Biggest faller was JLP:Jubilee Metals losing 27% of my purchase price

and making me very happy I sold a few the other week before the drop. They are

still 268% up though, and I think they may be at 20p by the end of the year if

they can demonstrate copper production is ramping up.

The other big loser was PLUS:Plus500 which is facing a class action

in Israel for a policy of pausing trading when markets are ultra volatile.

It smacks of disgruntled punters unable to cash in profits, but I find this

is a regular state of affairs with all brokers - I often can't buy or sell

when I want to because of "market volatility". It understandably spooked a

lot of investors, so a 6% drop isn't as bad as it could have been. This

holding is 19% down on my purchase price though.

Share of the Week is a tricky one as nothing increased by as much as 5%.

Both

WHR:Warehouse REIT and OPTI:Optibiotix climbed 3% so I think

the award goes to OPTI in the hope it continues next week.

It's been a very slow creep upwards for a few weeks now. Just a shame the downward moves are that much more drastic.

Still well below the trend line.

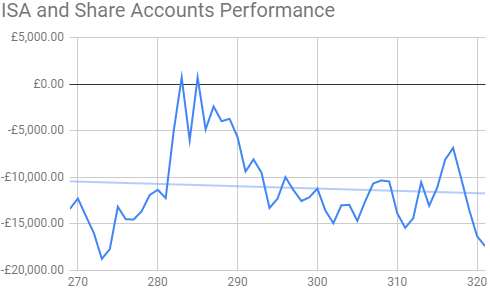

Here's the ISA and shares portfolio after week 13 of year 7.

JLP:Jubilee Metals dropped and caused the £387 reduction in potential profit, but overall value up by £1,057 thanks to OPTI:Optibiotix. Long term performance still on target at 10%

Same pattern as the overall portfolio

Quite a long way below the trend line.

| Weekly Change | |||

| Cash | £20.79 |

+£0 | |

| Portfolio cost | £70,491.00 | +£0 | |

| Portfolio sell value (bid price-commission) | £53,283.26 | (-24.4%) | +£1,057.85 |

| Potential profits | £3,748.40 | -£387.03 | |

| Yr 7 Dividends | £22.16 | +£0 | |

| Yr 7 Profit from sales | £2,245.07 | +£0 | |

| Yr 7 projected avg monthly profit | £753.24 | (20.6%) | -£62.77 |

| Total Dividends | £1,365.31 | +£0 | |

| Total Profit from sales | £26,369.01 | +£0 | |

| Average monthly cash profit |

£365.94 |

(10.0%) | -£1.13 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Compound performance | 62% | +0% |

JLP:Jubilee Metals dropped and caused the £387 reduction in potential profit, but overall value up by £1,057 thanks to OPTI:Optibiotix. Long term performance still on target at 10%

Same pattern as the overall portfolio

Quite a long way below the trend line.

The SIPP looks like this after week 309 overall and week 49 of year 6.

Quite a lot happened this week. First I had a couple of dividends, with £7.36 from SMS:Smart Metering Systems and £15.27 from CMCL:Caledonia Mining. I also sold all my Blackrock World Gold fund, as I didn't want that as well as the new iShares fund in my AJ Bell account. That made a small profit of £24.91 (6.6%) which isn't bad for 3 months. Unfortunately it appears the auto-purchase applies to the tax relief that comes from the injection, and when £30 appeared in my account it was automatically invested, so I'm stuck with 1.23 units coting £30, and that explains why the portfolio cost only reduced by £330 and not the £360 I spent originally.

