It was a great week for many of my shares. The rise was a relatively small

£2,335, but with OPTI:Optibiotix only climbing 1p, it accounted for

less than half the rise, so the others combined did better. That narrowed the

deficit between cost and value to £32,089 and increased overall portfolio

value to £83,512.

There was only one big faller this week. FXPO:Ferrexpo went

ex-dividend, but also announced that the injunction on selling some of its

shares lifted a few weeks ago has been re-imposed by a district court, so the

appeal process will have to start all over again. I think fear of doing

business in the Ukraine is what's holding these back, as all other performance

is great. The dividend will pay out in early July, but there is a Swiss

withholding tax, so 35% will be taken off me. It should still be worth about

£35.

BLU:Blue Star Capital climbed 6%. There seems to be renewed interest

since their venture into e-sports. Good job really as Satoshipay is looking

like a dead duck.

JLP:Jubilee Metals went on a mini charge, climbing 7% in my ISA and 9%

in my SIPP. They did a new deal to get access to a massive copper tailings

resource, which should double income within 2 years. I'm starting to waver on

taking profits too early now, as although we have the threat of Colin Bird

looming over us, there are increasing institutional investors, and they don't

take kindly to their company being used to bail out other companies. That

might make a big difference to the long term prospects here. The more

institutional investors appear, the more pressure there will be to start

paying a dividend.

IQE:IQE is on a roll, climbing another 8% this week. I'm only 29% down

in the ISA now, but 51% down in my trading account and 60% down in my SIPP.

IES:Invinity Energy almost made it to Share of the Week with a 12%

climb. Some people have made a lot of money buying these at their low, but my

holding went from 84% down to 72% down. Since the reverse takeover from

RED:RedT Energy, there seems to be much more commercial momentum. Given

I thought they were going bust a few months ago and I'd lose everything, now

I'm feeling some degree of hope.

Share of the Week is SBTX:SkinBioTherapeutics, climbing 15% in my ISA

and 20% in my SIPP and trading account. I now have the decision whether to

trade these as I said I would, or sit tight. I'll definitely trade the ones in

the trading account as soon as they hit 19.5p, as that will give £131 (25%)

profit, which is all I ask from the trading account. The tricky account is the

SIPP, where 19.5p would give me £666 (32%) profit. However, there is the risk

they will carry on up. The exchange market size for SBTX is only 7,500

and I hold 14,654, so one option would be to sell 7,154 to bank some profit,

but keep 7,500. If the price drops back, I can use the proceeds of the sale to

buy back in and increase my holding, but if it carries on upwards I won't miss

out.

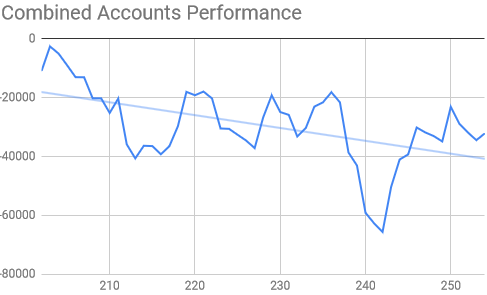

A very tiny tick up, but at least it is actually up this week.

In 3 weeks time the trend line could be a lot flatter as we lose the big peak.

I think the deficit needs to get below £20K before we see a change of

direction though.

The ISA and share accounts look like this

| Weekly Change | |||

| Cash |

£14.63 |

+£0 | |

| Portfolio cost | £60,070.42 | +£0 | |

| Portfolio sell value (bid price-commission) | £41,987.16 | (-30.1%) | +£1,437.05 |

| Potential profits | £0 | +£0 | |

| Yr 5 Dividends | £0.85 | +£0 | |

| Yr 5 Profit from sales | £-14.48 | +£0 | |

| Yr 5 Average monthly cash profit | -£4.82 | (-0.1%) | +£0.10 |

| Total Dividends | £1,343.15 | +£0 | |

| Total Profit from sales | £20,376.93 | +£0 | |

| Average monthly cash profit | £366.64 | (7.3%) | -£1.45 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Performance/Injection | 11.2% | +0% | |

| Compound performance | 54% | +0% |

A very quiet week, but the deficit was narrowed by £1,437. The nearest shares

to being in profit is a tie between JLP:Jubilee Metals and

SBTX:SkinBioTherapeutics, both of which are only 12% down. It would be

so nice to see a sliver of green in this account.

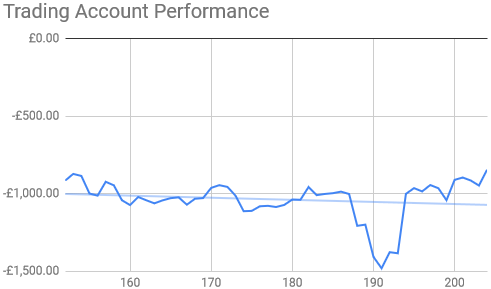

Bouncing off the injection line once again.

