I've been on holiday but took snapshots at the weekends so can still catch up,

but seeing as the weeks were so bad I don't have very much to say. This week

the deficit between cost and value widened by £1,920 and is now £40,239, with

the total portfolio value down to £108,833.

DDDD:4D Pharma had another bad week dropping 8% and was a significant

contributor to the drop.

Share of the Week is the only one that gained more than 5% as ASY:Andrews Sykes Group climbed by 9%. They are still 14% down, but I'm a bit more hopeful about these now.

CAML:Central Asia Metals dropped 7%, although my holding is much reduced

here these days. They are still up 16% and my only SIPP share in profit.

IES:Invinity Energy dropped 7% but the fact they haven't gone bust yet is

still a massive bonus.

SMS:Smart Metering Systems hasn't been great as a magic formula share and

dropped 7% this week.

POLY:Polymetal followed the other metals producers and dropped 5% to go 18%

down. At least I've had a dividend from them now which helps ease the pain.

Share of the Week is the only one that gained more than 5% as ASY:Andrews Sykes Group climbed by 9%. They are still 14% down, but I'm a bit more hopeful about these now.

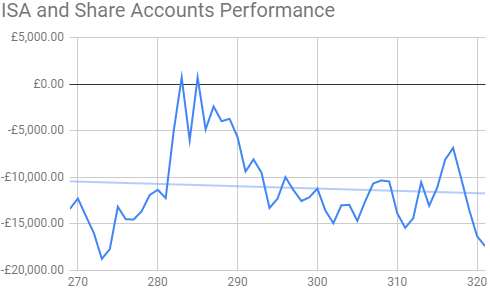

Another tick down but at least it's less steep than the recent ones

Here's the ISA and shares portfolio after week 9 of year 7.

My first ISA dividend in years was £22 from POLY:Polymetal. Cash only increased by £18 due to monthly fees. The value dropped by £1,071 which isn't a huge amount, and £344 of that was down to reduced potential profit for JLP:Jubilee Metals. Long term averages are still looking good.

Pretty bad.

The SIPP looks like this after week 305 overall and week 45 of year 6.

I decided to sell ASHM:Ashmore Group because of their exposure to Evergrande issues. They hold a lot of their bonds, so I got nervous and sold for a £104.42 (9.8%) loss. I know I should have stuck to my 12 month rule for magic formula shares, but I panicked.

Here's the ISA and shares portfolio after week 9 of year 7.

| Weekly Change | |||

| Cash | £52.50 |

+£18.41 | |

| Portfolio cost | £69,679.47 | +£0 | |

| Portfolio sell value (bid price-commission) | £52,250.50 | (-25.0%) | -£1,071.08 |

| Potential profits | £4,144.13 | -£344.28 | |

| Yr 7 Dividends | £22.16 | +£22.16 | |

| Yr 7 Profit from sales | £1,465.26 | +£0 | |

| Yr 7 projected avg monthly profit | £712.55 | (19.5%) | -£79.10 |

| Total Dividends | £1,365.31 | +£22.16 | |

| Total Profit from sales | £25,589.20 | +£0 | |

| Average monthly cash profit |

£359.97 |

(9.8%) | -£0.88 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Compound performance | 61% | +0% |

My first ISA dividend in years was £22 from POLY:Polymetal. Cash only increased by £18 due to monthly fees. The value dropped by £1,071 which isn't a huge amount, and £344 of that was down to reduced potential profit for JLP:Jubilee Metals. Long term averages are still looking good.

Pretty bad.

The SIPP looks like this after week 305 overall and week 45 of year 6.

| Weekly Change | ||||

| Cash | £244.30 | -£77.32 | ||

| Portfolio cost | £76,462.89 | +£0.08 | ||

|

Portfolio sell value (bid price - commission) |

£54,982.31 | (-28.1%) | -£765.11 | |

| Potential profits | £178.36 | -£90.00 | ||

| Yr 6 Dividends | £988.63 | +£44.05 | ||

| Yr 6 Interest | £0 | +£0 | ||

| Yr 6 Profit from sales | £8,241.18 | -£104.42 | ||

| Yr 6 projected avg monthly profit | £871.03 | (22.7%) | -£27.39 | |

| Total Dividends | £3,055.71 | +£44.05 | ||

| Total Interest | £0.20 | +£0 | ||

| Total Profit from sales | £23,700.62 | -£104.42 | ||

| Average monthly cash profit | £368.70 | (9.6%) | -£2.32 | |

|

(Sold stocks profit + Dividends - Fees / Months) |

||||

| Compound performance | 56% | -1% |

I decided to sell ASHM:Ashmore Group because of their exposure to Evergrande issues. They hold a lot of their bonds, so I got nervous and sold for a £104.42 (9.8%) loss. I know I should have stuck to my 12 month rule for magic formula shares, but I panicked.

I re-invested the proceeds plus some cash and bought 665 shares in

WHR:Warehouse REIT which is next on my list of magic formula shares.

They cost £1,011.29.

I had £44.05 dividends this week, with £18.90 from

POLY:Polymetal and £25.15 from CEY:Centamin, but forked out for monthly

fees. That meant I had to dip into £77 of cash to fund the new shares.

The loss didn't have much impact on long term performance and even year 6 is

still healthy at 22%. The portfolio lost £765 and £90 came off potential

profits as CAML:Central Asia Metals dropped again.

As with the other accounts there's no steep drop, but we're in a pretty bad state and it got worse this week.

As with the other accounts there's no steep drop, but we're in a pretty bad state and it got worse this week.

The trading account looks like this after week 271 overall and week 11 of year 6.

Yet another big drop as everything fell in value.

| Weekly Change | |||

| Cash | £259.74 | +£0 | |

| Portfolio cost | £2,374.14 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,044.47 | (-56.0%) | -£83.89 |

| Potential profits | £0.00 | +£0 | |

| Year 6 Dividends | £0.00 | +£0 | |

| Year 6 Profit | £0.00 | +£0 | |

| Yr 6 projected avg monthly profit | £0.00 | (0%) | +£0 |

| Dividends | £60.10 | +£0 | |

| Profit from sales | £937.88 | +£0 | |

| Average monthly cash profit | £15.96 | (8.1%) | -£0.06 |

|

(Sold stocks profit + Dividends - Fees / Months) |

Yet another big drop as everything fell in value.

Will it ever change direction?

Good job I was on holiday when all this was happening so I had something to

take my mind off it.

No comments:

Post a Comment