I can always tell when it's been a disappointing week, as I wait until Sunday

to write my blog. This week had small losses across nearly all shares, and a

2p drop in OPTI:Optibiotix provided £2,200 of the £3,130 drop in value.

That widened the deficit to £35,219 and reduced total value to £80,498.

MMX:Minds + Machines fell 6% and I suspect will continue to drift until

they confirm they are generating cash and are going to pay a dividend. That

announcement would see the price double in no time. This week they dropped 6%

and are now down by 29%.

SBTX:SkinBioTherapeutics suffered a huge sale from an institutional

investor, so the fact it only dropped 5% in my ISA and 7% in my SIPP was a

relief. Hopefully that overhang will clear soon and we can get up to 20p so I

can sell my trading holding. I did sell a few from my SIPP this week, more of

which later.

WRES:W Resources had a good week, which was surprising as all my other

metals companies dipped. They climbed 8% but are still 71% down so I won't

hold my breath.

Share of the Week was SAE:Simec Atlantis Energy which climbed 13%. I'm

still 73% down, which shows just how much they did climb. I think there's a

feeling they could get as big as some of the big power companies, but I'll

believe it when I see it. I bought them for their tidal energy production, so

not overly happy they are now proposing burning plastic to generate power.

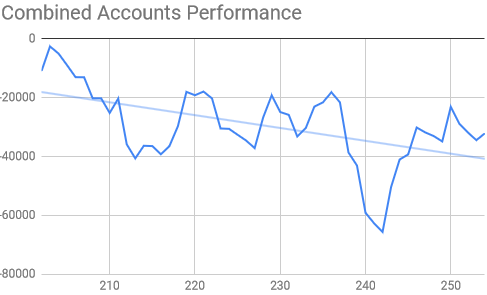

Last week's gains erased, and some more

Still the right side of the line, but way too close to it.

The ISA and share accounts look like this

| Weekly Change | |||

| Cash |

£14.63 |

+£0 | |

| Portfolio cost | £60,070.42 | +£0 | |

| Portfolio sell value (bid price-commission) | £40,354.07 | (-32.8%) | -£1,633.09 |

| Potential profits | £0 | +£0 | |

| Yr 5 Dividends | £0.85 | +£0 | |

| Yr 5 Profit from sales | £-14.48 | +£0 | |

| Yr 5 Average monthly cash profit | -£4.71 | (-0.1%) | +£0.11 |

| Total Dividends | £1,343.15 | +£0 | |

| Total Profit from sales | £20,376.93 | +£0 | |

| Average monthly cash profit | £365.21 | (7.3%) | -£1.43 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Performance/Injection | 11.1% | -0.1% | |

| Compound performance | 54% | +0% |

Generally bleak, and still no prospect of anything getting into profit.

Back almost on the injection line

Back to £20K in the red.

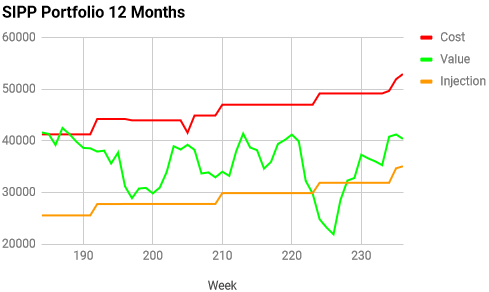

The SIPP looks like this after week 239

| Weekly Change | ||||

| Cash | £33.68 | +£3.87 | ||

| Portfolio cost | £53,058.85 | +£112.58 | ||

|

Portfolio sell value (bid price - commission) |

£38,439.17 | (-27.6%) | -£1,459.84 | |

| Potential profits | £189.29 | -£252.81 | ||

| Yr 5 Dividends | £0 | +£0 | ||

| Yr 5 Interest | £0.03 | +£0 | ||

| Yr 5 Profit from sales | £116.44 | +£116.44 | ||

| Yr 5 Average monthly cash profit | £2.65 | (0.1%) | +£16.74 | |

| Total Dividends | £1,899.24 | +£0 | ||

| Total Interest | £0.20 | +£0 | ||

| Total Profit from sales | £12,665.54 | +£116.44 | ||

| Average monthly cash profit | £254.27 | (5.8%) | +£1.05 | |

|

(Sold stocks profit + Dividends - Fees / Months) |

||||

| Performance/Injection | 8.7% | +0% | ||

| Compound performance | 40% | +0% |

Generally the same misery as the ISA, but lots of exciting things happened. I

sold my JLP:Jubilee Metals shares at 4.0015p which was a good move as

they ended the week 3.8p. I made £75.18 (15%) profit and liberated £567.67.

