OPTI:Optibiotix was the worst performer, dropping 12% after predictably underwhelming interim results. Given the fiasco with the way both SBTX:SkinBioTherapeutics and PBX:Probiotix Health are being run, and given the vast losses I suffered when DDDD:4D Pharma went bust, I'm concerned that my faith in microbiome shares was horribly misplaced. I guess it was a binary chance. I was either going to do really well or really badly, but it's currently looking like none of the promises being made are ever coming to anything. There have just been a relentless series of disappointments, and nothing is pointing to that ever changing. Buying more in my ISA the other week was a daft thing to do, as my SIPP holdings will never be sellable other than at a huge loss.

SAE:Simec Atlantis Energy fell 9% and are now 75% down, and the brief excitement of a few weeks ago seems to have been forgotten.

TRX:Tissue Regenix dropped 9% completely out of the blue. I thought this had turned a corner, but once again I was wrong.

CORE:Solidcore Resources was Share of the Week last week, climbing 10%, but gave back a significant proportion, dropping 6% this week.

APAX:Apax Global Alpha fell another 5% to go 26% down, and is one of my poorly performing magic formula shares. I have had £145 dividends though, so I'm only really down 13%.

PAGE:Pagegroup reversed their serial decline and went up 5% and are now 22% down.

ATYM:Atalaya

Mining had a great week as commodity prices surged, climbing 8% and are only 9% down now.

CMCL:Caledonia Mining went up 8% and into profit, with my holding up by 7%. That's while CEY:Centamin is standing still, so I think selling was the right thing to do.

RIO:Rio Tinto went up 11% after slipping for months. They are only 11% down now.

AAL:Anglo American Mining did even better than the other miners, climbing 14% to go just 3% down.

Share of the Week is CWR:Ceres Power, who produced a terrific set of results and zoomed up 29% to go into profit by 14%. One of my speculative ISA shares is finally doing something positive!

Here's the ISA and shares portfolio after week 9 of year 10.

| Weekly Change | |||

| Cash | £23.24 | +£0 | |

| Portfolio cost | £111,188.18 | +£0 | |

|

Portfolio sell value (bid price-commission) |

£44,645.74 | (-59.8%) | -£1,723.79 |

| Potential profits | £212.60 | +£212.60 | |

| Yr 10 Dividends | £0 | +£0 | |

| Yr 10 Interest | £0.11 | +£0 | |

| Yr 10 Profit from sales | £149.75 | +£0 | |

| Yr 10 proj avg monthly profit | £64.08 | (0.9%) | -£8.01 |

| Total Dividends | £12,222.49 | +£0 | |

| Total Interest | £6.91 | +£0 | |

| Total Profit from sales | £18,027.59 | +£0 | |

| Average monthly cash profit | £270.47 | (4.0%) | -£0.57 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Compound performance | 36% | +0% |

Big drop thanks to OPTI:Optibiotix, but potential profit up from £0 to £212 thanks to CWR:Ceres Power.

And still the decline continues.

Horrid.

The SIPP looks like this after week 461 overall and week 45 of year 9.

| Weekly Change | ||||

| Cash | £116.14 | -£105.65 | ||

| Portfolio cost | £115,565.66 | +£503.47 | ||

| Portfolio sell value (bid price - commission) | £59,457.40 | (-48.5%) | -£1,664.68 | |

| Potential profits | £5,034.01 | +£102.69 | ||

| Yr 9 Dividends | £1,001.40 | +£22.82 | ||

| Yr 9 Interest | £4.98 | +£0 | ||

| Yr 9 Profit from sales | £5,670.64 | +£0 | ||

| Yr 9 proj avg monthly profit | £624.89 | (9.8%) | -£11.95 | |

| Total Dividends | £15,636.28 | +£22.82 | ||

| Total Interest | £10.91 | +£0 | ||

| Total Profit from sales | £16,506.54 | +£0 | ||

| Average monthly cash profit | £289.60 | (4.6%) | -£0.41 | |

| (Sold stocks profit + Dividends - Fees / Months) | ||||

| Compound performance | 40% | +0% |

I had built up around £250 cash from tax rebates and dividends, so I added another £250 and topped up my holding in IPX:Impax Asset Management, as they are top of my magic formula rankings and the price is still very low. I bought 127 shares at 392.497p costing £503.47. They promptly fell in value some more.

Portfolio value dropped for reasons already stated, but despite that, potential profits grew by £102 and are now above £5,000. I also got a £22 dividend from RIO:Rio Tinto.

Grumble grumble...

Well below the trend line and dragging it lower.

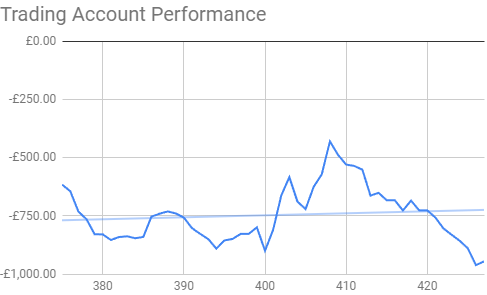

The trading account looks like this after week 427 overall and week 11 of year 9.

Amazingly this went up thanks to a 0.1p rise in JLP:Jubilee Metals. Is this the start of the turnaround?

Onward and upwards from here!

The trend line still points up...

Grumble grumble...

Well below the trend line and dragging it lower.

The trading account looks like this after week 427 overall and week 11 of year 9.

| Weekly Change | |||

| Cash | £63.39 | +£0 | |

| Portfolio cost | £2,073.87 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,128.23 | (-45.6%) | +£15.95 |

| Potential profits | £0 | +£0 | |

| Year 9 Dividends | £0 | +£0 | |

| Year 9 Interest | £0 | +£0 | |

| Year 9 Profit | £0 | +£0 | |

| Yr 8 proj avg monthly profit | £0 | (+0%) | +£0 |

| Dividends | £85.46 | +£0 | |

| Interest | £0.03 | +£0 | |

| Profit from sales | -£602.54 | +£0 | |

| Average monthly cash profit | -£5.25 | (-3.0%) | +£0.01 |

| (Sold stocks profit + Dividends - Fees / Months) |

Amazingly this went up thanks to a 0.1p rise in JLP:Jubilee Metals. Is this the start of the turnaround?

Onward and upwards from here!

The trend line still points up...

A week late writing this up. It would be nice to have a positive week so I actually want to write this!

No comments:

Post a Comment