I've been frustrated this week watching CAML:Central Asia Metals share price slide. Tomorrow is ex-dividend date and with the thumping great yield I thought the price would rise into it.

This hasn't been the case, and the price has drifted downwards from about 266p a few weeks ago to 232p today. It was 340p this time last year and things have only got better!

I couldn't watch that happen and not take advantage.

I'm sure the gold price will head northwards at some time soon, but that's been drifting lately too, so I decided to take advantage of the dip in CAML:Central Asia Metals price to buy some more before the dividend payout.

I sold my holding in PAF:Pan African Resources. 19,180 shares originally purchased at 7.375p and sold at 8.894p made a profit of £248.34 (17.6%). It's not a massive amount, but it's still a profit and freed up £1,700 for investing in CAML:Central Asia Metals.

I bought 724 shares at 232.945p costing £1,698.47 with commission. This brings my total holding to 3,672 shares at a weighted average price of 192.123p. costing £7,129 and currently making £1,414 (20%) paper profit, but if you add the £986 dividends that comes to 34%, and will be even more after this next dividend is paid. The new shares will get me an extra £57.92 dividend, taking the total I receive next month to £293 which will cover my monthly SIPP fees for a few years.

At the moment I plan to sell £1,700 worth of these when the price goes up, if the price of PAF:Pan African Resources has gone down, as I'm keen to re-invest there. However I've always been a little nervous about the risk of PAF:Pan African Resources. It's one that could double in very short time, but just as easily collapse. There has been civil unrest at the mine in the past and it could easily spark off again.

Prior to today I would have been chucking more cash at CEY:Centamin, but a great Q1 update today caused the share price to climb 12.8%, so I suspect the crowds will come rushing back and the price will get back to where it should be, well above 100p. I think that's likely to happen before I'm able to sell the CAML:Central Asia Metals shares. Having said that, CAML:Central Asia Metals is so utterly brilliant I may just leave them where they are. They have enough cash to take on another acquisition, and it could start snowballing from there. If the share price gets to a sensible level then the dividend is likely to stay the same or increase, and with my average purchase price the return will be huge. A perfect share for the SIPP.

My investment diary after starting out on the stock market in August 2015. The highs and lows, crashes and recoveries, profits and losses, takeovers and mergers that make investing so exhilarating.

Wednesday 24 April 2019

Saturday 20 April 2019

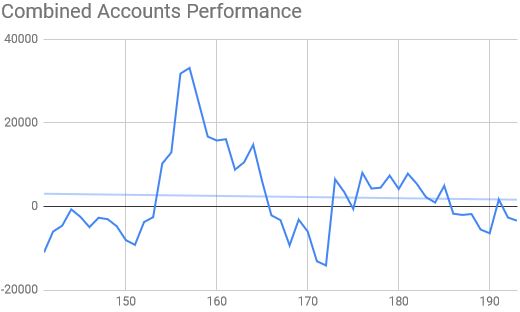

Week 193 Review - Downwards once again

Another down week. Bit of a damp squib really, and some re-trace of gains from a few weeks ago. The combined portfolio value dropped by £777 to £96,699 and is in the red by £3,545.

WRES:W Resources has been on a bit of a run recently, with good news about deplyment of the crusher and jig. They took a bit of a plunge when warrants were cashed and dropped 11% this week. They are 40% down but I think will recover when production starts. The dilution is so great I don't see them getting very high, but I'll be happy to take 30% to hit my 10% a year target.

JLP:Jubilee Metals had an amazing couple of weeks, but this was the week of profit taking, so there was a 10% drop. It's one of my biggest holdings, so contributed most of this week's losses. They are 36% down losing £1,671 but I'm feeling more bullish about prospects as Kabwe construction progresses and revenues build in the other projects. The Colin Bird factor still makes me nervous though.

CEY:Centamin is really frustrating. They have piles of cash and a good dividend and I thought I'd bought in for a bargain, but could have got much more of a bargain had I waited. My ISA holding is 38% down and losing £583 and my SIPP is 22% down and losing £664. The dividend will appear soon and should be round about £95 altogether. I'm tempted to buy more at these prices. They have an utterly massive pile of cash and when they announce what they plan to do with it, the price will recover.

TAP:Taptica just won't recover and dropped another 5% to go 47% down. Another disaster in my cursed trading account.

Only one share had a rise above 5% this week, so well done TND:Tandem Group on climbing 10% and winning Share of the Week. These are only 5% down now and move very quickly on small volume. At this share price PE ratio is still only 6, and with a robust outlook for 2019/20 ought to be at least 10 so I'm anticipating they will almost double. I'll sell out earlier than that as 40% is my target.

Only half as bad as 3 weeks ago, but still bad

It's happened - the trend line is pointing downwards for the first time. Deeply distressing.

Here's the ISA and share portfolios

Hardly any change in potential profits, with OPTI:Optibiotix staying still and CWR:Ceres Power dropping 1%. Most of the losses were down to JLP:Jubilee Metals losing 10%. I need TND:Tandem Group to do an upwards spurt so I can flog them and use the proceeds for more bargain CEY:Centamin. I was hoping it would happen before the dividend, but ex-date is on Monday so no chance now.