| Weekly Change | ||||

| Cash | £661.63 | +£406.64 | ||

| Portfolio cost | £76,354.78 | -£330.00 | ||

|

Portfolio sell value (bid price - commission) |

£55,784.75 | (-26.9%) | +£746.25 | |

| Potential profits | £376.05 | +£23.72 | ||

| Yr 6 Dividends | £1,094.34 | +£22.63 | ||

| Yr 6 Interest | £0 | +£0 | ||

| Yr 6 Profit from sales | £8,265.19 | +£24.01 | ||

| Yr 6 projected avg monthly profit | £811.40 | (21.1%) | -£12.69 | |

| Total Dividends | £3,161.42 | +£22.63 | ||

| Total Interest | £0.20 | +£0 | ||

| Total Profit from sales | £23,724.63 | +£24.01 | ||

| Average monthly cash profit | £365.75 | (9.5%) | -£0.53 | |

|

(Sold stocks profit + Dividends - Fees / Months) |

||||

| Compound performance | 57% | +1% |

Quite a lot happened this week. First I had a couple of dividends, with £7.36 from SMS:Smart Metering Systems and £15.27 from CMCL:Caledonia Mining. I also sold all my Blackrock World Gold fund, as I didn't want that as well as the new iShares fund in my AJ Bell account. That made a small profit of £24.91 (6.6%) which isn't bad for 3 months. Unfortunately it appears the auto-purchase applies to the tax relief that comes from the injection, and when £30 appeared in my account it was automatically invested, so I'm stuck with 1.23 units coting £30, and that explains why the portfolio cost only reduced by £330 and not the £360 I spent originally.

Potential profits are up £23 thanks to small rises in both

CAML:Central Asia Metals and WHR:Warehouse REIT and overall

value up by £746 which disguises many small drops throughout the portfolio.

Year 6 only has 3 weeks to go and annual performance is fantastic, with long

term performance not bad either, just 0.5% below target. Given that target is

a percentage of the portfolio injection amount, which keeps going up as I add

more transfers, I'm very happy with it.

Same as the other charts

Much closer to crossing the trend line than the ISA.

The trading account looks like this after week 275 overall and week 15 of year 6.

Yet another drop thanks to DDDD:4D Pharma losing yet more ground. What an absolute disaster that share has been. I made £2,366 profit from my original holding, but since buying back, my paper losses are £10,516 on an investment of £16,641 across my 3 accounts. If these don't turn around then they could be my most catastrophic investment ever and wipe out about half of all my profits over the last 7 years. My track record with pharma companies has been pretty dreadful.

The up-tick was all too brief

Still below the trend line.

My pension transfer of £2,200 has gone out of my work pension account so will land in my SIPP around the middle of the week. I still haven't decided what to do with it. I'll add it to the £500 cash so will have £2,700 to spend.

Same as the other charts

Much closer to crossing the trend line than the ISA.

The trading account looks like this after week 275 overall and week 15 of year 6.

| Weekly Change | |||

| Cash | £259.74 | +£0 | |

| Portfolio cost | £2,374.14 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,098.64 | (-53.7%) | -£23.96 |

| Potential profits | £0.00 | +£0 | |

| Year 6 Dividends | £0.00 | +£0 | |

| Year 6 Profit | £0.00 | +£0 | |

| Yr 6 projected avg monthly profit | £0.00 | (0%) | +£0 |

| Dividends | £60.10 | +£0 | |

| Profit from sales | £937.88 | +£0 | |

| Average monthly cash profit | £15.73 | (7.9%) | -£0.05 |

|

(Sold stocks profit + Dividends - Fees / Months) |

Yet another drop thanks to DDDD:4D Pharma losing yet more ground. What an absolute disaster that share has been. I made £2,366 profit from my original holding, but since buying back, my paper losses are £10,516 on an investment of £16,641 across my 3 accounts. If these don't turn around then they could be my most catastrophic investment ever and wipe out about half of all my profits over the last 7 years. My track record with pharma companies has been pretty dreadful.

The up-tick was all too brief

Still below the trend line.

My pension transfer of £2,200 has gone out of my work pension account so will land in my SIPP around the middle of the week. I still haven't decided what to do with it. I'll add it to the £500 cash so will have £2,700 to spend.

If OPTI:Optibiotix stays around 50p I may buy a load more. If

CAML:Central Asia Metals stays below 250p I may buy a load more. I may

still buy magic formula shares PAF:Pan African Resources and

SSE:SSE and use the leftover £700 for more OPTI or

CAML.

PAF:Pan African Resources has been on a small climb recently compared

to other gold miners, and they have a dividend ex-date on 2nd December so they

are a temping prospect. I need to do more research on SSE:SSE, as they

are at a 10-year high and a lot of smaller energy companies are going out of

business, so now might not be a good time to buy. Maybe a compromise would be

to get PAF and put the rest into OPTI and/or CAML.