No big fallers this week, but not a great deal of risers either.

TRX:Tissue Regenix climbed 6% after a torrid few weeks. They are still

62% down but there is hope that things will turn around as more surgical

operations use their products.

Share of the Week is SBTX:SkinBioTherapeutics. After falling 24% in the

3 weeks since I bought them, they climbed 9% this week so are only 15% down

now. News on new products expected early in the new year should see them

re-rate.

Not exactly a stunning recovery

Still well below the trend line after a terrible year

Here's the ISA and shares portfolio after week 21 of year 7.

A small rise of £40 in potential profits with JLP:Jubilee Metals climbing a tiny amount. Portfolio value also up slightly with OPTI:Optibiotix unchanged. Long term performance still above target and year 7 performance twice target but with little prospect of being able to sell anything for a while.

Next week sees the removal of the low from 12 months ago, so the overall picture of 2021 will look grim.

Well below the trend line which will steepen next week, and in 4 weeks time we'll lose the brief blips when the account went into profit.

| Weekly Change | |||

| Cash | £37.05 |

+£0 | |

| Portfolio cost | £72,195.21 | +£0 | |

| Portfolio sell value (bid price-commission) | £46,614.24 | (-35.4%) | +£418.59 |

| Potential profits | £2,255.29 | +£40 | |

| Yr 7 Dividends | £22.16 | +£0 | |

| Yr 7 Profit from sales | £3,664.29 | +£0 | |

| Yr 7 projected avg monthly profit | £757.60 | (20.6%) | -£37.88 |

| Total Dividends | £1,365.31 | +£0 | |

| Total Profit from sales | £27,788.23 | +£0 | |

| Average monthly cash profit |

£375.52 |

(10.2%) | -£1.13 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Compound performance | 65% | +0% |

A small rise of £40 in potential profits with JLP:Jubilee Metals climbing a tiny amount. Portfolio value also up slightly with OPTI:Optibiotix unchanged. Long term performance still above target and year 7 performance twice target but with little prospect of being able to sell anything for a while.

Next week sees the removal of the low from 12 months ago, so the overall picture of 2021 will look grim.

Well below the trend line which will steepen next week, and in 4 weeks time we'll lose the brief blips when the account went into profit.

The SIPP looks like this after week 317 overall and week 5 of year 7.

A better performance than the ISA with small increases throughout the portfolio, and there are more SBTX:SkinBioTherapeutics shares in this account, which was the biggest climber this week. Annual performance has rapidly dropped below long term average as we go past the first month of year 7 and the long term average dropped another 0.1% with no prospect of imminent improvement. Potential profits climbed £11 thanks to PAF:Pan African Resources, and their dividend should arrive next week.

| Weekly Change | ||||

| Cash | £189.43 | +£0 | ||

| Portfolio cost | £80,392.42 | +£0 | ||

|

Portfolio sell value (bid price - commission) |

£52,097.13 | (-35.2%) | +£773.42 | |

| Potential profits | £15.29 | +£11.18 | ||

| Yr 7 Dividends | £41.20 | +£0 | ||

| Yr 7 Interest | £0 | +£0 | ||

| Yr 7 Profit from sales | £381.04 | +£0 | ||

| Yr 7 projected avg monthly profit | £351.37 | (8.6%) | -£87.84 | |

| Total Dividends | £3,245.59 | +£0 | ||

| Total Interest | £0.20 | +£0 | ||

| Total Profit from sales | £24,105.67 | +£0 | ||

| Average monthly cash profit | £362.42 | (8.8%) | -£1.15 | |

|

(Sold stocks profit + Dividends - Fees / Months) |

||||

| Compound performance | 54% | +0% |

A better performance than the ISA with small increases throughout the portfolio, and there are more SBTX:SkinBioTherapeutics shares in this account, which was the biggest climber this week. Annual performance has rapidly dropped below long term average as we go past the first month of year 7 and the long term average dropped another 0.1% with no prospect of imminent improvement. Potential profits climbed £11 thanks to PAF:Pan African Resources, and their dividend should arrive next week.

Dangerously close to the injection line

This is going to look very grim next week as we plunge from profit to almost £30k down in 2021

This is going to look very grim next week as we plunge from profit to almost £30k down in 2021

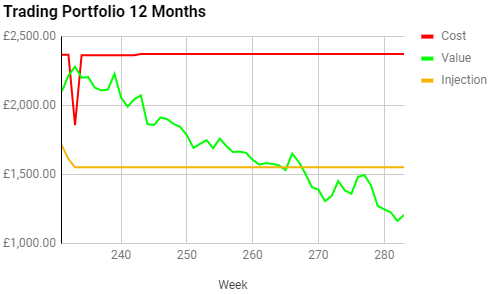

The trading account looks like this after week 283 overall and week 23 of year 6.

A welcome change in fortune with all shares up slightly and DDDD:4D Pharma gaining 3% to recover some of the recent losses.

A long way below the injection line

A very neat line, but unfortunately neatly downwards.

| Weekly Change | |||

| Cash | £259.74 | +£0 | |

| Portfolio cost | £2,374.14 | +£0 | |

| Portfolio sell value (bid price - commission) | £944.23 | (-60.2%) | +£43.42 |

| Potential profits | £0.00 | +£0 | |

| Year 6 Dividends | £0.00 | +£0 | |

| Year 6 Profit | £0.00 | +£0 | |

| Yr 6 projected avg monthly profit | £0.00 | (0%) | +£0 |

| Dividends | £60.10 | +£0 | |

| Profit from sales | £937.88 | +£0 | |

| Average monthly cash profit | £15.28 | (7.7%) | -£0.06 |

|

(Sold stocks profit + Dividends - Fees / Months) |

A welcome change in fortune with all shares up slightly and DDDD:4D Pharma gaining 3% to recover some of the recent losses.

A long way below the injection line

A very neat line, but unfortunately neatly downwards.

Just one more update left for 2021 and whatever happens next week it's going

to be a depressing picture for 2021. Having to write about a consistently

falling portfolio for a whole year has been very depressing.

I've sold some of my best shares to try and boost my morale with some

realised profits, and to provide a double boost by getting hold of some

bargain shares. Unfortunately every time I do that, they drop further.

I think I have to accept that the sectors I have targeted are unloved by the

markets this year. Gold, commodities and the microbiome are all struggling

and undervalued, but I'm happy with all the companies I've invested in this

year. Despite them all dropping 20-30% after me considering them as

bargains, you can only hold back a share paying 6% dividends with a P/E

ratio of 6 for so long, and many of my recent buys are in this situation.

Crazy when the average P/E ratio is 15, and even higher in USA.

Let's hope 2022 reverses the form of 2021, else I'll be in deep trouble.