As good as flat really. Next week I need to adjust the chart to set the bottom limit on the x axis to £40,000. That might boost my morale a little.

Slight downward inflection on the trend line now.

The SIPP looks like this after week 177

The small drop in potential profit was down to a 3% drop in CAML:Central Asia Metals, offset by a 4% rise in VRS:Versarien which now sits 31% up with paper profit of £459. A little tempting to flog it as the price is getting ahead of itself again, but too scared of something big being announced. I'll stick with it this time.

Staying above the line, but historically this account has enjoyed a much bigger buffer.

It will be very upsetting if this trend line reverses. It's being dragged lower so needs something magical very soon to save it.

Here's the trading account after week 143

The only gfood news about this poxy account is that the long term average performance improves by 1p every week - or should I say the losses reduce by 1p each week! Drops in CAML:Central Asia Metals and TAP:Taptica were greater than the small gain in IQE:IQE so value dropped by £24.

Still rubbish

Still above the abysmal trend line which is the only crumb of comfort.

That's it for this shortened week. Next week is another short one and there are dividend ex-dates for both CEY:Centamin and CAML:Central Asia Metals so there are likely to be corresponding drops in share price. I was hoping the dividend for CAML:Central Asia Metals would see a rise into ex-date as it's such a good yield, but it ought to have happened by now. At least my trading account will get the dividend, which will be the only income that account has had for a long time.

WRES:W Resources has been on a bit of a run recently, with good news about deplyment of the crusher and jig. They took a bit of a plunge when warrants were cashed and dropped 11% this week. They are 40% down but I think will recover when production starts. The dilution is so great I don't see them getting very high, but I'll be happy to take 30% to hit my 10% a year target.

JLP:Jubilee Metals had an amazing couple of weeks, but this was the week of profit taking, so there was a 10% drop. It's one of my biggest holdings, so contributed most of this week's losses. They are 36% down losing £1,671 but I'm feeling more bullish about prospects as Kabwe construction progresses and revenues build in the other projects. The Colin Bird factor still makes me nervous though.

CEY:Centamin is really frustrating. They have piles of cash and a good dividend and I thought I'd bought in for a bargain, but could have got much more of a bargain had I waited. My ISA holding is 38% down and losing £583 and my SIPP is 22% down and losing £664. The dividend will appear soon and should be round about £95 altogether. I'm tempted to buy more at these prices. They have an utterly massive pile of cash and when they announce what they plan to do with it, the price will recover.

TAP:Taptica just won't recover and dropped another 5% to go 47% down. Another disaster in my cursed trading account.

Only one share had a rise above 5% this week, so well done TND:Tandem Group on climbing 10% and winning Share of the Week. These are only 5% down now and move very quickly on small volume. At this share price PE ratio is still only 6, and with a robust outlook for 2019/20 ought to be at least 10 so I'm anticipating they will almost double. I'll sell out earlier than that as 40% is my target.

Only half as bad as 3 weeks ago, but still bad

It's happened - the trend line is pointing downwards for the first time. Deeply distressing.

Here's the ISA and share portfolios

| Weekly Change | |||

| Cash | £26.97 | +£0 | |

| Portfolio cost | £57,274.78 | +£0 | |

| Portfolio sell value (bid price - commission) | £53,428.18 | (-6.7%) | -£397.02 |

| Potential profits | £6,995.37 | -£7.33 | |

| Yr 4 Dividends | £60.50 | +£0 | |

| Yr 4 Profit from sales | £1,077.60 | +£0 | |

| Yr 4 Average monthly cash profit | £129.78 | (2.7%) | -£3.60 |

| Total Dividends | £1,298.83 | +£0 | |

| Total Profit from sales | £19,774.72 | +£0 | |

| Average monthly cash profit | £469.19 | (9.8%) | -£2.44 |

| (Sold stocks profit + Dividends - Fees / Months) |

Hardly any change in potential profits, with OPTI:Optibiotix staying still and CWR:Ceres Power dropping 1%. Most of the losses were down to JLP:Jubilee Metals losing 10%. I need TND:Tandem Group to do an upwards spurt so I can flog them and use the proceeds for more bargain CEY:Centamin. I was hoping it would happen before the dividend, but ex-date is on Monday so no chance now.

As good as flat really. Next week I need to adjust the chart to set the bottom limit on the x axis to £40,000. That might boost my morale a little.

Slight downward inflection on the trend line now.

The SIPP looks like this after week 177

| Weekly Change | |||

| Cash | £78.67 | +£0 | |

| Portfolio cost | £40,524.05 | +£0 | |

| Portfolio sell value (bid price - commission) | £41,690.13 | (2.9%) | -£352.66 |

| Potential profits | £6,003.06 | -£160.19 | |

| Yr 4 Dividends | £0 | +£0 | |

| Yr 4 Interest | £0.07 | +£0 | |

| Yr 4 Profit from sales | £484.30 | +£0 | |

| Yr 4 Average monthly cash profit | £87.39 | (2.7%) | -£4.37 |

| Total Dividends | £1,342.25 | +£0 | |

| Total Interest | £0.09 | +£0 | |

| Total Profit from sales | £11,029.22 | +£0 | |

| Average monthly cash profit | £294.49 | (8.7%) | -£1.67 |

| (Sold stocks profit + Dividends - Fees / Months) |

The small drop in potential profit was down to a 3% drop in CAML:Central Asia Metals, offset by a 4% rise in VRS:Versarien which now sits 31% up with paper profit of £459. A little tempting to flog it as the price is getting ahead of itself again, but too scared of something big being announced. I'll stick with it this time.