The reason I did this was that I noticed

POLR:Polar Capital Holdings had dropped unexpectedly, and they also

confirmed their dividend ex-date in early July. They also increased their

stake in CAML:Central Asia Metals by 1% last week, which gives me great

confidence that they know what they are doing. I've wanted these for my magic

formula experiment, as they were third in my rankings, but needed a bit more

cash to have £1,000 to spend.

I sold 2,700 of my SBTX:SkinBioTherapeutics shares at 16.625p. It was

much less than I wanted for them, but allowed me to liberate the £436.93 I

needed to buy POLR:Polar Capital Holdings. I made £41.27 (10.1%) profit

on the sale. Not a lot, but better than nothing.

This allowed me to buy 197 shares in POLR:Polar Capital Holdings at

501.92p costing £1,000.73. Tragically they dropped to 495 bid price so are

currently 4% down on spread and commission. However, I am really pleased that

I now have 4 of my magic formula shares, and will be getting quite a few

dividends in July.

As my total profits from the sales was only £116 it made £1 a month difference

to my long term performance, which is about what I normally lose each week I

don't sell anything. My annual performance was much improved though, as it

covered all my fees and instead of being negative, I'm now up by £16 a month

to £2 profit. Certainly not enough to retire on!

A little dip and a slightly worrying longer term decline

Way too close to the trend line, and following it!

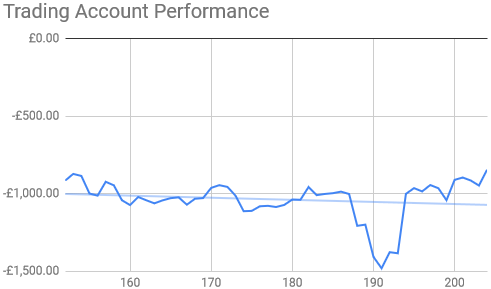

The trading account looks like this after week 205

| Weekly Change | |||

| Cash | £186.37 | +£0 | |

| Portfolio cost | £2,354.11 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,470.75 | (-37.5%) | -£37.30 |

| Potential profits | £30.72 | -£33.61 | |

| Year 4 Dividends | £13.20 | +£0 | |

| Year 4 Profit | £320.95 | +£0 | |

| Yr 4 Average monthly cash profit | £29.55 | (15.1%) | -£0.62 |

| Dividends | £47.92 | +£0 | |

| Profit from sales | £256.66 | +£0 | |

| Average monthly cash profit | £6.44 | (3.3%) | -£0.03 |

|

(Sold stocks profit + Dividends - Fees / Months) |

Most of the losses were the halving of potential profit for

SBTX:SkinBioTherapeutics. Nothing much else to say other than my

disappointment at not having been able to offload them at 19.5p yet.

I'm not troubled by this chart.

I think we may have a flat line by the week after next!

The virtual magic formula portfolio is down by 14.60% compared to 13.68% last

week, so a similar story of small losses here too. No real difference in top

and bottom performers to last week.

None of my wishes came true whatsoever from last week, so I'm still wanting a

Sweetbiotix deal from OPTI:Optibiotix, a dividend from

CAML:Central Asia Metals, FXPO:Ferrexpo back in the black,

SBTX:SkinBoioTherapeutics hitting 19.5p so I can sell my trading

account holding, and JLP:Jubilee Metals getting to 4.5p to my ISA is in

profit.

I'll throw in one more wish - that Hargreaves Lansdown allow me to partake in

the TLOU:Tlou Energy offer so I can get another 8,809 shares and take

my holding to 40,000. I'll need to inject £200, but I think it's a bargain at

this price as my faith in this one delivering is improving despite my holding

being 76% down. I've made over £1,500 profit selling TLOU in the past,

but my current holding cost £2,723 so I'm at risk of losing £1,200 if it goes

belly up. However, they are planning the transmission lines now, which makes

me think they are serious about selling electricity.