WRES:W Resources has been on a bit of a run recently, with good news about deplyment of the crusher and jig. They took a bit of a plunge when warrants were cashed and dropped 11% this week. They are 40% down but I think will recover when production starts. The dilution is so great I don't see them getting very high, but I'll be happy to take 30% to hit my 10% a year target.

JLP:Jubilee Metals had an amazing couple of weeks, but this was the week of profit taking, so there was a 10% drop. It's one of my biggest holdings, so contributed most of this week's losses. They are 36% down losing £1,671 but I'm feeling more bullish about prospects as Kabwe construction progresses and revenues build in the other projects. The Colin Bird factor still makes me nervous though.

CEY:Centamin is really frustrating. They have piles of cash and a good dividend and I thought I'd bought in for a bargain, but could have got much more of a bargain had I waited. My ISA holding is 38% down and losing £583 and my SIPP is 22% down and losing £664. The dividend will appear soon and should be round about £95 altogether. I'm tempted to buy more at these prices. They have an utterly massive pile of cash and when they announce what they plan to do with it, the price will recover.

TAP:Taptica just won't recover and dropped another 5% to go 47% down. Another disaster in my cursed trading account.

Only one share had a rise above 5% this week, so well done TND:Tandem Group on climbing 10% and winning Share of the Week. These are only 5% down now and move very quickly on small volume. At this share price PE ratio is still only 6, and with a robust outlook for 2019/20 ought to be at least 10 so I'm anticipating they will almost double. I'll sell out earlier than that as 40% is my target.

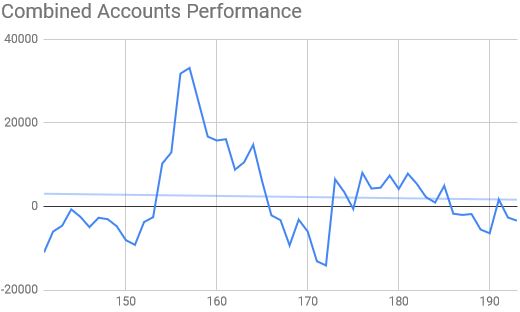

Only half as bad as 3 weeks ago, but still bad

It's happened - the trend line is pointing downwards for the first time. Deeply distressing.

Here's the ISA and share portfolios

| Weekly Change | |||

| Cash | £26.97 | +£0 | |

| Portfolio cost | £57,274.78 | +£0 | |

| Portfolio sell value (bid price - commission) | £53,428.18 | (-6.7%) | -£397.02 |

| Potential profits | £6,995.37 | -£7.33 | |

| Yr 4 Dividends | £60.50 | +£0 | |

| Yr 4 Profit from sales | £1,077.60 | +£0 | |

| Yr 4 Average monthly cash profit | £129.78 | (2.7%) | -£3.60 |

| Total Dividends | £1,298.83 | +£0 | |

| Total Profit from sales | £19,774.72 | +£0 | |

| Average monthly cash profit | £469.19 | (9.8%) | -£2.44 |

| (Sold stocks profit + Dividends - Fees / Months) |

Hardly any change in potential profits, with OPTI:Optibiotix staying still and CWR:Ceres Power dropping 1%. Most of the losses were down to JLP:Jubilee Metals losing 10%. I need TND:Tandem Group to do an upwards spurt so I can flog them and use the proceeds for more bargain CEY:Centamin. I was hoping it would happen before the dividend, but ex-date is on Monday so no chance now.

As good as flat really. Next week I need to adjust the chart to set the bottom limit on the x axis to £40,000. That might boost my morale a little.

Slight downward inflection on the trend line now.

The SIPP looks like this after week 177

| Weekly Change | |||

| Cash | £78.67 | +£0 | |

| Portfolio cost | £40,524.05 | +£0 | |

| Portfolio sell value (bid price - commission) | £41,690.13 | (2.9%) | -£352.66 |

| Potential profits | £6,003.06 | -£160.19 | |

| Yr 4 Dividends | £0 | +£0 | |

| Yr 4 Interest | £0.07 | +£0 | |

| Yr 4 Profit from sales | £484.30 | +£0 | |

| Yr 4 Average monthly cash profit | £87.39 | (2.7%) | -£4.37 |

| Total Dividends | £1,342.25 | +£0 | |

| Total Interest | £0.09 | +£0 | |

| Total Profit from sales | £11,029.22 | +£0 | |

| Average monthly cash profit | £294.49 | (8.7%) | -£1.67 |

| (Sold stocks profit + Dividends - Fees / Months) |

The small drop in potential profit was down to a 3% drop in CAML:Central Asia Metals, offset by a 4% rise in VRS:Versarien which now sits 31% up with paper profit of £459. A little tempting to flog it as the price is getting ahead of itself again, but too scared of something big being announced. I'll stick with it this time.

Staying above the line, but historically this account has enjoyed a much bigger buffer.

It will be very upsetting if this trend line reverses. It's being dragged lower so needs something magical very soon to save it.

Here's the trading account after week 143

| Weekly Change | |||

| Cash | £18.80 | +£0 | |

| Portfolio cost | £2,321.29 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,458.07 | (-37.2%) | -£24.77 |

| Potential profits | £0 | +£0 | |

| Year 3 Dividends | £17.33 | +£0 | |

| Year 3 Profit | £177.06 | +£0 | |

| Yr 3 Average monthly cash profit | £21.60 | (11.2%) | -£0.57 |

| Dividends | £18.48 | +£0 | |

| Profit from sales | -£64.29 | +£0 | |

| Average monthly cash profit | -£1.39 | (-0.7%) | +£0.01 |

| (Sold stocks profit + Dividends - Fees / Months) |

The only gfood news about this poxy account is that the long term average performance improves by 1p every week - or should I say the losses reduce by 1p each week! Drops in CAML:Central Asia Metals and TAP:Taptica were greater than the small gain in IQE:IQE so value dropped by £24.

Still rubbish

Still above the abysmal trend line which is the only crumb of comfort.

That's it for this shortened week. Next week is another short one and there are dividend ex-dates for both CEY:Centamin and CAML:Central Asia Metals so there are likely to be corresponding drops in share price. I was hoping the dividend for CAML:Central Asia Metals would see a rise into ex-date as it's such a good yield, but it ought to have happened by now. At least my trading account will get the dividend, which will be the only income that account has had for a long time.

No comments:

Post a Comment