Staying above the line, but historically this account has enjoyed a much bigger buffer.

It will be very upsetting if this trend line reverses. It's being dragged lower so needs something magical very soon to save it.

Here's the trading account after week 143

| Weekly Change | |||

| Cash | £18.80 | +£0 | |

| Portfolio cost | £2,321.29 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,458.07 | (-37.2%) | -£24.77 |

| Potential profits | £0 | +£0 | |

| Year 3 Dividends | £17.33 | +£0 | |

| Year 3 Profit | £177.06 | +£0 | |

| Yr 3 Average monthly cash profit | £21.60 | (11.2%) | -£0.57 |

| Dividends | £18.48 | +£0 | |

| Profit from sales | -£64.29 | +£0 | |

| Average monthly cash profit | -£1.39 | (-0.7%) | +£0.01 |

| (Sold stocks profit + Dividends - Fees / Months) |

The only gfood news about this poxy account is that the long term average performance improves by 1p every week - or should I say the losses reduce by 1p each week! Drops in CAML:Central Asia Metals and TAP:Taptica were greater than the small gain in IQE:IQE so value dropped by £24.

Still rubbish

Still above the abysmal trend line which is the only crumb of comfort.

That's it for this shortened week. Next week is another short one and there are dividend ex-dates for both CEY:Centamin and CAML:Central Asia Metals so there are likely to be corresponding drops in share price. I was hoping the dividend for CAML:Central Asia Metals would see a rise into ex-date as it's such a good yield, but it ought to have happened by now. At least my trading account will get the dividend, which will be the only income that account has had for a long time.

Saturday 13 April 2019

Week 192 Review - Back to the misery

Well that didn't last long. Half last week's gains vanished as the portfolio dropped by £4,308 going back below £100K to £97,475 and back into the red by £2,769. Bugger!

Worst performer was SBTX:SkinBioTherapeutics which dropped 12% following the results of their human trials. It appears the market doesn't understand what the results mean. They were as good as could possibly be expected if not better, and what the potential big corporate partners would have been waiting for before signing a deal and producing their own formulations. I'd buy some more if I didn't have so much invested in OPTI:Optibiotix that I already own a huge amount, although likely to materialise as a cash dividend rather than shares.

CAML:Central Asia Metals was the next biggest loser, dropping 9% which was very expensive given the size of my holding. This was because the dividend was 2p less than last year, but it's still 8p and still yielding 5.7% which is pretty incredible. My dividend will be £252 after an interim dividend of £146 and take my total for this year to £398. That's a pretty good return and actually 6.7% given my shares were bought for 33% less than they cost now. This is definitely a company to gradually build a bigger stake in, and with the ex-date of 25th April, I may add some more if TND:Tandem Group go into profit.

OPTI:Optibiotix put the seal of doom on the week by dropping 8%. That 5p is worth over £4,000 so contributed most of the losses. I can't believe that in a week we won regulatory approval for Slimbiome in India and signed a new deal for Slimbiome Medical in Bulgaria, we lost 8%. For most companies only a profit warning would do something like that!

On the plus side JLP:Jubilee Metals rose another 8% and is giving me some hope that a turnaround is on the cards. It is still down 26% and losing £1,200 but that's half the losses of a few weeks ago. Fingers crossed for this one. I'll be taking some profit fairly early if it does recover, as I think £4,600 was too much to risk on this company. I'll gamble with a smaller amount, but would rather not gamble with quite so much. You never know though, if it looks like they work out how to produce sustainable profit, maybe I'll be convinced to stay.

TND:Tandem Group had a great week, with analysts raising targets and investors realising that a PE ratio of 5 is way too low. It briefly got into profit if you don't include the commission and I was tempted to sell, but this positive sentiment could run a bit longer yet and the price moves very quickly as it's such an illiquid share.

WRES:W Resources seems to be sneaking up, with a 12% increase as maiden production gets closer. These could yet rally! I'm not looking for a huge profit from them. I see them as mega high risk so will not hold on for much more than 40% which would be 10% for each year I've held them.

Share of the Week is CWR:Ceres Power which climbed 15% and is now 18% up and making £189 potential profit. There's a heck of a lot about to take off with this one, especially as China seem to be leaning more towards hydrogen as a fuel. That would create huge demand for their fuel cells, and with in increasing number of high margin licence deals, regular profit may not be far away.

Back into the red.

Back below the almost-flat trend line.

