The only 2 shares down significantly were my magic formula shares that have been hit by Russia invading Ukraine. Both FXPO:Ferrexpo and POLY:Polymetal dropped 5% to go 91% and 83% down respectively. I think FXPO has now dropped enough to stop reporting on its movements, as anything over 90% down may as well be regarded as a basket case and ignored.

CWR:Ceres Power has been recovering from a massive drop just after I bought them and went up 6% this week. They are only 14% down now, which is pretty good for one of my speculative buys.

IPX:Impax Asset Management went up 7% and are now 1% in profit. I don't know if the recent slide was just a blip or if these may settle down now. If they carry on being volatile I may consider them for the trading account when I sell JLP:Jubilee Metals.

Speaking of which, JLP:Jubilee Metals had a brilliant week climbing 9% which has put my biggest holding up by 21% with £2,314 potential profit. Unfortunately most of my other holdings are still down by about 35% so I need it to break 12p.

Share of the week was last week's biggest faller SBTX:SkinBioTherapeutics, which made up for it by climbing 18% this week. I don't know why, as there's no sign of any news, but I'm not complaining.

Here's the ISA and shares portfolio after week 42 of year 9.

| Weekly Change | |||

| Cash | £61.20 | -£4.93 | |

| Portfolio cost | £105,005.30 | +£0 | |

|

Portfolio sell value (bid price-commission) |

£50,565.50 | (-51.8%) | +£2,395.33 |

| Potential profits | £3,212.60 | +£1,266.59 | |

| Yr 9 Dividends | £245.03 | +£0 | |

| Yr 9 Interest | £4.14 | +£0 | |

| Yr 9 Profit from sales | £262.11 | +£0 | |

| Yr 9 proj avg monthly profit | £45.28 | (0.7%) | -£1.63 |

| Total Dividends | £12,156.46 | +£0 | |

| Total Interest | £6.07 | +£0 | |

| Total Profit from sales | £17,560.64 | +£0 | |

| Average monthly cash profit | £276.96 | (4.4%) | -£0.65 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Compound performance | 38% | +0% |

Cash is down £4 due to monthly fees, and value up by a wonderful £2,395, with £1,266 of that increased profits mainly thanks to JLP:Jubilee Metals.

Almost at the level 3 months ago, but after injecting loads more cash.

The trend line is still just pointing upwards and we're almost on it.

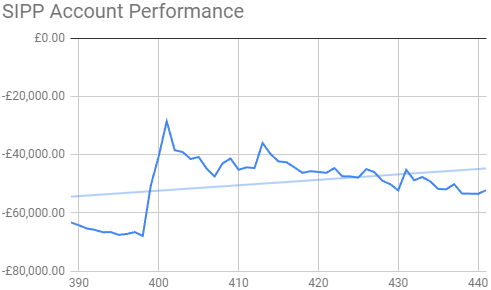

The SIPP looks like this after week 442 overall and week 26 of year 9.

| Weekly Change | ||||

| Cash | £86.61 | +£9.36 | ||

| Portfolio cost | £108,831.67 | +£0 | ||

|

Portfolio sell value (bid price - commission) |

£58,052.87 | (-46.7%) | +£1,403.98 | |

| Potential profits | £4,391.14 | +£418.55 | ||

| Yr 9 Dividends | £313.90 | +£11.55 | ||

| Yr 9 Interest | £2.81 | +£0 | ||

| Yr 9 Profit from sales | £4,004.44 | +£0 | ||

| Yr 9 proj avg monthly profit | £701.66 | (11.6%) | -£26.45 | |

| Total Dividends | £14,948.78 | +£11.55 | ||

| Total Interest | £8.74 | +£0 | ||

| Total Profit from sales | £14,840.34 | +£0 | ||

| Average monthly cash profit | £279.70 | (4.6%) | -£0.54 | |

|

(Sold stocks profit + Dividends - Fees / Months) |

||||

| Compound performance | 39% | +0% |

Cash was up thanks to an £11 dividend from GAW:Games Workshop, minus monthly fees. Value up a wonderful £1,403, but potential profits only made up £418 of that, with small rises in many shares contributing.

Still same as ISA

A bit further below the trend line in this one, which is a surprise as the SIPP usually beats the ISA. It's probably due to my massive ISA holding in JLP:Jubilee Metals, as opposed to lots of safer shares in here.

The trading account looks like this after week 408 overall and week 44 of year 8.

| Weekly Change | |||

| Cash | £63.39 | +£0 | |

| Portfolio cost | £2,073.87 | +£0 |

|

|

Portfolio sell value (bid price - commission) |

£1,644.53 | (-20.7%) | +£141.68 |

| Potential profits | £175.75 | +£59.73 | |

| Year 8 Dividends | £25.36 | +£0 | |

| Year 8 Interest | £0 | +£0 | |

| Year 8 Profit | £328.15 | +£0 | |

| Yr 8 proj avg monthly profit | £34.81 | (+20.1%) | -£0.81 |

| Dividends | £85.46 | +£0 | |

| Interest | £0.03 | +£0 | |

| Profit from sales | -£602.54 | +£0 | |

| Average monthly cash profit | -£5.49 | (-3.2%) | +£0.02 |

|

(Sold stocks profit + Dividends - Fees / Months) |

An absolutely brilliant week, with JLP:Jubilee Metals up 9% and SBTX:SkinBioTherapeutics up 18% resulting in an improvement of £141 and potential profit is up to £175, but still I hold firm for a bit more.

I love to see a steep green line!

Soaring above the trend line and in the best position this account has seen since just before the dreaded DDDD:4D Pharma collapse.

OPTI:Optibiotix has been pretty much stagnant for a month now after a long, slow decline. Monday sees a business update on the Investor Meet platform, but will we see an RNS on the same day? I worry that there's nothing to tell, and that if anything the share price will drop further as the prospect of anything happening soon gets kicked down the road.

Meanwhile there's massive momentum with JLP:Jubilee Metals, and if that can continue then it won't matter if OPTI stays stagnant. I do rather need JLP to take off, as I lent my ISA most of my holiday money so I could buy them cheap and take the money out of my dealing account when I sell them at near break-even to avoid capital gains tax. The first lot I'm selling is at 8.5p, so we're only 0.3p away from that and it could come next week. That will give me £266 (24%) profit and return £1,356 to my holiday fund. I then need to wait for 11.5p to sell the next lot, which will give £408 (19%) and return £2,538 to my holiday fund, then finally 14p, which will give me £219 (11%) and return £2,218 to my holiday fund. When it gets to 14p my main holding bought with my holiday money will be up by £11,615 making 107% profit. If it goes pear-shaped then I'll have to rob my premium bonds to pay for my holiday.

I should get a massive dividend from CAML:Central Asia Metals on Wednesday, so I'll top that up with cash to £500 and get something in my SIPP. Most likely that will be EDV:Endeavour Mining, as I only have £500 worth in my AJ Bell account and it's only 3% up, so a similar price to when I first bought them. My original holding is still down by 13% which is ridiculous considering the current gold price compared to when I bought them.

I should get a massive dividend from CAML:Central Asia Metals on Wednesday, so I'll top that up with cash to £500 and get something in my SIPP. Most likely that will be EDV:Endeavour Mining, as I only have £500 worth in my AJ Bell account and it's only 3% up, so a similar price to when I first bought them. My original holding is still down by 13% which is ridiculous considering the current gold price compared to when I bought them.