Biggest loser was TEK:Tekcapital in the trading account, so that account had a bad week. There was a 12% drop which wiped out most of the recent rise and left my holding down by 37%.

The other big loser was quite costly, with TLOU:Tlou Energy dropping 8% to go 16% down. I think people are starting to believe that the news release from the Botswana government just meant that the tender process is progressing and the rival bids are both being considered, rather than Tlou having anything in the bag.

Mostly small rises and falls elsewhere, but there were a couple of bigger risers. IQE:IQE climbed 7% of my purchase price in the ISA with the shares I bought as a temporary holding area for the SBTX:SkinBioTherapeutics sale. That's good news but if I'd left it invested in SBTX:SkinBioTherapeutics I'd be better off, as that has continued to climb.

Share of the Week is one of the most volatile at the moment. IKA:Ilika climbed 11% and is up and down like a yo-yo. My holding is still 25% down though.

Still underwater but so close to breaking the surface.

Just above the trend line but competing with that huge mountain from last summer so very unlikely to flatten out the trend.

Here's the ISA and share portfolios

| Weekly Change | |||

| Cash | £26.98 | -£0.21 | |

| Portfolio cost | £57,827.12 | +£256.31 | |

| Portfolio sell value (bid price - commission) | £55,559.69 | (-3.9%) | -£430.69 |

| Potential profits | £8,331.17 | -£233.38 | |

| Yr 4 Dividends | £88.07 | +£0 | |

| Yr 4 Profit from sales | £1,606.13 | +£256.11 | |

| Yr 4 Average monthly cash profit | £167.33 | (3.5%) | +£22.44 |

| Total Dividends | £1,326.40 | +£0 | |

| Total Profit from sales | £20,303.25 | +£256.11 | |

| Average monthly cash profit | £467.07 | (9.7%) | +£3.25 |

| (Sold stocks profit + Dividends - Fees / Months) |

Quite revealing that the sale of CWR:Ceres Power which generated £256 was only enough to keep the average monthly performance at 9.7%. Small profits are not doing much to help the performance any more. The problem is I'm running out of profitable shares to sell. I realised a 23.4% profit from CWR:Ceres Power after only holding a short time. I do want to get back in but the shares have a habit of drifting badly on no news.

I re-invested the proceeds in C4XD:C4X Discovery Holdings which quite a few of my fellow OPTI:Optibiotix shareholders are keen on. I decided that they were way oversold given the potential for big revenues, and so bought them while I wait for CWR:Ceres Power to drop back around 150p. I bought 2,762 shares at 48p costing £1,337.71. They are up 4p but with commission and spread I'm still down 2%.

The drop in paper profit was down to the sale, and the losses were mostly JLP:Jubilee Metals.

The gap widens slightly. Nice to see the cost line creeping up after a very flat year.

Pretty similar to the overall performance chart, with the mountain looming.

The SIPP looks like this after week 183

| Weekly Change | |||

| Cash | £421.50 | +£0 | |

| Portfolio cost | £40,725.38 | +£0 | |

| Portfolio sell value (bid price - commission) | £41,844.81 | (2.7%) | +£60.39 |

| Potential profits | £5,643.09 | -£40.03 | |

| Yr 4 Dividends | £361.99 | +£0 | |

| Yr 4 Interest | £0.07 | +£0 | |

| Yr 4 Profit from sales | £732.65 | +£0 | |

| Yr 4 Average monthly cash profit | £163.58 | (4.8%) | -£6.29 |

| Total Dividends | £1,704.24 | +£0 | |

| Total Interest | £0.10 | +£0 | |

| Total Profit from sales | £11,277.57 | +£0 | |

| Average monthly cash profit | £298.94 | (8.7%) | -£1.64 |

| (Sold stocks profit + Dividends - Fees / Months) |

Tiny drop in profits caused by small fall in CAML:Central Asia Metals but everything else as flat as you can get.

In a relatively happy place on this chart

In a much less happy place on this chart, both below the trend line and with the mountain approaching. There's no doubt that we have almost a year of declining performance now, in what has always been my best account.

The trading account looks like this after week 149

| Weekly Change | |||

| Cash | £35.04 | +£0 | |

| Portfolio cost | £2,321.29 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,484.17 | (-36.1%) | -£39.48 |

| Potential profits | £0 | +£0 | |

| Year 3 Dividends | £33.57 | +£0 | |

| Year 3 Profit | £177.06 | +£0 | |

| Yr 3 Average monthly cash profit | £20.28 | (10.5%) | -£0.46 |

| Dividends | £34.72 | +£0 | |

| Profit from sales | -£64.29 | +£0 | |

| Average monthly cash profit | -£0.86 | (-0.4%) | +£0.01 |

| (Sold stocks profit + Dividends - Fees / Months) |

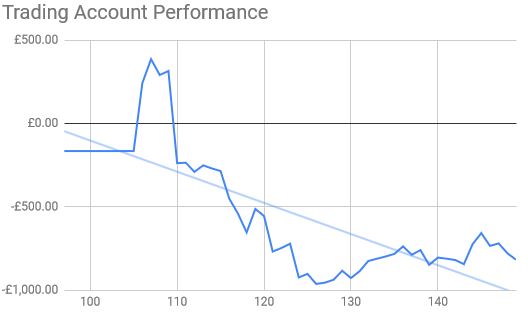

Another bad week and most of the recent gains are gone.

Dropping down towards its lowest low

In 6 months time the trend might point upwards.

Really late with this week's update as I was driving down from Scotland all weekend. This week isn't going very well so far, although I did add £200 to my SIPP and combined it with my CAML:Central Asia Metals dividends to buy another 230 shares in the same company at 221.125p costing £520.54.

I had to take advantage of these low prices and would rather buy more CAML than hold the dividends as cash. When current performance is revealed they will soon climb to 300p and I've decided to keep accumulating long term as the dividend is so great. It's a perfect share for the SIPP, so if any of my other smaller holdings bear fruit I'll likely buy more of these with the proceeds. They make up 8.5% of my total portfolio cost so plenty of headroom before I start to worry about being overweight at 10%.

No comments:

Post a Comment