The ISA and share accounts look like this

Great big drop in profits thanks to OPTI:Optibiotix, but JLP:Jubilee Metals and CWR:Ceres Power helped reduce the losses so the drop in value is around £400 less than the drop in potential profits. Still need to sell something to get back above 10%. Come on TND:Tandem - you can do it!

Nearly 10 weeks in the red now

The trend line is exactly along the zero axis. That's quite impressive! I think it means I've stood still for a year.

The SIPP looks like this after week 176

Apart from the 1p interest, the opposite happened compared to the other accounts, with losses deepening further than profits dropping. It's a big drop with OPTI:Optibiotix and CAML:Central Asia Metals combined reducing the profits and drops in many other holdings deepening losses.

From a position of comfort, suddenly we're in peril of crossing the line.

Back below the trend line and back to dragging it flat.

The trading account looks like this after week 142

Hardly any change, but it's downwards and all the potential profits are gone. At least I can hold out for the CAML:Central Asia Metals dividend. Says a lot about my failure as a trader that I've had both interim and final dividends on this one.

The nice gentle rise doesn't look like a rise any more.

Still above the trend line so can't complain, even if it is a rubbish trend line.

I don't think anything interesting is due to happen this week. My finger will be hovering over the sell button for PAF:Pan African Resources, TND:Tandem Group and some JLP:Jubilee Metals, but I doubt very much if any of them will get to a price where I will sell.

Worst performer was SBTX:SkinBioTherapeutics which dropped 12% following the results of their human trials. It appears the market doesn't understand what the results mean. They were as good as could possibly be expected if not better, and what the potential big corporate partners would have been waiting for before signing a deal and producing their own formulations. I'd buy some more if I didn't have so much invested in OPTI:Optibiotix that I already own a huge amount, although likely to materialise as a cash dividend rather than shares.

CAML:Central Asia Metals was the next biggest loser, dropping 9% which was very expensive given the size of my holding. This was because the dividend was 2p less than last year, but it's still 8p and still yielding 5.7% which is pretty incredible. My dividend will be £252 after an interim dividend of £146 and take my total for this year to £398. That's a pretty good return and actually 6.7% given my shares were bought for 33% less than they cost now. This is definitely a company to gradually build a bigger stake in, and with the ex-date of 25th April, I may add some more if TND:Tandem Group go into profit.

OPTI:Optibiotix put the seal of doom on the week by dropping 8%. That 5p is worth over £4,000 so contributed most of the losses. I can't believe that in a week we won regulatory approval for Slimbiome in India and signed a new deal for Slimbiome Medical in Bulgaria, we lost 8%. For most companies only a profit warning would do something like that!

On the plus side JLP:Jubilee Metals rose another 8% and is giving me some hope that a turnaround is on the cards. It is still down 26% and losing £1,200 but that's half the losses of a few weeks ago. Fingers crossed for this one. I'll be taking some profit fairly early if it does recover, as I think £4,600 was too much to risk on this company. I'll gamble with a smaller amount, but would rather not gamble with quite so much. You never know though, if it looks like they work out how to produce sustainable profit, maybe I'll be convinced to stay.

TND:Tandem Group had a great week, with analysts raising targets and investors realising that a PE ratio of 5 is way too low. It briefly got into profit if you don't include the commission and I was tempted to sell, but this positive sentiment could run a bit longer yet and the price moves very quickly as it's such an illiquid share.

WRES:W Resources seems to be sneaking up, with a 12% increase as maiden production gets closer. These could yet rally! I'm not looking for a huge profit from them. I see them as mega high risk so will not hold on for much more than 40% which would be 10% for each year I've held them.

Share of the Week is CWR:Ceres Power which climbed 15% and is now 18% up and making £189 potential profit. There's a heck of a lot about to take off with this one, especially as China seem to be leaning more towards hydrogen as a fuel. That would create huge demand for their fuel cells, and with in increasing number of high margin licence deals, regular profit may not be far away.

Back into the red.

Back below the almost-flat trend line.

The ISA and share accounts look like this

| Weekly Change | |||

| Cash | £26.97 | +£0 | |

| Portfolio cost | £57,274.78 | +£0 | |

| Portfolio sell value (bid price - commission) | £53,825.30 | (-6%) | -£1,930.13 |

| Potential profits | £7,002.70 | -£2,368.54 | |

| Yr 4 Dividends | £60.50 | +£0 | |

| Yr 4 Profit from sales | £1,077.60 | +£0 | |

| Yr 4 Average monthly cash profit | £133.38 | (2.8%) | -£3.81 |

| Total Dividends | £1,298.83 | +£0 | |

| Total Profit from sales | £19,774.72 | +£0 | |

| Average monthly cash profit | £471.63 | (9.9%) | -£2.47 |

| (Sold stocks profit + Dividends - Fees / Months) |

Great big drop in profits thanks to OPTI:Optibiotix, but JLP:Jubilee Metals and CWR:Ceres Power helped reduce the losses so the drop in value is around £400 less than the drop in potential profits. Still need to sell something to get back above 10%. Come on TND:Tandem - you can do it!

Nearly 10 weeks in the red now

The trend line is exactly along the zero axis. That's quite impressive! I think it means I've stood still for a year.

