The 2p fall in OPTI:Optibiotix was a very small percentage, but cost £2,000. Most of the rest of the drop was IQE:IQE which fell 7% in my ISA just as it looked like profit was around the corner.

SBTX:SkinBioTherapeutics was the other big faller, dropping 5% and making me relieved I sold my SIPP holding last week.

Share of the week is WRES:W Resources, which climbed 3% and was the highest percentage gain. It was worth about £20 so not exactly enough to retire on. They have at least started producing concentrate now, so if some revenue figures start coming in we may see enough of a re-rate for me to sell the things.

Note the increase in cost, which will be explained in my SIPP review.

Nothing to worry about,

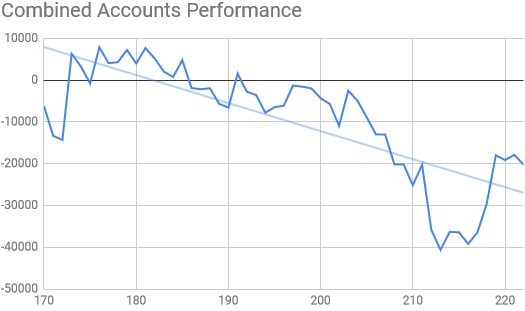

Here's the ISA and share accounts' performance

| Weekly Change | |||

| Cash | £19.49 | -£3.75 | |

| Portfolio cost | £57,768.95 | +£0 | |

| Portfolio sell value (bid price-commission) | £45,241.03 | (-21.7%) | -£1,366.82 |

| Potential profits | £0 | +£0 | |

| Yr 5 Dividends | £0.63 | +£0 | |

| Yr 5 Profit from sales | £-167.28 | +£0 | |

| Yr 5 Average monthly cash profit | -£55.07 | (-1.1%) | +£2.98 |

| Total Dividends | £1,342.93 | +£0 | |

| Total Profit from sales | £20,224.13 | +£0 | |

| Average monthly cash profit | £417.02 | (8.7%) | -£1.96 |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Performance/Injection | 13.4% | -0.1% | |

| Compound performance | 57% | +0% |

Cash dropped due to the monthly ISA charge, and a sizeable drop in value. Still nothing in profit.

Not a scary dip.

Still safely on the right side of the trend line

The SIPP looks like this after week 206

| Weekly Change | ||||

| Cash | £103.28 | -£3,334.69 | ||

| Portfolio cost | £44,895.31 | +£3,319.46 | ||

| Portfolio sell value (bid price - commission) |

£38,153.31 | (-15.0%) | -£957.00 | |

| Potential profits | £482.97 | +£75.00 | ||

| Yr 4 Dividends | £556.99 | +£0 | ||

| Yr 4 Interest | £0.10 | +£0 | ||

| Yr 4 Profit from sales | £2,004.18 | +£0 | ||

| Yr 4 Average monthly cash profit | £208.00 | (5.6%) | -£5.59 | |

| Total Dividends | £1,899.24 | +£0 | ||

| Total Interest | £0.13 | +£0 | ||

| Total Profit from sales | £12,549.10 | +£0 | ||

| Average monthly cash profit | £294.61 | (7.9%) | -£1.76 | |

| (Sold stocks profit + Dividends - Fees / Months) | ||||

| Performance/Injection | 12.7% | -0.1% | ||

| Compound performance | 50% | +0% |

Cash plummeted as I spent £3,319.46 on more OPTI:Optibiotix shares and paid the monthly SIPP charge. I know I said I would wait for SBTX:SkinBioTherapeutics to drop, but when OPTI slipped below 63p I couldn't stop myself from getting some more. I have around £2,000 coming from my work pension in a few weeks, so I'll endeavor to buy SBTX with that (honest).

I bought another 5,309 shares at 62.3p which is still a complete bargain and averages down my SIPP price from just over 66p to 65.97p. It's like buying SBTX anyway, as it just increases the amount of dividend I get when OPTI sell off some of their shares.

It wasn't a great week, and even my 62.3p resulted in a loss on the new shares as they closed at bid price of 61p. The increase in portfolio cost meant my performance fell from 8.6% to 7.9% against cost, but just 0.1% against the injection amount.

