Worst performer was recent high-flyer ALU:Alumasc Group, which fell 13%, but fortunately is still 28% up. I'm assuming this is people taking profits after the recent rapid rise, as there's no other reason I can see.

IPX:Impax Asset Management did almost as bad, dropping 10%, but this was due to St James's Place dropping them from managing one of its funds. It was however a small fund and 10% seems a ridiculously big drop.

PSN:Persimmon has been on a good run lately but dropped 6% this week and are now only 8% up. All these falls in companies where I had potential profits was very damaging there, although it wasn't enough to completely wipe out last week's gains.

At last a change of fortune for AFC:AFC Energy, which had halved in value over the last few weeks. This week it turned around and went up 9%. Still a long way to go back to break-even though.

FXPO:Ferrexpo are really surging, and went up 9% this week, but are still 88% down. That does mean I can report on them again now they are better than 90% down.

SCT:Softcat had absolutely brilliant results and zoomed up 10% to go 3% in profit, and were one of the few good magic formula shares this week.

Share of the Week for the 2nd week in a row is SBTX:SkinBioTherapeutics, which went up 12% in anticipation of an imminent Croda deal. Experience tells me that nothing will happen before Christmas and this will drop like a brick.

Here's the ISA and shares portfolio after week 13 of year 10.

| Weekly Change | |||

| Cash | £76.90 | +£32.85 | |

| Portfolio cost | £111,273.84 | +£0 | |

| Portfolio sell value (bid price-commission) | £40,936.39 | (-63.2%) | +£27.64 |

| Potential profits | £0 | -£61.84 | |

| Yr 10 Dividends | £53.50 | +£32.85 | |

| Yr 10 Interest | £0.37 | +£0 | |

| Yr 10 Profit from sales | £243.66 | +£0 | |

| Yr 10 proj avg monthly profit | £90.81 | (1.3%) | +£4.29 |

| Total Dividends | £12,275.99 | +£32.85 | |

| Total Interest | £7.17 | +£0 | |

| Total Profit from sales | £18,121.50 | +£0 | |

| Average monthly cash profit | £269.48 | (4.0%) | +£0.26 |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Compound performance | 37% | +0% |

OPTI:Optibiotix dropped 0.5p but the rise in SBTX:SkinBiotheapeutics was enough to counter it, and the portfolio ended £27 better than last week. CWR:Ceres Power dropped yet again and all my potential profits are wiped out. The £32 dividend was from CAML:Central Asia Metals.

Flattened out from the relentless fall.

Still well below the trend line.

The SIPP looks like this after week 465 overall and week 49 of year 9.

| Weekly Change | ||||

| Cash | £219.37 | +£87.58 | ||

| Portfolio cost | £118,243.38 | +£194.97 | ||

| Portfolio sell value (bid price - commission) | £58,934.06 | (-50.2%) | -£1,059.71 | |

| Potential profits | £5,221.17 | -£672.34 | ||

| Yr 9 Dividends | £1,426.74 | +£220.05 | ||

| Yr 9 Interest | £6.45 | +£0 | ||

| Yr 9 Profit from sales | £5,606.15 | +£0 | ||

| Yr 9 proj avg monthly profit | £604.21 | (9.2%) | +£7.28 | |

| Total Dividends | £16,061.62 | +£220.05 | ||

| Total Interest | £12.38 | +£0 | ||

| Total Profit from sales | £16,442.05 | +£0 | ||

| Average monthly cash profit | £290.30 | (4.4%) | +£1.43 | |

| (Sold stocks profit + Dividends - Fees / Months) | ||||

| Compound performance | 40% | +1% |

I got a tax rebate plus a £220 dividend from CAML:Central Asia Metals, so although I prefer not to spend more than £500 in one transaction, because AJ Bell commission is only £5 I bought another 4,169 shares in JLP:Jubilee Metals at 4.5568p costing £194.97. They have frozen at 4.5p and I'm convinced that's the minimum the big seller will allow them to be sold for, so in theory we shouldn't drop below this price unless they get desperate and accept less.

Potential profits were hammered by £672 as lots of profitable shares had big drops, and the portfolio ended up losing £1,059.

So depressing that I came within a whisker of crossing the injection line a few months ago, but now it's as far away as ever.

Worst situation for the last 12 months at least, and I may have to adjust the Y axis next week if we cross £60k deficit.

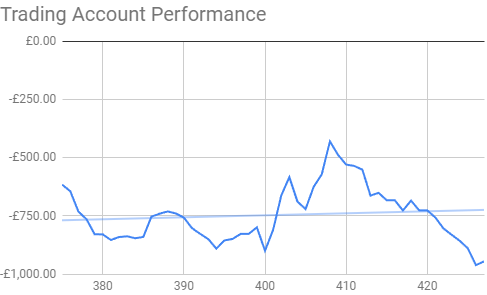

The trading account looks like this after week 431 overall and week 15 of year 9.

A great week, with JLP:Jubilee Metals up 1% and SBTX:SkinBioTherapeutics up 12%, so that resulted in a £41 improvement, but most importantly, SBTX is in profit by £26! It's at 16p and my target is 23p so I may have a while to wait.

It's a tick up, but still looking grim.

Still well below the trend line, and that's pointing down now.

So depressing that I came within a whisker of crossing the injection line a few months ago, but now it's as far away as ever.

Worst situation for the last 12 months at least, and I may have to adjust the Y axis next week if we cross £60k deficit.

The trading account looks like this after week 431 overall and week 15 of year 9.

| Weekly Change | |||

| Cash | £63.39 | +£0 | |

| Portfolio cost | £2,073.87 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,180.98 | (-43.1%) | +£41.43 |

| Potential profits | £26.80 | +£26.80 | |

| Year 9 Dividends | £0 | +£0 | |

| Year 9 Interest | £0 | +£0 | |

| Year 9 Profit | £0 | +£0 | |

| Yr 8 proj avg monthly profit | £0 | (+0%) | +£0 |

| Dividends | £85.46 | +£0 | |

| Interest | £0.03 | +£0 | |

| Profit from sales | -£602.54 | +£0 | |

| Average monthly cash profit | -£5.20 | (-3.0%) | +£0.01 |

| (Sold stocks profit + Dividends - Fees / Months) |

A great week, with JLP:Jubilee Metals up 1% and SBTX:SkinBioTherapeutics up 12%, so that resulted in a £41 improvement, but most importantly, SBTX is in profit by £26! It's at 16p and my target is 23p so I may have a while to wait.

It's a tick up, but still looking grim.

Still well below the trend line, and that's pointing down now.

It's the PBX:Probiotix Health general meeting this week. I've voted, so just a case of waiting to see whether the CEO managed to block OPTI:Optibiotix from voting. If he did then it's not a done deal that he'll be sacked, but there's still a reasonable chance.

The main question is whether the JLP:Jubilee Metals seller will finish and hopefully take the brakes off the share price. Ideally I need it to happen next week, as I want to buy back the CAML:Central Asia Metals shares I sold, and preferably double my holding.

The main question is whether the JLP:Jubilee Metals seller will finish and hopefully take the brakes off the share price. Ideally I need it to happen next week, as I want to buy back the CAML:Central Asia Metals shares I sold, and preferably double my holding.