounts are also up by over 10% on purchase price, maybe things are going better than I thought!

Also pretty stable. The green line has gone up less than the red because it includes cash, so the rise in value was already reflected last week when the dividend and tax rebate arrived.

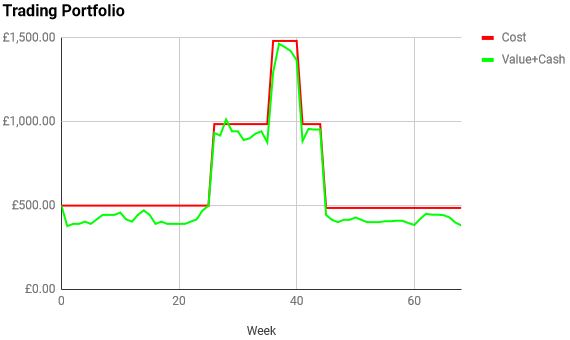

Here's the crappy trading account after week 67

|

|

|

Weekly Change |

| Cash |

£79.63 |

|

+£0 |

| Portfolio cost |

£486.05 |

|

+£0 |

| Portfolio sell value (bid price - commission) |

£318.87 |

(-34.2%) |

-£30.58 |

| Potential profits |

£0 |

|

+£0 |

| Dividends |

£1.15 |

|

+£0 |

| Profit from sales |

-£22.85 |

|

+£0 |

| Average monthly cash profit |

-£1.40 |

(-3.5%) |

+£0.02 |

| (Sold stocks profit + Dividends - Fees / Months) |

REDS:RedstoneConnect dropped by 6% following confirmation that the proposed buy-out wasn't really serious. All hope of getting rid of these any time soon has vanished so the torture continues.

Dire

Absolutely anything could happen this week. I'm actually quite excited as there seems to be gossip a-plenty. For a start the closing bid price for

OPTI:Optibiotix was crazy given people were selling at above 73p so I'm hoping for an immediate tick up of at least a penny which would generate £450.

JLP:Jubilee Platinum could be interesting as we're approaching the date they usually give a trading update.

LMI:Lonmin have announced they will be selling off some of their production capability, so

JLP:Jubilee Platinum may possibly be tempted as they would be able to sell platinum rather than just concentrate.

The iPhone X has launched well, and that could drive

IQE:IQE higher, particularly if the shorters decide now is the time to close.

KIBO:Kibo Mining now have the environmental and social certificates from the government which I was expecting to drive the price higher rather than a 4% drop, but these are really key documents. The RNS stated

that now these are completed, the Memorandum of

Understanding on the Power Purchase Agreement is

progressing well and will be finalized shortly. Not sure how "short" shortly will be, but once that is done the construction of the power plant can begin.

AFPO:African Potash is trading again. That allowed the share bid price to drop from 0.02p to 0.01p which I'm really hoping is as low as it can go. If it moves to 0.0099p then I may fall into despair. My only hope is that they can get something for their potash mining licence, but with over 2 billion shares in issue, my 27,860 are not going to see much of the proceeds. I probably ought to resign myself to losing everything, which is £707 so not the end of the world.

What really scares me about this share is the optimism I had in the early days. Everything seemed so good, and all the right steps had been taken to make it seem one of the most exciting projects on AIM. Given the vast number of shares that changed hands, many people bought into the story. Unfortunately the ability to deliver any fertiliser to anyone failed completely and ended up with a warehouse full of the stuff that nobody would pay for.

My main lesson from this experience is to research the track record of the directors, and especially the CEO. Have they run successful companies before? A prime example is

TLOU:Tlou Energy, with a CEO that has taken 2 companies to over a billion dollars. That gives me much more confidence that despite the project being risky, it's in good hands.

Just a few more hours and the excitement begins all over again...