As with the overall chart, this should trend a lot flatter in a few weeks.

The SIPP looks like this after week 238

| Weekly Change | ||||

| Cash | £29.81 | +£0 | ||

| Portfolio cost | £52,946.27 | +£0 | ||

|

Portfolio sell value (bid price - commission) |

£39,786.43 | (-24.9%) | +£796.34 | |

| Potential profits | £442.10 | +£375.82 | ||

| Yr 5 Dividends | £0 | +£0 | ||

| Yr 5 Interest | £0.03 | +£0 | ||

| Yr 5 Profit from sales | £0 | +£0 | ||

| Yr 5 Average monthly cash profit | -£14.09 | (-0.3%) | +£0.48 | |

| Total Dividends | £1,899.24 | +£0 | ||

| Total Interest | £0.20 | +£0 | ||

| Total Profit from sales | £12,549.10 | +£0 | ||

| Average monthly cash profit | £253.22 | (5.7%) | -£1.07 | |

|

(Sold stocks profit + Dividends - Fees / Months) |

||||

| Performance/Injection | 8.7% | +0% | ||

| Compound performance | 40% | +0% |

Overall value didn't climb as much as the ISA because there were losses for

CAML:Central Asia Metals and FXPO:Ferrexpo, but the great news

was potential profits rising by £375 to £442. Most of this was

SBTX:SkinBioTherapeutics, with a small contribution from

JLP:Jubilee Metals. Unfortunately FXPO:Ferrexpo slipped into the

red.

We'll have a few months of stability here now, as the next injection won't be

until late September, unless the bond prices do well and my work pension

holding goes up a bit, as my July contribution will leave it just short of the

minimum transfer amount. In that case I may be able to do another transfer

hitting the account in August.

This one might be harder to reverse the trend, as anything below £5,000 loss

is going to leave the line pointing downwards.

The trading account looks like this after week 204

| Weekly Change | |||

| Cash | £186.37 | +£0 | |

| Portfolio cost | £2,354.11 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,508.05 | (-35.9%) | +£102.25 |

| Potential profits | £64.33 | +£64.33 | |

| Year 4 Dividends | £13.20 | +£0 | |

| Year 4 Profit | £320.95 | +£0 | |

| Yr 4 Average monthly cash profit | £30.17 | (15.4%) | -£0.64 |

| Dividends | £47.92 | +£0 | |

| Profit from sales | £256.66 | +£0 | |

| Average monthly cash profit | £6.47 | (3.3%) | -£0.03 |

|

(Sold stocks profit + Dividends - Fees / Months) |

A good week, with £102 increase in value and £64 potential profits from the

SBTX:SkinBioTherapeutics purchase a few weeks ago. It's rather a relief

that this account is finally starting to work a bit better, although it would

have been hard to do much worse.

If I can sell SBTX for 19.5p I'll be able to bank another £100 of the

original injection and get the orange line a bit lower.

Oh my goodness, the line is almost flat! It's so long since I've seen a trend

line pointing upwards, I can hardly contain myself!

The virtual magic formula portfolio climbed 1.39% from 15.07% down to 13.68%

down this week. There are still only 5 out of 30 shares in the black.

PLUS:Plus 500 is still way ahead at 45% up, but

CARD:Card Factory is no longer last, climbing to -42% as

VTY:Vistry Group dropped to 47% down and ITV:ITV went 46%

down.

Last week I said "My dream for next week is a SweetBiotix announcement from

OPTI:Optibiotix, re-instatement of the dividend for

CAML:Central Asia Metals, a trading update from

JLP:Jubilee Metals, and IQE:IQE going on a roll. Even just one

of those would be nice..."

So did any of that come to pass?

No SweetBiotix announcement from OPTI:Optibiotix, in fact no news at

all since 1st June, so the wish for a Sweetbiotix announcement will have to

pass on to next week. Same goes for the

CAML:Central Asia Metals dividend as I suspect they are being cautious,

which is no bad thing.

There was a kind of trading update from JLP:Jubilee Metals when they

announced the tailings acquisition, as it included the current healthy cash

position and that debt had been paid down, so things are looking very

positive. My wish for next week is that positivity spreads to the market and

we get back to the 5p range where I think we should be.

IQE:IQE did in fact go on a roll, and it may be a sustainable one, so 2

out of my 4 wishes came true, and I would have been happy with just one of

them.

So for next week, we'll have the carry over of the OPTI and

CAML wishes, along with my FXPO:Ferrexpo holding getting back

into profit, and being able to sell some SBTX:SkinBioTherapeutics at

19.5p, and JLP:Jubilee Metals getting into profit in my ISA by hitting

4.5p.

No comments:

Post a Comment