CEY:Centamin has been on a slow and steady recovery, rising another 5% this week to go just 9% down. It's only 1% down if you include dividends. It's trading at a healthy P/E ratio for a miner, a trend they need to continue if I'm ever going to get in profit. The next review date isn't until June so I'll keep them for a while yet.

The only other big mover was OPTI:Optibiotix, which gets Share of the

Week. They climbed 5% in my main accounts, but an amazing 16% in my trading

holdings. The trading shares are in profit, but my main holding is still 64%

down.

Last week's loss has been fully recovered plus a bit more. Hope is re-kindled.

Starting to pull that trend line flatter

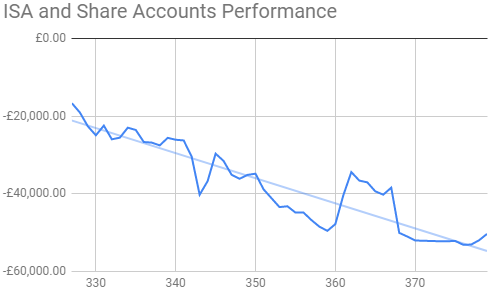

Here's the ISA and shares portfolio after week 17 of year 8.

| Weekly Change | |||

| Cash | £52.68 |

+£0 | |

| Portfolio cost | £82,003.25 | +£0 | |

| Portfolio sell value (bid price-commission) | £33,072.27 | (-59.7%) | +£3,140.53 |

| Potential profits | £156.12 | +£156.12 | |

| Yr 8 Dividends | £0 | +£0 | |

| Yr 8 Interest | £0.03 | +£0 | |

| Yr 8 Profit from sales | -£995.63 | +£0 | |

| Yr 8 projected avg monthly profit | -£256.65 | (-6.9%) | +£16.04 |

| Total Dividends | £11,768.92 | +£0 | |

| Total Interest | £0.03 | +£0 | |

| Total Profit from sales | £27,098.43 | +£0 | |

| Average monthly cash profit |

£439.37 |

(11.9%) | -£1.16 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Compound performance | 87% | +0% |

Big increase in value, and much joy as my short-term pot of OPTI:Optibiotix goes into £156 profit.

If I'm to make up the £995 loss for year 8 sales I need OPTI to get to 30p from its current 21p. I think that's achievable, and so my target price to sell the trading pot. This is money from selling JLP:Jubilee Metals, which I still hope to buy back in January when the pesky warrant holder has finished offloading shares and dragging the share price down.

Getting back above the £40k loss line will be a big boost to the morale. Might

take a while though.

The SIPP looks like this after week 365 overall and week 1 of year 8.

Cash went up thanks to a tax rebate. Big increase in value from OPTI:Optibiotix, and potential profits up but not by as much as they dropped last week. Year 8 starting means all year stats re-set to zero.

Closer to the injection line than the ISA

Very similar to the ISA, with almost identical amount of loss, due to almost identical number of OPTI:Optibiotix shares!

The trading account looks like this after week 331 overall and week 19 of year 7.

The biggest rise for a long time, with OPTI:Optibiotix rising £74 and going £23 into profit. I need to make more than £71 profit to get year 7 back into the black, which needs OPTI to get to 23p from the current 21p. I may give it a wee bit longer than that, maybe to at least 25p.

Still doesn't look very good.

That doesn't look too good either. Maybe I should be waiting a bit longer before I sell, although when I do this chart will look dreadful.

| Weekly Change | ||||

| Cash | £94.94 | +£32.50 | ||

| Portfolio cost | £98,772.58 | +£0 | ||

|

Portfolio sell value (bid price - commission) |

£48,283.87 | (-51.1%) | +£3,505.23 | |

| Potential profits | £632.76 | +£76.59 | ||

| Yr 8 Dividends | £0 | +£0 | ||

| Yr 8 Interest | £0 | +£0 | ||

| Yr 8 Profit from sales | £0 | +£0 | ||

| Yr 8 projected avg monthly profit | £0 | (0%) | +£0 | |

| Total Dividends | £14,142.78 | +£0 | ||

| Total Interest | £0.25 | +£0 | ||

| Total Profit from sales | £20,433.75 | +£0 | ||

| Average monthly cash profit | £398.67 | (8.1%) | -£1.10 | |

|

(Sold stocks profit + Dividends - Fees / Months) |

||||

| Compound performance | 57% | +0% |

Cash went up thanks to a tax rebate. Big increase in value from OPTI:Optibiotix, and potential profits up but not by as much as they dropped last week. Year 8 starting means all year stats re-set to zero.

Closer to the injection line than the ISA

Very similar to the ISA, with almost identical amount of loss, due to almost identical number of OPTI:Optibiotix shares!

The trading account looks like this after week 331 overall and week 19 of year 7.

| Weekly Change | |||

| Cash | £0.10 | +£0 | |

| Portfolio cost | £1,849.21 | +£0 | |

| Portfolio sell value (bid price - commission) | £769.96 | (-58.4%) | +£74.07 |

| Potential profits | £23.26 | +£23.26 | |

| Year 7 Dividends | £0.00 | +£0 | |

| Year 7 Interests | £0.01 | +£0 | |

| Year 7 Profit | -£71.73 | +£0 | |

| Yr 7 projected avg monthly profit | -£16.36 | (-10.6%) | +£0.91 |

| Dividends | £60.10 | +£0 | |

| Interest | £0.01 | +£0 | |

| Profit from sales | £154.87 | +£0 | |

| Average monthly cash profit | £2.81 | (1.8%) | -£0.01 |

|

(Sold stocks profit + Dividends - Fees / Months) |

The biggest rise for a long time, with OPTI:Optibiotix rising £74 and going £23 into profit. I need to make more than £71 profit to get year 7 back into the black, which needs OPTI to get to 23p from the current 21p. I may give it a wee bit longer than that, maybe to at least 25p.

Still doesn't look very good.

That doesn't look too good either. Maybe I should be waiting a bit longer before I sell, although when I do this chart will look dreadful.

Seems like ages since I felt good writing the blog. Having said that, 3p is a

pretty dismal rise compared to the old days when OPTI:Optibiotix could

easily do 15p in a week. In those days it meant over £10k increase in value,

but these days it would be around £35k which would smash my record for best

week. I'm still optimistic I could be writing about such a week in the not too

distant future.