Worst performer and the only share that dropped by more than 5% was SBTX:SkinBioTherapeutics. That fell 6% and put a dampener on the week.

AJB:AJ Bell went up another 5% and is now 17% in profit.

CAML:Central Asia Metals also went up 5% which is great for my SIPP profits as that holding is up 25% and is one of my bigger holdings.

GAW:Games Workshop also went up 5% and is now 7% in profit, but it tends to wax and wane around break even so it may be short-lived.

PAGE:Pagegroup also went up 5% and is now only 8% down, however whenever this looks like getting close to break-even some bit of news seems to shoot it back down again.

PSN:Persimmon also went up 5% this week and now is only 2% down and teetering on the brink of profitability.

Share of the Week is AFC:AFC Energy which went up 10% and has gone back into profit by 3%. They do tend to yo-yo, but I'm hoping for a re-rate at some point. I'd like to get some more, but no prospect of getting cash in the short term.

Here's the ISA and shares portfolio after week 41 of year 9.

| Weekly Change | |||

| Cash | £66.13 | +£0.19 | |

| Portfolio cost | £105,005.30 | +£0 | |

|

Portfolio sell value (bid price-commission) |

£48,170.17 | (-54.1%) | +£928.66 |

| Potential profits | £1,946.01 | +£741.19 | |

| Yr 9 Dividends | £245.03 | +£0 | |

| Yr 9 Interest | £4.14 | +£0.19 | |

| Yr 9 Profit from sales | £262.11 | +£0 | |

| Yr 9 proj avg monthly profit | £46.91 | (0.7%) | -£1.15 |

| Total Dividends | £12,156.46 | +£0 | |

| Total Interest | £6.07 | +£0.19 | |

| Total Profit from sales | £17,560.64 | +£0 | |

| Average monthly cash profit | £277.61 | (4.4%) | -£0.61 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Compound performance | 38% | +0% |

A good week for both value and potential profits, and 19p interest to boost the cash!

It appears to have been pretty flat for almost a year.

Still below the trend line and the flatness above is an illusion when you take into account increased portfolio cost.

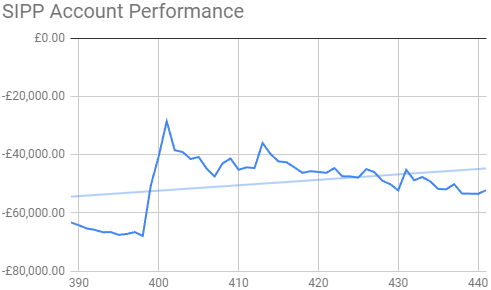

The SIPP looks like this after week 441 overall and week 25 of year 9.

| Weekly Change | ||||

| Cash | £77.25 | -£249.16 | ||

| Portfolio cost | £108,831.67 | +£249.23. | ||

| Portfolio sell value (bid price - commission) | £56,648.89 | (-47.9%) | +£1,248.97 | |

| Potential profits | £3,972.59 | +£759.02 | ||

| Yr 9 Dividends | £302.35 | +£0 | ||

| Yr 9 Interest | £2.81 | +£0.07 | ||

| Yr 9 Profit from sales | £4,004.44 | +£0 | ||

| Yr 9 proj avg monthly profit | £728.11 | (12.1%) | -£30.32 | |

| Total Dividends | £14,902.59 | +£0 | ||

| Total Interest | £8.74 | +£0.07 | ||

| Total Profit from sales | £14,840.34 | +£0 | ||

| Average monthly cash profit | £280.24 | (4.6%) | -£0.64 | |

| (Sold stocks profit + Dividends - Fees / Months) | ||||

| Compound performance | 39% | +0% |

Similar story to ISA, but costs have gone up more as there's a regular injection.

As with the ISA, a long term decline which will reflect in the trend line in a few months unless we can get above it.

The trading account looks like this after week 407 overall and week 43 of year 8.

| Weekly Change | |||

| Cash | £63.39 | +£0 | |

| Portfolio cost | £2,073.87 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,502.85 | (-27.5%) | +£53.78 |

| Potential profits | £116.02 | +£34.12 | |

| Year 8 Dividends | £25.36 | +£0 | |

| Year 8 Interest | £0 | +£0 | |

| Year 8 Profit | £328.15 | +£0 | |

| Yr 8 proj avg monthly profit | £35.62 | (+20.6%) | -£0.85 |

| Dividends | £85.46 | +£0 | |

| Interest | £0.03 | +£0 | |

| Profit from sales | -£602.54 | +£0 | |

| Average monthly cash profit | -£5.51 | (-3.2%) | +£0.01 |

| (Sold stocks profit + Dividends - Fees / Months) |

A good week for JLP:Jubileee Metals offset by a bad week for SBTX:SkinBioTherapeutics, but we still end up £53 better off and potential profits are now £116. Normally I would have sold by now, but I'm determined to hang on for 11.5p which will be enough to put my long term performance back in the black.

Back where we were a few weeks ago.

Way above the trend line which is now pointing up again.

I'm a week late writing this up after going to Spain, so winding up so I can write this weeks.

No comments:

Post a Comment