The SIPP looks like this after week 176

| Weekly Change | |||

| Cash | £78.67 | +£0.01 | |

| Portfolio cost | £40,524.05 | +£0 | |

| Portfolio sell value (bid price - commission) | £42,042.79 | (3.7%) | -£2,370.45 |

| Potential profits | £6,163.25 | -£2,012.52 | |

| Yr 4 Dividends | £0 | +£0 | |

| Yr 4 Interest | £0.07 | +£0.01 | |

| Yr 4 Profit from sales | £484.30 | +£0 | |

| Yr 4 Average monthly cash profit | £91.76 | (2.7%) | -£4.83 |

| Total Dividends | £1,342.25 | +£0 | |

| Total Interest | £0.09 | +£0.01 | |

| Total Profit from sales | £11,029.22 | +£0 | |

| Average monthly cash profit | £296.16 | (8.8%) | -£4.83 |

| (Sold stocks profit + Dividends - Fees / Months) |

Apart from the 1p interest, the opposite happened compared to the other accounts, with losses deepening further than profits dropping. It's a big drop with OPTI:Optibiotix and CAML:Central Asia Metals combined reducing the profits and drops in many other holdings deepening losses.

From a position of comfort, suddenly we're in peril of crossing the line.

Back below the trend line and back to dragging it flat.

The trading account looks like this after week 142

| Weekly Change | |||

| Cash | £18.80 | +£0 | |

| Portfolio cost | £2,321.29 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,482.84 | (-36.1%) | -£8.02 |

| Potential profits | £0 | -£25.17 | |

| Year 3 Dividends | £17.33 | +£0 | |

| Year 3 Profit | £177.06 | +£0 | |

| Yr 3 Average monthly cash profit | £22.17 | (11.5%) | -£0.60 |

| Dividends | £18.48 | +£0 | |

| Profit from sales | -£64.29 | +£0 | |

| Average monthly cash profit | -£1.40 | (-0.7%) | +£0.01 |

| (Sold stocks profit + Dividends - Fees / Months) |

Hardly any change, but it's downwards and all the potential profits are gone. At least I can hold out for the CAML:Central Asia Metals dividend. Says a lot about my failure as a trader that I've had both interim and final dividends on this one.

The nice gentle rise doesn't look like a rise any more.

Still above the trend line so can't complain, even if it is a rubbish trend line.

I don't think anything interesting is due to happen this week. My finger will be hovering over the sell button for PAF:Pan African Resources, TND:Tandem Group and some JLP:Jubilee Metals, but I doubt very much if any of them will get to a price where I will sell.

Saturday 6 April 2019

Week 191 Review - At last something to cheer about

After what seems like months of misery, this week has turned everything around. There was no bad news, many of my largest holdings had big rises, and the net effect was an increase in portfolio value compared to cost of £8,136 which was enough to take it £1,539 into the black with a total value of £101,783.

Only one share had a drop of 5% or more, with TAP:Taptica losing 14%. This has almost halved since I bought them, but this drop was caused by the dilution caused by taking over Rhythm One. Immediately after they started a share buy-back scheme and I'm confident it won't be long before they recover. The problem is they are in my trading account which was meant to be for quick wins.

RED:RedT Energy got their placing away successfully and raised the amount required to the strategic review. This is great news and offers some hope. There was also a big grid storage scheme announced for UK. A few more announcements like that and we could be back in the black, just as it was looking like everything was doomed. I got an extra 1,428 shares in the open offer, costing 2p each and a total of £28.56. That dragged down my weighted average price to 9.48p and had the effect of raising the price 5%. They are still down by 79%.

TND:Tandem Group had a couple of big buys, and as there are so few shares in circulation they raised the share price by 7%. These are only 20% down now, so I may be able to get rid of them soon as they would not feature in my portfolio if I came across them now.

BLU:Blue Star Capital are starting to feel a bit more positive about Satoshipay despite the buy-out failing. There still aren't enough publishers using Satoshipay and we really need one of the big newspapers. An 8% rise was welcome, but these are still 74% down.

OPTI:Optibiotix had a good week considering there wasn't really any news. The UK Investor Show may have attracted some interest, which could explain the higher volume and 7p rise which was 11% of purchase price in my ISA but 9% in my SIPP. 7p is worth £5,782, so it's great that £2,354 of this week's improvement came from other shares.

CAML:Central Asia Metals is finally moving. As one of my biggest holdings, the 13% rise was worth a lot. They are now 47% up on my purchase price with paper profit of £2,288. These are a keeper though, as the dividend is immense.

SBTX:SkinBioTherapeutics have been in one of their dip periods, but rocketed up 15% this week. My holding is only 4% down now, so if positive sentiment extends to next week we could easily go into the black.

JLP:Jubilee Metals nearly won Share of the Week with a healthy 16% rise. I was feeling a bit desperate about these, as I had such high hopes but they seemed to keep shooting themselves in the foot. This week Vikrant Bhargava bought 167 million shares which is 9% of the company. Add that to a very positive broker note from Shard Capital with a target price of 6p, and the price climbed by 16%. My holding is still 34% down on purchase price, but this week's rise was worth £700.

