No massive falls this week, but OPTI:Optibiotix dropped 3p which is 5% and cost me £3,300m so I would have been £300 up without that.

SBTX:SkinBioTherapeutics fell 7% in my SIPP and 5% in my ISA, and TLOU:Tlou Energy also dropped 5% after putting operations on hold.

IQE:IQE had a good week, climbing 6% in my ISA and 9% in my SIPP but I'm still down £4,500 on these, and I doubt they will get back to 100p+ for many years now.

N4P:N4 Pharma climbed 13% but is still 79% down. They announced trials at using Nuvec to deliver a Covid-19 vaccine, but I don't for a minute think it will come to anything.

TEK:Tekcapital wins Share of the Week, climbing 15% after some promising announcements from three of its companies.

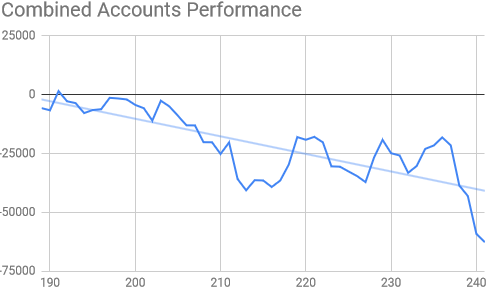

The rate of decline has slowed, but it's still firmly downwards.

Four weeks of abject misery.

The ISA and share portfolios look like this

| Weekly Change | |||

| Cash | £55.48 | +£0 | |

| Portfolio cost | £59,787.80 | +£0 | |

| Portfolio sell value (bid price-commission) | £22,882.60 | (-61.7%) | -£1,738.31 |

| Potential profits | £0 | +£0 | |

| Yr 5 Dividends | £0.63 | +£0 | |

| Yr 5 Profit from sales | £-167.28 | +£0 | |

| Yr 5 Average monthly cash profit | -£24.59 | (-0.5%) | +£0.74 |

| Total Dividends | £1,342.93 | +£0 | |

| Total Profit from sales | £20,224.13 | +£0 | |

| Average monthly cash profit | £382.29 | (7.7%) | -£1.58 |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Performance/Injection | 11.7% | +0% | |

| Compound performance | 54% | +0% |

A similar week to last week. I suspect it will be a few months before this stops looking desperate.

Getting dangerously close to my lowest axis.

Almost £40K in the red now.

The SIPP looks like this after week 226

| Weekly Change | ||||

| Cash | £48.51 | +£0 | ||

| Portfolio cost | £49,176.17 | +£0 | ||

| Portfolio sell value (bid price - commission) |

£21,832.00 | (-55.6%) | -£1,311.03 | |

| Potential profits | £0 | +£0 | ||

| Yr 5 Dividends | £0 | +£0 | ||

| Yr 5 Interest | £0.03 | +£0 | ||

| Yr 5 Profit from sales | £0 | +£0 | ||

| Yr 5 Average monthly cash profit | -£13.39 | (-0.3%) | +£0.78 | |

| Total Dividends | £1,899.24 | +£0 | ||

| Total Interest | £0.20 | +£0 | ||

| Total Profit from sales | £12,549.10 | +£0 | ||

| Average monthly cash profit | £267.47 | (6.5%) | -£1.19 | |

| (Sold stocks profit + Dividends - Fees / Months) | ||||

| Performance/Injection | 10.1% | +0% | ||

| Compound performance | 44% | +0% |

Absolutely the same story as the ISA. Some hints of recovery, but blown away by continued decline in OPTI:Optibiotix.

The account that was always in the black has been in the red for over 6 months and is now about £10K lower than what I've put in.

Let's just hope it can go back up as fast as it fell.

The trading account looks like this after week 192

| Weekly Change | |||

| Cash | £48.24 | +£0 | |

| Portfolio cost | £2,321.29 | +£0 | |

| Portfolio sell value (bid price - commission) | £942.97 | (-59.4%) | +£103.92 |

| Potential profits | £0 | +£0 | |

| Year 4 Dividends | £13.20 | +£0 | |

| Year 4 Profit | £0 | +£0 | |

| Yr 4 Average monthly cash profit | £1.59 | (0.8%) | -£0.04 |

| Dividends | £47.92 | +£0 | |

| Profit from sales | -£64.29 | +£0 | |

| Average monthly cash profit | -£0.37 | (-0.2%) | +£0 |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Performance/Injection | -0.2% | +0% | |

| Compound performance | -1% | +0% |

A surprisingly good week, with all non-suspended shares climbing except TRMR:Tremor which didn't drop enough to cause a problem. Could this be the start of the big recovery? I suspect not!

A very welcome sight

I didn't need to adjust my lower axis after all.

Although I'm not reporting on the virtual magic formula portfolio in detail any more, I do still maintain it, and it is down 29%. That's better than my real portfolio, which is down 50% since the time I set up the magic formula portfolio.

I applied for my pension transfer of £2,000 last week, so it should come through next week. I'm a little annoyed, as the value was only £2,300 and I always leave £300 in the account, but it's now £2,595 so bond prices must have improved and I could have transferred an extra £200. Never mind, that will just have to wait for another 4 months. In fact it would be great if there was enough to do a transfer after 3 months instead of the usual four.

I've had a long time to think about how I spend the £2,000, and I'm wavering now. I'm still absolutely definitely increasing my CAML:Central Asia Metals holding to 5,000 shares, which will cost pretty much bang on £1,000 at the current price of 134p. Even if it increases before the transfer comes through, I'll still do this and add any extra cash needed so I still leave £1,000 for something else. If it goes up to 150p before I get my transfer, I'll have to add £120, so I'm hoping the market stagnates for a while. My average purchase price is 189p so I'll buy for anything under that, but that price would mean me having to add £411 which is too much, so I'd use the transfer and then hold the rest for May when I get a £500 tax rebate to bring me up to £1,000. It would be quite upsetting if CAML:Central Asia Metals decide to postpone their dividend like others have done. I'm hoping they have enough cash to ride out the current crisis, but it wouldn't be a shock if they did postpone it.

So that brings me on to the other £1,000, which I have earmarked for FXPO:Ferrexpo. Their results were excellent, but they have postponed the dividend. I still really want to invest in them, and I still want to start my magic formula experiment. However, I can't ignore the fact that OPTI:Optibiotix can be bought for 32p, which is less than half my 65.9p average in the SIPP. I'd be able to get £3,087 shares and that purchase would lower my weighted average from 65.9p to 63.9p which is quite a significant drop. I think FXPO:Ferrexpo may stay low enough to be good value until May when I have another £1,000 to play with, but I fully expect OPTI:Optibiotix to be back around 67p by then.

So assuming there isn't a big surge in OPTI:Optibiotix before the money hits my account, I'll be buying yet more of those, else I'll stick to my plan with FXPO:Ferrexpo.

I'm almost tempted to stick more in JLP:Jubilee Metals, as their recent results were really encouraging. They will be impacted in the short term by the lockdown in South Africa, although there is a suggestion that producers of platinum group metals may be exempt due to the consequences of a world shortage. I still regard these as too risky to sink more than my current £4,600 though.