The dismay turned to elation when I read the placing was for the current share price and the institutions were locked in for 3 months. All those shorters counting on it going lower, and now 67 million shares sold at 140p - surely it's unlikely the price will drop below that now?

This morning it all came together as the share price soared. I anticipated a pull-back but it never came, with the price finishing 23p up on yesterday. My ISA holding was bought at 29.59p so that meant a 77.7% rise in a day!

Up until that point it had been a terrible week, but IQE:IQE has saved it big-style. The combined portfolios finished up by £902 at a total value of £79,290 and the buffer between cost and value up to £8,226. Maybe not all Fridays are bad!

Lots of smaller losses this week, including another 1p off OPTI:Optibiotix, but by far the worst performer was MTFB:Motif Bio, dropping 11% and in severe danger of going back into loss as people lose patience and take profits.

I'm torn over Share of the Week this week, as IQE:IQE has had such a wonderful day and saved my week from being well in the red. However, with the SIPP up 11% and the ISA up 49% it suffered from having a less successful start to the week so today was a bit of a recovery. Granted I'm over the moon at total potential profits of £9,276 despite already cashing in £4,978, and my original ISA holding is now 446% up on cost price. However, there's one share that beat it this week.

TLOU:Tlou Energy rose an incredible 42% this week and I don't really know why. It's now up by 60% on purchase price and making potential profits of £832. I think the potential is getting recognised by more people, and if the tender is won for the power station then it could really fly.

Onwards and upwards

The ISA and share portfolios look like this

| Weekly Change | |||

| Cash | £46.18 | -£3.75 | |

| Portfolio cost | £44,426.84 | +£0 | |

| Portfolio sell value (bid price - commission) | £49,949.69 | (+12.4%) | +£856.51 |

| Potential profits | £10,884.34 | +£1,200.15 | |

| Yr 3 Dividends | £10.34 | +£0 | |

| Yr 3 Profit from sales | £585.38 | +£0 | |

| Yr 3 Average monthly cash profit | £166.97 | (4.5%) | -£14.09 |

| Total Dividends | £1,189.39 | +£0 | |

| Total Profit from sales | £7,297.85 | +£0 | |

| Average monthly cash profit | £307.40 | (8.3%) | -£2.76 |

| (Sold stocks profit + Dividends - Fees / Months) |

Cash down due to ISA charge. Potential profits up by £1,200 mainly thanks to IQE:IQE but lots of deepening losses took £350 of that away as the sell price rose by a lower £856.

That'll do nicely for a few weeks thank you.

The SIPP looks like this after week 102

| Weekly Change | |||

| Cash | £19.31 | -£10.88 | |

| Portfolio cost | £26,007.03 | +£0 | |

| Portfolio sell value (bid price - commission) | £28,893.03 | (11.1%) | +£62.34 |

| Potential profits | £4,263.18 | +£82.01 | |

| Yr 2 Dividends | £502.91 | +£0 | |

| Yr 2 Profit from sales | £6,575.33 | +£0 | |

| Yr 2 Average monthly cash profit | £605.04 | (27.9%) | -£13.31 |

| Total Dividends | £916.10 | +£0 | |

| Total Profit from sales | £8,925.19 | +£0 | |

| Average monthly cash profit | £411.82 | (19.0%) | -£4.54 |

| (Sold stocks profit + Dividends - Fees / Months) |

£10.88 vanished from cash as SIPP fees, profit just sneaked up a little thanks to IQE:IQE but almost nullified by drops in LGEN:Legal & General and OPTI:Optibiotix. CAML:Central Asia Metals climbed a little to help out.

The rise has been very shallow over the last few weeks, but it is heading upwards.

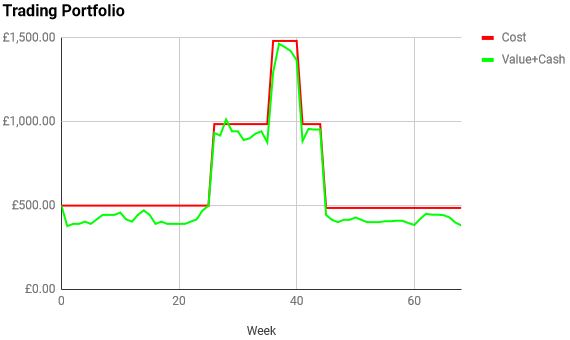

The trading account looks like this after week 68

| Weekly Change | |||

| Cash | £79.63 | +£0 | |

| Portfolio cost | £486.05 | +£0 | |

| Portfolio sell value (bid price - commission) | £302.19 | (-37.8%) | -£16.68 |

| Potential profits | £0 | +£0 | |

| Dividends | £1.15 | +£0 | |

| Profit from sales | -£22.85 | +£0 | |

| Average monthly cash profit | -£1.38 | (-3.4%) | +£0.02 |

| (Sold stocks profit + Dividends - Fees / Months) |

It's just a relentless drip downwards - dull, dull, dull, dull, dull

Dull, dull, dull, dull, dull

So Friday saved the week, and all is well. I don't care what's happening next week as I'm off to Costa Rica. Hopefully I'll get connectivity to take the weekly snapshots so the graphs don't look odd, but the next update will be week 121.

No comments:

Post a Comment