Share of the Week is the one I was desperate to get back into when it dropped below 100p, VRS:Versarien. I'm so glad I did as they announced that VRS:Versarien is the first company in the world to become a Verified Graphene Producer by the Graphene Council. This saw the share price climb a whopping 26% so they went from 1% down to 25% up. That's worth £369 paper profit. I'm tempted to trade this share as I think it will be as volatile as OPTI:Optibiotix until they can confirm revenue, but I can't bear to be out as a massive deal could come through at any time. I think for my sanity I will remain a long term investor instead.

Oh happy, happy day, we're back in the black.

Despite the great rise, we're still below the trend line and still dragging it downwards.

The ISA and share portfolios look like this

Cash dropped due to the RED:RedT Energy open offer and monthly ISA fee. Paper profit up £3,569 but absolutely brilliant news that losses were reduced by £1,200 as it's the losing shares that are dragging down the performance. Average monthly performance dropped below the target 10% for the first time in ages, but the only company in profit other than OPTI:Optibiotix is CWR:Ceres Power and I want to hold those long term.

Main targets for selling are TND:Tandem Group but that would likely be accepting a loss to free up funds, SBTX:SkinBioTherapeutics which I may trade as they are so volatile, and IKA:Ilika which could be ok but I don't like companies where the directors are more interested in doing science than making money for shareholders.

Still under water but not by much

The trend line is almost flat and right along the £0 line. We're still below the trend line so it may be flat by next week.

The SIPP looks like this after week 175

Cash dropped due to monthly fees, and cost went up as I invested my pension transfer in more OPTI:Optibiotix shares. Potential profits were up loads, and losses were reduced by almost £100. The increase in portfolio cost hammered the average performance percentage, dropping from 9.9% to 8.8% and a long way off the target 10%. I just need a bit of a gold rally so I can sell PAF:Pan African Resources to get the performance figure back up. I really need some good news form MMX:Minds+Machines as I'd quite like to be able to sell those, but they are 28% down.

Zoom!

Back above the trend line. Let's start dragging it upwards!

The trading account looks like this after week 141

Great week for CAML:Central Asia Metals taking potential profit to £25. I need at least £65 if I'm going to get back to long term break-even. Pretty pathetic really to still be at a loss after nearly 3 years. I'm not very good at trading because I don't know how to take a quick loss. TAP:Taptica ruined the week by dropping so much that the gains elsewhere were turned into an overall £6 loss.

Still pretty dreadful.

Very slowly flattening the trend line, but if it flattens it will be well below £0.

I popped onto the NEX website and discovered BLOC:Block Commodities are no longer suspended. It allowed them to drop even further to 0.01p. I guess the fact they are still in existence means there's a fragment of hope I may get some of my £700 back, but I suspect it's a fools hope.

This week has restored my wavering faith, as the relentless gloom was getting a bit depressing. There's no doubt some of my riskier investments are doomed, but they are all fighting on, so maybe a few will come good.

Only one share had a drop of 5% or more, with TAP:Taptica losing 14%. This has almost halved since I bought them, but this drop was caused by the dilution caused by taking over Rhythm One. Immediately after they started a share buy-back scheme and I'm confident it won't be long before they recover. The problem is they are in my trading account which was meant to be for quick wins.

RED:RedT Energy got their placing away successfully and raised the amount required to the strategic review. This is great news and offers some hope. There was also a big grid storage scheme announced for UK. A few more announcements like that and we could be back in the black, just as it was looking like everything was doomed. I got an extra 1,428 shares in the open offer, costing 2p each and a total of £28.56. That dragged down my weighted average price to 9.48p and had the effect of raising the price 5%. They are still down by 79%.

TND:Tandem Group had a couple of big buys, and as there are so few shares in circulation they raised the share price by 7%. These are only 20% down now, so I may be able to get rid of them soon as they would not feature in my portfolio if I came across them now.

BLU:Blue Star Capital are starting to feel a bit more positive about Satoshipay despite the buy-out failing. There still aren't enough publishers using Satoshipay and we really need one of the big newspapers. An 8% rise was welcome, but these are still 74% down.

OPTI:Optibiotix had a good week considering there wasn't really any news. The UK Investor Show may have attracted some interest, which could explain the higher volume and 7p rise which was 11% of purchase price in my ISA but 9% in my SIPP. 7p is worth £5,782, so it's great that £2,354 of this week's improvement came from other shares.

CAML:Central Asia Metals is finally moving. As one of my biggest holdings, the 13% rise was worth a lot. They are now 47% up on my purchase price with paper profit of £2,288. These are a keeper though, as the dividend is immense.

SBTX:SkinBioTherapeutics have been in one of their dip periods, but rocketed up 15% this week. My holding is only 4% down now, so if positive sentiment extends to next week we could easily go into the black.

JLP:Jubilee Metals nearly won Share of the Week with a healthy 16% rise. I was feeling a bit desperate about these, as I had such high hopes but they seemed to keep shooting themselves in the foot. This week Vikrant Bhargava bought 167 million shares which is 9% of the company. Add that to a very positive broker note from Shard Capital with a target price of 6p, and the price climbed by 16%. My holding is still 34% down on purchase price, but this week's rise was worth £700.

