What an utterly desperate, miserable, soul-destroying week. A complete lack of understanding from shareholders and the market caused the

OPTI:Optibiotix share price to plummet when the H1 results were announced, despite year on year income being almost double H1 last year. When licence payments and royalties are paid annually and most of them occur in H2, you can't compare H1 this year with H2 last year!

As a result of the panic selling, my portfolio lost £15,563 in about an hour and the deficit has widened to £35,836, with overall portfolio about half of what it was last year at £68,561

Biggest and most spectacular loser was

OPTI:Optibiotix dropping 17p which is 24%. I did manage to scoop up some more at around 47p on results day after selling

AMYT:Amryt Pharma for a small loss. I wish just one of my other shares was in profit as I would have sold them to take advantage of this, but I already did that with my badly timed sale of

CEY:Centamin when

OPTI were still 67p.

TRMR:Tremor yo-yos by about 7% a week so it was no surprise they dropped 7% this week and are now 52% down on when I bought them.

SBTX:SkinBioTherapeutics suffered inexplicably from

OPTI dropping and were a bargain mid-week, but clawed back much of the looses and ended up 6% down. That means my holding is 27% down which is grim given I thought I'd bought them at the bottom of their trading range.

IQE:IQE continue to suffer and were down 5% this week, which is expensive as they are one of my larger holdings.

There were only three shares that increased in value this week, so I'm going to list them all to try and boost my morale.

CAML:Central Asia Metals climbed 2%, which means they are only 5% down now. Fortunately I've had so much in dividends that they are kind of 8% up, but that's small consolation. They were around 40% in profit at one point before the copper price collapse. Given they are such a low cost producer, I still don't understand why they get hammered so badly as they still pay a big dividend even when the copper price is low.

WRES:W Resources climbed a measly 3% given they completed their concentrator construction. My holding is 47% down, so even if they start producing and making a profit, I'm unlikely to be in the black for a long time as they have been massively diluted from placings since I bought them. I only bought £430 worth when I had some spare dividends and fancied a punt, so fairly relaxed.

Share of the Week is

TEK:Tekcapital which managed to drag itself up by 5% but is still 47% down so I suspect this will be making a loss until they have enough cash to pay a dividend, which will probably be a decade.

There you go. The green line almost meets the cash injection line, so if I sold everything today I would have been better off putting it in the Building Society. However, I'm still happy that the value of my shares is such that this blip can't last, and given the volatility of

OPTI:Optibiotix I wouldn't be surprised if the recovery wasn't swift and soon. It happened just over a year ago when we went from 56p to 134p in about a month. In those days we were a lot further away from revenues than we are now, with over £1 million a very realistic target for this year, and a dividend from the sale of

SBTX:SkinBioTherapeutics not that far away.

Here's the performance of the ISA and share portfolios

|

|

|

Weekly Change |

| Cash |

£10.11 |

|

-£13.41 |

| Portfolio cost |

£57,768.95 |

|

-£153.87 |

| Portfolio sell value (bid price-commission) |

£36,062.61 |

(-37.6%) |

-£9,123.51 |

| Potential profits |

£0 |

|

-£11.66 |

| Yr 5 Dividends |

£0 |

|

+£0 |

| Yr 5 Profit from sales |

£-167.28 |

|

-£167.28 |

| Yr 5 Average monthly cash profit |

-£181.22 |

(-3.8%) |

-£181.22 |

| Total Dividends |

£1,342.30 |

|

+£0 |

| Total Profit from sales |

£20,224.13 |

|

-£167.28 |

| Average monthly cash profit |

£436.91 |

(9.1%) |

-£5.50 |

(Sold stocks profit + Dividends - Fees

/ Months) |

A sea of red. The sale of

AMYT:Amryt Pharma gave me a £167 loss, and it was the first sale of year 5 so the annual performance is negative. The hit on overall performance was very low, dropping from 9.2% to 9.1%. The most horrific figure is the £9,123 drop in value. Utterly shocking and it makes me miserable every time I look at it.

This one plunges below the injection line. I would have been better off leaving my cash under the mattress!

Ouch!

