OPTI:Optibiotix was the only significant faller, but they dropped 6% and my holding is now 35% down. That's about £20,000

IQE:IQE had a good week with the SIPP climbing 7%, the trading account climbing 8% and the ISA climbing 11% of the purchase price. The ISA is only 15% down now, so looking slightly less horrific.

Share of the Week is SBTX:SkinBioTherapeutics, with the ISA holding climbing 18% and the SIPP climbing 25% on anticipation of an impending big deal.

Back below the injection line

Not quite as bad as 3 weeks ago, but almost

The ISA amd share portfolios look like this

| Weekly Change | |||

| Cash | £6.36 | +£0 | |

| Portfolio cost | £57,768.95 | +£0 | |

| Portfolio sell value (bid price-commission) | £33,749.94 | (-41.6%) | -£1,713.64 |

| Potential profits | £0 | +£0 | |

| Yr 5 Dividends | £0 | +£0 | |

| Yr 5 Profit from sales | £-167.28 | +£0 | |

| Yr 5 Average monthly cash profit | -£92.64 | (-1.9%) | +£13.24 |

| Total Dividends | £1,342.30 | +£0 | |

| Total Profit from sales | £20,224.13 | +£0 | |

| Average monthly cash profit | £428.74 | (8.9%) | -£2.00 |

| (Sold stocks profit + Dividends - Fees / Months) |

Down again and all thanks to OPTI:Optibiotix

Here's the SIPP after week 200

| Weekly Change | ||||

| Cash | £17.96 | +£0 | ||

| Portfolio cost | £43,965.42 | +£0 | ||

| Portfolio sell value (bid price - commission) |

£29,801.35 | (-32.2%) | -£1,062.33 | |

| Potential profits | £678.48 | +£450.51 | ||

| Yr 4 Dividends | £361.99 | +£0 | ||

| Yr 4 Interest | £0.10 | +£0 | ||

| Yr 4 Profit from sales | £1,161.95 | +£0 | ||

| Yr 4 Average monthly cash profit | £136.87 | (3.7%) | -£3.18 | |

| Total Dividends | £1,704.24 | +£0 | ||

| Total Interest | £0.13 | +£0 | ||

| Total Profit from sales | £11,706.87 | +£0 | ||

| Average monthly cash profit | £281.56 | (7.7%) | -£1.41 | |

| (Sold stocks profit + Dividends - Fees / Months) |

Same story as above, but the losses reduced by a decent increase in SBTX:SkinBioTherapeutics.

Just about staying the right side of the orange line

Way below the trend line

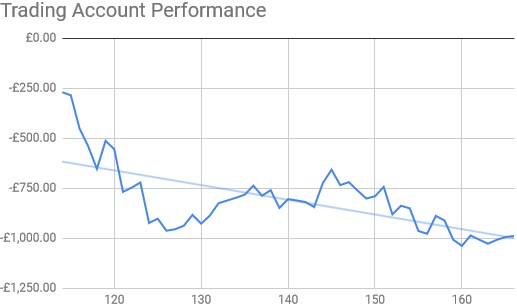

The trading portfolio looks like this after week 166

| Weekly Change | |||

| Cash | £35.04 | +£0 | |

| Portfolio cost | £2,321.29 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,296.95 | (-44.1%) | +£5.41 |

| Potential profits | £0 | +£0 | |

| Year 4 Dividends | £0 | +£0 | |

| Year 4 Profit | £0 | +£0 | |

| Yr 4 Average monthly cash profit | £0 | (0%) | +£0 |

| Dividends | £34.72 | +£0 | |

| Profit from sales | -£64.29 | +£0 | |

| Average monthly cash profit | -£0.77 | (-0.4%) | +£0.01 |

| (Sold stocks profit + Dividends - Fees / Months) |

Tiny rise from climb in IQE:IQE offset by drops in everything else.

Just the right side of the trend line

That's it. Late this week due to a weekend in North Norfolk. I'm not going to mention the horror that unfolded at MTFB:Motif Bio today as that's far too depressing.

No comments:

Post a Comment