Share of the Week is the one I was desperate to get back into when it dropped below 100p, VRS:Versarien. I'm so glad I did as they announced that VRS:Versarien is the first company in the world to become a Verified Graphene Producer by the Graphene Council. This saw the share price climb a whopping 26% so they went from 1% down to 25% up. That's worth £369 paper profit. I'm tempted to trade this share as I think it will be as volatile as OPTI:Optibiotix until they can confirm revenue, but I can't bear to be out as a massive deal could come through at any time. I think for my sanity I will remain a long term investor instead.

Oh happy, happy day, we're back in the black.

Despite the great rise, we're still below the trend line and still dragging it downwards.

The ISA and share portfolios look like this

| Weekly Change | |||

| Cash | £26.97 | -£32.31 | |

| Portfolio cost | £57,274.78 | +£28.56 | |

| Portfolio sell value (bid price - commission) | £55,755.33 | (-2.7%) | +£4,785.13 |

| Potential profits | £9,371.24 | +£3,569.87 | |

| Yr 4 Dividends | £60.50 | +£0 | |

| Yr 4 Profit from sales | £1,077.60 | +£0 | |

| Yr 4 Average monthly cash profit | £137.19 | (2.9%) | -£4.52 |

| Total Dividends | £1,298.83 | +£0 | |

| Total Profit from sales | £19,774.72 | +£0 | |

| Average monthly cash profit | £474.10 | (9.9%) | -£2.58 |

| (Sold stocks profit + Dividends - Fees / Months) |

Cash dropped due to the RED:RedT Energy open offer and monthly ISA fee. Paper profit up £3,569 but absolutely brilliant news that losses were reduced by £1,200 as it's the losing shares that are dragging down the performance. Average monthly performance dropped below the target 10% for the first time in ages, but the only company in profit other than OPTI:Optibiotix is CWR:Ceres Power and I want to hold those long term.

Main targets for selling are TND:Tandem Group but that would likely be accepting a loss to free up funds, SBTX:SkinBioTherapeutics which I may trade as they are so volatile, and IKA:Ilika which could be ok but I don't like companies where the directors are more interested in doing science than making money for shareholders.

Still under water but not by much

The trend line is almost flat and right along the £0 line. We're still below the trend line so it may be flat by next week.

The SIPP looks like this after week 175

| Weekly Change | |||

| Cash | £78.66 | -£14.41 | |

| Portfolio cost | £40,524.05 | +£2,199.28 | |

| Portfolio sell value (bid price - commission) | £44,413.24 | (9.6%) | +£3,358.30 |

| Potential profits | £8,175.77 | +£3,261.31 | |

| Yr 4 Dividends | £0 | +£0 | |

| Yr 4 Interest | £0.05 | +£0 | |

| Yr 4 Profit from sales | £484.30 | +£0 | |

| Yr 4 Average monthly cash profit | £96.59 | (2.9%) | -£9.01 |

| Total Dividends | £1,342.25 | +£0 | |

| Total Interest | £0.08 | +£0 | |

| Total Profit from sales | £11,029.22 | +£0 | |

| Average monthly cash profit | £297.85 | (8.8%) | -£2.09 |

| (Sold stocks profit + Dividends - Fees / Months) |

Cash dropped due to monthly fees, and cost went up as I invested my pension transfer in more OPTI:Optibiotix shares. Potential profits were up loads, and losses were reduced by almost £100. The increase in portfolio cost hammered the average performance percentage, dropping from 9.9% to 8.8% and a long way off the target 10%. I just need a bit of a gold rally so I can sell PAF:Pan African Resources to get the performance figure back up. I really need some good news form MMX:Minds+Machines as I'd quite like to be able to sell those, but they are 28% down.

Zoom!

Back above the trend line. Let's start dragging it upwards!

The trading account looks like this after week 141

| Weekly Change | |||

| Cash | £18.80 | +£0 | |

| Portfolio cost | £2,321.29 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,490.86 | (-35.8%) | -£6.63 |

| Potential profits | £25.17 | +£25.17 | |

| Year 3 Dividends | £17.33 | +£0 | |

| Year 3 Profit | £177.06 | +£0 | |

| Yr 3 Average monthly cash profit | £22.77 | (11.8%) | -£0.63 |

| Dividends | £18.48 | +£0 | |

| Profit from sales | -£64.29 | +£0 | |

| Average monthly cash profit | -£1.41 | (-0.7%) | +£0.01 |

| (Sold stocks profit + Dividends - Fees / Months) |

Great week for CAML:Central Asia Metals taking potential profit to £25. I need at least £65 if I'm going to get back to long term break-even. Pretty pathetic really to still be at a loss after nearly 3 years. I'm not very good at trading because I don't know how to take a quick loss. TAP:Taptica ruined the week by dropping so much that the gains elsewhere were turned into an overall £6 loss.

Still pretty dreadful.

Very slowly flattening the trend line, but if it flattens it will be well below £0.

