IQE:IQE gave a surprisingly negative trading statement, moving to a loss despite most of their customers showing increased profits. This caused the price to plummet by 30% in my ISA, 21% in my trading account and 17% in my SIPP. It's now losing £2,800 altogether, but I can't complain too much as I made £7,000 profit trading it a few years ago. I'm confident it will bounce back once income starts to flow from the new foundry, but it may be a long wait to get back into the black. There was sustained shorting attack again, so at some point surely they will give up and cash in their profits?

WRES:W Resources was the only other big loser, dropping 6%. It seems an odd time for them to be dropping, as production has started and revenues should soon start to flow. I think they are massively over-diluted and have crippling debts, but that's always been the case so I'm not sure why the drop this week. I only bought them with some spare dividend cash so anything positive would be a bonus and I'll get rid of them as soon as I can.

Share of the Week is MMX:Minds + Machines, which is the only share with an increase of more than 5%. They climbed 7% and are only 13% down. I still believe these are generating more cash than people realise from a very low cost base, so I'm anticipating a re-rate and a dividend before too long.

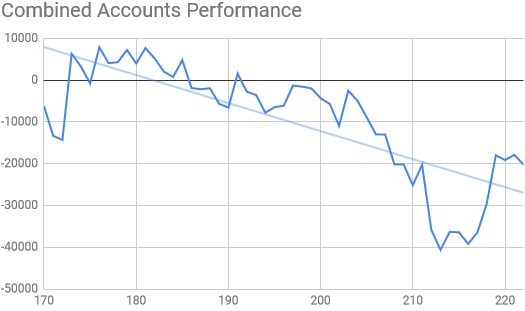

Flat isn't really good enough at the moment

At least it's snuck back onto the trend line, but it's not getting any shallower.

Here's the ISA and share account performance

| Weekly Change | |||

| Cash | £19.49 | +£0 | |

| Portfolio cost | £57,768.95 | +£0 | |

| Portfolio sell value (bid price-commission) | £39,429.06 | (-31.7%) | -£232.80 |

| Potential profits | £0 | +£0 | |

| Yr 5 Dividends | £0.63 | +£0 | |

| Yr 5 Profit from sales | £-167.28 | +£0 | |

| Yr 5 Average monthly cash profit | -£48.18 | (-1.0%) | +£3.21 |

| Total Dividends | £1,342.93 | +£0 | |

| Total Profit from sales | £20,224.13 | +£0 | |

| Average monthly cash profit | £413.30 | (8.6%) | -£1.87 |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Performance/Injection | 13.3% | -0.1% | |

| Compound performance | 57% | +0% |

The exposure to IQE:IQE is quite heavy in this account, so the drop exceeded the amount by which OPTI:Optibiotix climbed, but a £232 drop is pretty much flat.

Just on the right side of the trend line

The SIPP looks like this after week 208 and indeed at the end of year 4

| Weekly Change | ||||

| Cash | £103.28 | +£0 | ||

| Portfolio cost | £44,895.31 | +£0 | ||

| Portfolio sell value (bid price - commission) |

£33,775.70 | (-24.8%) | +£204.03 | |

| Potential profits | £392.97 | +£30.00 | ||

| Yr 4 Dividends | £556.99 | +£0 | ||

| Yr 4 Interest | £0.10 | +£0 | ||

| Yr 4 Profit from sales | £2,004.18 | +£0 | ||

| Yr 4 Average monthly cash profit | £200.00 | (5.3%) | -£3.92 | |

| Total Dividends | £1,899.24 | +£0 | ||

| Total Interest | £0.13 | +£0 | ||

| Total Profit from sales | £12,549.10 | +£0 | ||

| Average monthly cash profit | £291.77 | (7.8%) | -£1.41 | |

| (Sold stocks profit + Dividends - Fees / Months) | ||||

| Performance/Injection | 12.6% | -0.1% | ||

| Compound performance | 50% | +0% |

Less exposure to IQE:IQE here so the rise in OPTI:Optibiotix and the rise in MMX:Minds+Machines was enough to increase portfolio value by £204. The year finished on a nice even £200 per month profit, which at 5.3% is around half my target, but better than a building society. It's also 8.6% of the total injection amount, which is a bit closer to the target. I end the year with only 7 companies in the SIPP, 3 of which are in desperate trouble and probably doomed, one of which is in short term trouble, 2 of which are almost in the black, and one is making a profit.

Although the value is better than the ISA, and the trend line in a shallower decline, this account is below the trend line.

The trading account looks like this after week 174

| Weekly Change | |||

| Cash | £48.24 | +£0 | |

| Portfolio cost | £2,321.29 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,207.51 | (-48%) | -£100.30 |

| Potential profits | £0 | +£0 | |

| Year 4 Dividends | £13.20 | +£0 | |

| Year 4 Profit | £0 | +£0 | |

| Yr 4 Average monthly cash profit | £3.18 | (1.6%) | -£0.18 |

| Dividends | £47.92 | +£0 | |

| Profit from sales | -£64.29 | +£0 | |

| Average monthly cash profit | -£0.41 | (-0.2%) | +£0 |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Performance/Injection | -0.2% | +0% | |

| Compound performance | -1% | +0% |

A big drop of £100 thanks to IQE:IQE and the account is in a pretty dreadful state.

Just as things were looking up, the performance is now the worst it has ever been.

The only ray of light in an otherwise fairly bleak situation is that there is now enough to apply for another transfer from my work pension to my SIPP. I've put in a transfer request for £2,100 which should arrive within the next 2 weeks. I now need to decide what to buy with it.

I suspect both SBTX:SkinBioTherapeutics and OPTI:Optibiotix to have recovered enough over the next 2 weeks to miss out on the opportunity to top up cheap. I'm astounded that SBTX actually dropped on the day the RNS dropped confirming their massive deal with Croda. There was a slight recovery at the end of the week, but a feeble 2% rise on such amazing news is incredible. I want to buy SBTX with the SIPP money though, after selling my last batch and ploughing it into OPTI at what I incorrectly thought was a bargain.

I'm half tempted to buy IQE:IQE if it stays down around 43p, but there is a nagging doubt that their costs will remain so high that they don't make any profit and will stay down here for a long time. It's enough of a concern to put me off, although the way I made my profit from them in the past was buying in one of their dips.

I did mention TFW:Thorpe Lighting last week as a potential re-investment. They are well run, but is there a risk with it being a family firm that they will always be in the top jobs even if not necessarily the best man for the job?

I could contemplate getting back into gold, but the price is still a little high, or top up my old faithful CAML:Central Asia Metals. I could get 500 CAML for around £1,100 and use the other £1,000 for something a tad more risky. I've been watching SKIN:Integumen for a long, long time but am still uneasy about them, but I've also been watching D4T4:D4T4 Solutions and I'm tempted to put the £1,000 there as they are increasing profits every year and increasing dividends too.

That does make me think - maybe a new rule is in order for my SIPP. I could have a rule that only buy companies that pay a regular dividend in that account. Most of my current holdings don't pay a dividend, but there's no reason why I can't introduce the rule for new shares. I think I like that idea - it will stop me going mad with startups and focus on good companies. So I'm penciling in my suggestion above of half CAML and half D4T4. Let's see if I hold to that!