Here's the SIPP after week 196

|

|

|

Weekly Change |

| Cash |

£35.53 |

|

+£20.01 |

| Portfolio cost |

£44,226.49 |

|

+£0 |

Portfolio sell value

(bid price - commission) |

£31,139.87 |

(-29.6%) |

-£6,572.36 |

| Potential profits |

£0 |

|

+£0 |

| Yr 4 Dividends |

£361.99 |

|

+£0 |

| Yr 4 Interest |

£0.10 |

|

+£0.01 |

| Yr 4 Profit from sales |

£1,440.43 |

|

+£0 |

| Yr 4 Average monthly cash profit |

£182.04 |

(4.9%) |

-£4.66 |

| Total Dividends |

£1,704.24 |

|

+£0 |

| Total Interest |

£0.13 |

|

+£0.01 |

| Total Profit from sales |

£11,985.35 |

|

+£0 |

| Average monthly cash profit |

£293.73 |

(8.0%) |

-£1.50 |

(Sold stocks profit + Dividends - Fees

/ Months) |

Cash went up as I had to inject £20 to cover fees. I also got another 1p interest so there's some good news this week! Portfolio value crashed by £6,572 but overall performance stayed at 8%.

At least this one didn't drop to the injection level and is managing to keep my overall portfolios above the dreaded orange line.

Looks rather like a cliff face.

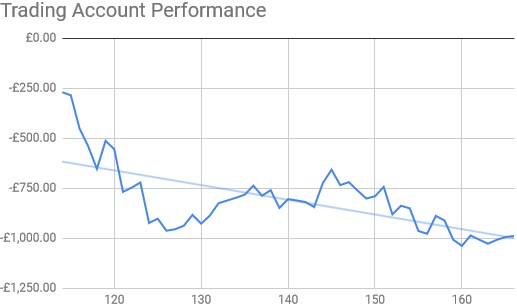

Here's the trading account after week 162

|

|

|

Weekly Change |

| Cash |

£35.04 |

|

+£0 |

| Portfolio cost |

£2,321.29 |

|

+£0 |

| Portfolio sell value (bid price - commission) |

£1,278.08 |

(-44.9%) |

-£21.01 |

| Potential profits |

£0 |

|

+£0 |

| Year 4 Dividends |

£0 |

|

+£0 |

| Year 4 Profit |

£0 |

|

+£0 |

| Yr 4 Average monthly cash profit |

£0 |

(0%) |

+£0 |

| Dividends |

£34.72 |

|

+£0 |

| Profit from sales |

-£64.29 |

|

+£0 |

| Average monthly cash profit |

-£0.79 |

(-0.4%) |

+£0.01 |

(Sold stocks profit + Dividends - Fees

/ Months) |

A pretty flat week as this account is sheltered from the pains of

OPTI:Optibiotix, but the 5% rise in

TEK:Tekcapital wasn't enough to mitigate losses elsewhere.

A slow steady descent into oblivion.

It's now starting to follow the trend line exactly, which isn't good.

Here's the fantasy stock performance

I actually climbed 22 places this week from 791st to 769th.

I've not really had time to look at this properly. I still don't know if I chrystallise losses when I sell a losing company, let alone checking performance of other FTSE companies, but it's a bit of fun and a handy way of keeping an eye on some shares I may consider adding to my SIPP when I get my next £2,000 in November.

So, in a week when my football team got booted out of the league, I also had to watch my portfolio dive right back to the injection line and obliterate every penny of profit I've made over the last four years. I know that's not really the case, as I have the assets that cost me over £100K, but it feels that way.

On the positive side, I've increased my

OPTI:Optibiotix holding to 97,000 shares and am still confident that will allow me to retire early no matter what the rest of the portfolio does. When

CAML:Central Asia Metals recovers it will be swift, and I've significantly increased my holding there to 5,000 shares which will give me some hefty dividends.

JLP:Jubilee Metals may finally be about to make some profits and a re-rate there should follow.

SBTX:SkinBioTherapeutics will announce a major deal shortly and will rocket.

IQE:IQE have dramatically increased production and that investment will pay off, and the shorters have been gradually closing their positions.

TLOU:Tlou Energy are producing gas so it won't be too long before they are generating power.

With that lot there's plenty to be excited about. There's also my high-risk pot that are in the doldrums but which could come good.

MTFB:Motif Bio probably have the best chance. They are 93% down, but once they show there's no liver toxicity with Iclaprim they could rapidly return to the original price.

KIBO:Kibo Energy are still making progress. The market doesn't believe they will ever deliver which is why they are down 90%, but if they do then I can get out as I don't want to be investing in coal during a climate crisis! My ethics don't stretch to suffering a massive loss to get out now though.

I'm looking forward to next week, as it's hard to imagine how things could get any worse...