I popped onto the NEX website and discovered BLOC:Block Commodities are no longer suspended. It allowed them to drop even further to 0.01p. I guess the fact they are still in existence means there's a fragment of hope I may get some of my £700 back, but I suspect it's a fools hope.

This week has restored my wavering faith, as the relentless gloom was getting a bit depressing. There's no doubt some of my riskier investments are doomed, but they are all fighting on, so maybe a few will come good.

Wednesday 3 April 2019

Pension transfer finally arrives - and last minute change of plan

I've been checking my Hargreaves Lansdown SIPP every couple of hours for the last three days after receiving confirmation on Saturday that Legal & General had completed my transfer request.

I was muttering darkly about the delay, but began to formulate a new plan last night.

My original plan was a split between CEY:Centamin and VRS:Versarien, but then the VRS:Versarien share price went bonkers and there was no way I was paying 125p a share. Instead I was just celebrating my recent purchase being 25% up already.

I re-formulated my plan to put it all into CEY:Centamin, which I feel is still massively undervalued and would enable me to average down. There's also a dividend ex-date looming so I would have got about £30 extra dividends.

However, last night OPTI:Optibiotix slipped below 80p. Granted, the average price in my SIPP is 67p, so buying at this price would increase the average, but with all the great news out recently and the promise of even greater news to come, I was wavering.

The reason I was wavering is I'm massively overweight in OPTI:Optibiotix already. In the interest of a diversified portfolio, surely it would be mad to invest even more?

This morning the price dropped again. I couldn't believe it. When the transfer finally arrived just after lunch, I tried a speculative order for OPTI:Optibiotix to see how cheap it would be. When the answer came as 78.399p I hit the buy button without hesitating. That bought me another 2,790 shares and cost £2,199.28. The effect on my average SIPP price wasn't too bad, raising from 67p to 68.1p.

Normally when I buy something I can pretty much guarantee it will drop immediately.

Not this time!

A big buy sent the share price up to a bid price of 83p by the end of the day.

That doesn't normally happen!

So where does that leave my OPTI:Optibiotix holding?

Altogether I have 82,667 shares bought at average of 66.9p costing a total, when commission is added, of £55,615.82. That's a sightly shocking £310 of commission.

They are currently up around 25% making paper profit of £12,961.94 but as far as I'm concerned things haven't even started yet.

Given that each 1p rise in share price is now worth £826.67 it will have even more of an impact on my portfolio than it did before, even with small rises.

If we can get back to 130p, which VRS:Versarien nearly did the other day from similar levels, that would whack up my paper profits to £51,815.43.

I honestly believe that could happen in a matter of days after a big RNS for Sweetbiotix confirming a global contract. As sweetbiotix is miles ahead of any of the competition, it's not a question of "if" a global contract is signed, but "when".

I'm always very excited about OPTI:Optibiotix, but now more than ever.

I was muttering darkly about the delay, but began to formulate a new plan last night.

My original plan was a split between CEY:Centamin and VRS:Versarien, but then the VRS:Versarien share price went bonkers and there was no way I was paying 125p a share. Instead I was just celebrating my recent purchase being 25% up already.

I re-formulated my plan to put it all into CEY:Centamin, which I feel is still massively undervalued and would enable me to average down. There's also a dividend ex-date looming so I would have got about £30 extra dividends.

However, last night OPTI:Optibiotix slipped below 80p. Granted, the average price in my SIPP is 67p, so buying at this price would increase the average, but with all the great news out recently and the promise of even greater news to come, I was wavering.

The reason I was wavering is I'm massively overweight in OPTI:Optibiotix already. In the interest of a diversified portfolio, surely it would be mad to invest even more?

This morning the price dropped again. I couldn't believe it. When the transfer finally arrived just after lunch, I tried a speculative order for OPTI:Optibiotix to see how cheap it would be. When the answer came as 78.399p I hit the buy button without hesitating. That bought me another 2,790 shares and cost £2,199.28. The effect on my average SIPP price wasn't too bad, raising from 67p to 68.1p.

Normally when I buy something I can pretty much guarantee it will drop immediately.

Not this time!

A big buy sent the share price up to a bid price of 83p by the end of the day.

That doesn't normally happen!

So where does that leave my OPTI:Optibiotix holding?

Altogether I have 82,667 shares bought at average of 66.9p costing a total, when commission is added, of £55,615.82. That's a sightly shocking £310 of commission.

They are currently up around 25% making paper profit of £12,961.94 but as far as I'm concerned things haven't even started yet.

Given that each 1p rise in share price is now worth £826.67 it will have even more of an impact on my portfolio than it did before, even with small rises.

If we can get back to 130p, which VRS:Versarien nearly did the other day from similar levels, that would whack up my paper profits to £51,815.43.

I honestly believe that could happen in a matter of days after a big RNS for Sweetbiotix confirming a global contract. As sweetbiotix is miles ahead of any of the competition, it's not a question of "if" a global contract is signed, but "when".

I'm always very excited about OPTI:Optibiotix, but now more than ever.

Subscribe to:

Posts (Atom)