There are only 2 weeks left of year 4, so it's looking like a below average year for profits, with just 5.6%. That's still better than any building society though.

The cost bounces back up and is around £1,000 higher thanks to the profit from the SBTX:SkinBioTherapeutics sale the other week and the CAML:Central Asia Metals dividend. Value doesn't go up as the cash was included last week.

Third week of dipping for this account, but the right side of the trend line.

Here's the trading account after week 172

| Weekly Change | |||

| Cash | £48.24 | +£0 | |

| Portfolio cost | £2,321.29 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,364.17 | (-41.2%) | -£11.31 |

| Potential profits | £0 | +£0 | |

| Year 4 Dividends | £13.20 | +£0 | |

| Year 4 Profit | £0 | +£0 | |

| Yr 4 Average monthly cash profit | £3.57 | (1.8%) | -£0.24 |

| Dividends | £47.92 | +£0 | |

| Profit from sales | -£64.29 | +£0 | |

| Average monthly cash profit | -£0.41 | (-0.2%) | +£0 |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Performance/Injection | -0.2% | +0% | |

| Compound performance | -1% | +0% |

A small drop this week as everything except CAML:Central Asia Metals lost ground. I'm doing more trading in my SIPP than I am in this account!

I'm not going to flatten out the trend line very fast at this rate.

Things are really moving at JLP:Jubilee Metals. Last week there was an announcement that they have purchased the rights to sell all the chrome from what used to be Hernic and is now called Inyoni. It cost $16m but should return a lot more. It also included access to another million tons of PGM-rich tailings, so the monthly income from Inyoni and Windsor is really stepping up. Production is imminent at Kabwe too, so we may be on the verge of a significant breakout. Results are due next week or the week after, and for once I'm looking forward to them.

I bought my shares for an average of 4.41p and we currently have a bid price of 4.4p and an offer price of 4.6p. I very nearly used the £3,300 cash to buy more of these at 4.3p. I had the screen up and was hovering over the buy button. I decided against it because they are still very, very high risk despite the fact things may be going well. I decided 104,545 shares was enough of a risk and so went back to my old faithful OPTI:Optibiotix instead.

There's talk of JLP getting to 7p quite soon which would put them at £2,667 paper profit. There's also talk of them getting to 10p by Christmas, which would give me £5,803 paper profit. That would be a review point as this company has a Chairman I don't like and a habit of shooting themselves in the foot. The problem is, if the cash comes in at the rate they think it might, and if metal prices recover, they could be at 38p by next year. That's paper profit of £35,000 so I just need to ask myself how risk averse am I feeling?

They are talking to global producers about "dealing with" their tailings dumps. They have the technology to extract the metals, and the end result is they clean up the polluted sites, so on environmental grounds this would seem an ethical investment. I may decide to sell enough to get my original investment back, and hold the rest for the long term. I've never managed to do that yet, but there's always a first time.

OPTI:Optibiotix sold a million or so SBTX:SkinBioTherapeutics shares this week in order to ensure they have contingency to meet the supply requirements of major retailers in UK and USA. There are launches planned for January 2020 and they include TV adverts, so our products will finally start to get some brand recognition. The spring is coiling tighter and tighter, and I can't wait for it to let go.

I guess I should review my OPTI:Optibiotix holding stats again after the recent purchase, and calculate how much the value changes for each 1p change in share price. My total holding is now 105,332 shares. This is significant as it means I can sell the 3,965 in my standard share account to pay for my Antarctic holiday without dropping below 100,000 shares. The total cost of the shares is £69,515.60 at a weighted average price of 65.99p, so any more I can buy below that price is a bonus.

My shares are currently in the red by £5,298 but each penny change is worth £1,053 so I need a 6p increase to get back into profit. The broker target is 97p which would give me paper profit of £32,620, and a 6p dividend for SBTX:SkinBioTherapeutics (which I consider to be around what we could expect) would give £6,319. It's nice to dream of what might be. Let's see if any of it comes true...

No comments:

Post a Comment