Only one big loser this week but it was SBTX:SkinBioTherapeutics which I think suffered some profit taking after last week and dropped 8% in my ISA and 10% in my SIPP. I'm still around £160 up on my combined holdings though.

IQE:IQE had a great week, with my SIPP holding gaining 7%, my trading account gaining 9% and my ISA gaining 11%. The ISA is only 8% down now, so it would be nice to get a slow move up to around 90p for £400 (19%) potential profit. My traget for these is 120p which would give me £1,261 (58%) profit and ease my falling average profit performance.

Share of the Week is JLP:Jubilee Metals, which six months ago looked like it was never going to get anywhere. An announcement that they have bought out the rights to all PGM profits at Hernic for $5.1 million gave the share price a good kick, and most people won't be aware of it yet. With earnings of over $1 million a month from Hernic, and with Kabwe not far from production, there could finally be a re-rate. They climbed 11% this week and are only 6% down. Given I own over 100,000 shares and invested £4,639 this is one of my largest holdings and has been in the red for a long, long time. I'm hoping they will do a SLP:Sylvania Platinum and get to 30p, as that will give me £26K profit, and I will take that!

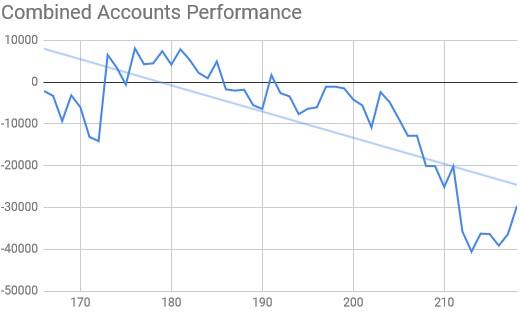

Compared to some weeks over the last few months that's not a bad chart. It does seem odd that I'm starting to consider a £1,000 drop as a flat week! It looks quite flat on the chart though.

Still above the trend line which is very important.

Here's the ISA and share accounts

| Weekly Change | |||

| Cash | £3.24 | +£0 | |

| Portfolio cost | £57,768.95 | +£0 | |

| Portfolio sell value (bid price-commission) | £45,447.53 | (-21.3%) | -£378.88 |

| Potential profits | £0 | +£0 | |

| Yr 5 Dividends | £0.63 | +£0 | |

| Yr 5 Profit from sales | £-167.28 | +£0 | |

| Yr 5 Average monthly cash profit | -£62.89 | (-1.3%) | +£5.72 |

| Total Dividends | £1,342.93 | +£0 | |

| Total Profit from sales | £20,224.13 | +£0 | |

| Average monthly cash profit | £420.88 | (8.7%) | -£1.93 |

| (Sold stocks profit + Dividends - Fees / Months) |

The big gains for IQE:IQE and JLP:Jubilee Metals almost cancelled out the drops in SBTX:SkinBioTherapeutics and OPTI:Optibiotix. IQE:IQE is now looking my best bet for a sale and a return towards my 10% target.

There will be a tiny tweak upwards on the injection line next week as I need to add £20 to the ISA to cover fees. Meanwhile the value is still nearer the injection amount than the cost so a severe under-performance.

Although the right side of the trend line, it needs to be much higher above it than this.

The SIPP looks like this after week 204

| Weekly Change | ||||

| Cash | £206.17 | +£200.00 | ||

| Portfolio cost | £43,965.42 | +£0 | ||

| Portfolio sell value (bid price - commission) |

£38,113.45 | (-13.3%) | -£830.48 | |

| Potential profits | £808.65 | -£134.74 | ||

| Yr 4 Dividends | £556.99 | +£195.00 | ||

| Yr 4 Interest | £0.10 | +£0 | ||

| Yr 4 Profit from sales | £1,161.95 | +£0 | ||

| Yr 4 Average monthly cash profit | £142.00 | (3.9%) | +£14.95 | |

| Total Dividends | £1,899.24 | +£195.00 | ||

| Total Interest | £0.13 | +£0 | ||

| Total Profit from sales | £11,706.87 | +£0 | ||

| Average monthly cash profit | £279.93 | (7.6%) | +£2.79 | |

| (Sold stocks profit + Dividends - Fees / Months) |

Cash increased thanks to £195 dividend from CAML:Central Asia Metals and £5 from the tax man for a small injection I made a few months ago. The value was hit by the SBTX:SkinBioTherapeutics and OPTI:Optibiotix drops, and the small rise in CAML:Central Asia Metals wasn't enough to mitigate it. Long term performance didn't flinch, with the dividend only moving it up by £2.79 a month. 7.6% is way too low and I need to do something about that soon. I'm still counting on MMX:Minds + Machines for that, but it steadfastly refuses to increase in value despite director purchases and a buy-back scheme.

A bit of a steeper dip, but not too far from getting back into the black.

This account has far fewer toxic shares than the ISA so the recovery should be much faster.

Here's the trading account after week 170

| Weekly Change | |||

| Cash | £48.24 | +£13.20 | |

| Portfolio cost | £2,321.29 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,358.02 | (-41.5%) | +£65.96 |

| Potential profits | £0 | +£0 | |

| Year 4 Dividends | £13.20 | +£13.20 | |

| Year 4 Profit | £0 | +£0 | |

| Yr 4 Average monthly cash profit | £4.09 | (2.1%) | +£4.09 |

| Dividends | £47.92 | +£13.20 | |

| Profit from sales | -£64.29 | +£0 | |

| Average monthly cash profit | -£0.42 | (-0.2%) | +£0.34 |

| (Sold stocks profit + Dividends - Fees / Months) |

I bet not many people get dividends in their trading account! It was a great week, with nearly all the shares up and IQE:IQE up a lot. The £13 dividend gave me something to put in the year 4 profit rows, and I'm one sale away from getting into overall profit. I'm pretty certain that sale will be CAML:Central Asia Metals as it's like a coiled spring.

Still a hell of a big gap to make up.

At last we're on the right side of the trend line. I so desperately want to see one of these lines pointing upwards.

So what might happen next week?

There are strikes in the copper mines in Chile, where 25% of the world's copper is produced. The copper price is so low that no companies are exploring for new mines, but demand is still high and set to increase, with things like electric cars having large amounts of copper. Copper is also being heavily shorted, so at some point the shorters will close and the price should rise sharply. When it does, CAML:Central Asia Metals should return to the price it was at before the slump in prices. That was 340p, and with my enlarged holding that would give paper profits of £4,277 (72%). I'd like to buy back the 2,000 shares I sold last month so hope they can hang on at these levels till late November when I get my next £2,000 SIPP transfer.

It's possible something is going on at BLU:Blue Star Capital, one of my more disastrous shares in my trading account. They are 88% down but there was a 6% rise on Friday following a placing earlier in the week to allow them to invest in e-sports. Add to that some stirrings on Twitter from Satoshipay and there's a vague possibility things may turn around. There's a lot of turning round to do if I'm going to see any profit though.

Nothing else happening that I'm aware of, so just keep everything crossed we get news of some exciting deals.