Most things had a great week, unfortunately OPTI:Optibiotix didn't, so

the difference between cost and value widened by £2,966. That increased the

deficit to £31,778 and dropped total portfolio value to £83,670.

There was only one big loser this week, but it was OPTI:Optibiotix as

mentioned above which dropped 4p and cost me £4,400. Great news that the

portfolio only fell by just under £3,000, meaning everything else covered

£1,400 of the OPTI losses.

SBTX:SkinBioTherapeutics had a good week, climbing 5% in my ISA and 7%

in my SIPP. I thought they would climb higher now the OPTI sale has

cleared, but I think investors are scared they will do it again.

TRMR:Tremor went up 6% but I'm still losing 47% in my trading account.

IQE:IQE climbed 5% in my SIPP, 6% in my trading account, and 9% in my

ISA as they very slowly but steadily recover.

FXPO:Ferrexpo are one of my new "magic formula" shares and are already

in profit, climbing 10% this week to go 6% up altogether and making £59

potential profit. Even better they went ex-dividend on Thursday so I should

get around £18 and my SIPP is starting to behave like a proper pension

account.

SAE:Simec Atlantis Energy has had a rocket up it lately, and climbed

11% this week. They are still 81% down and it's a very small holding, but I

shall watch with interest.

Share of the Week by a million miles is JLP:Jubilee Metals, which is

finally starting to re-rate. My ISA holding climbed 11% and is only 18% down

now, my new SIPP holding climbed 15% and is 5% in profit, and best of all my

trading holding climbed to 30% so I sold them and banked some profit.

Pretty upsetting that despite so many shares climbing this week, we're still

heading back towards the orange line.

A worryingly steep drop, but we're on the right side of the trend line.

The ISA and share accounts look like this

| Weekly Change | |||

| Cash | £104.45 | +£96.47 | |

| Portfolio cost | £59,827.79 | +£0 | |

| Portfolio sell value (bid price-commission) | £41,574.55 | (-30.5%) | -£1.698.30 |

| Potential profits | £0 | +£0 | |

| Yr 5 Dividends | £0.85 | +£0.22 | |

| Yr 5 Profit from sales | £-167.28 | +£0 | |

| Yr 5 Average monthly cash profit | -£20.11 | (-0.4%) | +£0.09 |

| Total Dividends | £1,343.15 | +£0.22 | |

| Total Profit from sales | £20,224.13 | +£0 | |

| Average monthly cash profit | £366.93 | (7.4%) | -£1.53 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Performance/Injection | 11.2% | +0% | |

| Compound performance | 54% | +0% |

First of all let's cover the 22p dividend. That was the left-over after the

share consolidation by IES:Invinity Energy. I also added £100 to my ISA

as I'd run out of cash to pay the £3.75 fees, and the minimum to start up a

new ISA for the tax year is £100. It means a small increase in the injection

amount.

Portfolio value is down £1,698 thanks to OPTI:Optibiotix, and there's

still nothing in profit. The nearest shares to being in profit are

OPTI:Optibiotix and IKA:Ilika, which are both down by 16%, and

JLP:Jubileee Metals which is down by 18%.

SBTX:SkinBioTherapeutics is down 25% and everything else is absolutely

trashed.

This does raise the rather worrying question of where my next sale is coming

from to try and improve my 7.4% of portfolio cost average monthly return. I've

made it clear I'm not selling any OPTI:Optibiotix, so my only hopes are

the other three. I have stated I'm willing to trade

SBTX:SkinBioTherapeutics, but haven't done a very good job of it so

far. Although I guess I have made £2,425 profit doing just that, so maybe I

shouldn't be too hard on myself.

I'll sell IKA:Ilika relatively soon if they get into profit, as I'm

still not convinced at their commercial credentials, and I'm way overweight on

JLP:Jubilee Metals given their openly acknowledged aim to grow the

company and not return value to shareholders. There's way too much risk of

getting fleeced to line the pockets of the Chairman, so although I'll retain a

token holding, I'll sell 80% of my shares gradually.

Still above the injection line, but only just. The momentum seems to have

ground to a halt.

I was hoping to get the deficit below £10,000 by now, but we're back nearer

£20,000.

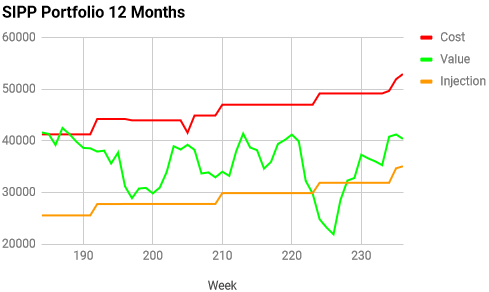

The SIPP looks like this after week 236

| Weekly Change | ||||

| Cash | £29.81 | -£626.97 | ||

| Portfolio cost | £52,946.27 | +£1,011.06 | ||

|

Portfolio sell value (bid price - commission) |

£40,337.17 | (-23.8%) | -£1,248.29 | |

| Potential profits | £109.04 | +£109.04 | ||

| Yr 5 Dividends | £0 | +£0 | ||

| Yr 5 Interest | £0.03 | +£0 | ||

| Yr 5 Profit from sales | £0 | +£0 | ||

| Yr 5 Average monthly cash profit | -£15.09 | (-0.3%) | -£1.99 | |

| Total Dividends | £1,899.24 | +£0 | ||

| Total Interest | £0.20 | +£0 | ||

| Total Profit from sales | £12,549.10 | +£0 | ||

| Average monthly cash profit | £255.37 | (5.8%) | -£1.38 | |

|

(Sold stocks profit + Dividends - Fees / Months) |

||||

| Performance/Injection | 8.7% | -0.2% | ||

| Compound performance | 40% | +0% |

This is complicated! I added £400 cash because I wanted to keep the

JLP:Jubilee Metals shares while they re-rate, and I could do with the

£100 tax rebate to cover future charges. That meant I had £1,000 to be able to

buy my next "magic formula" share.

Number 2 on my ranking spreadsheet was APAX:Apax Global Alpha which is

a managed fund, and which has been clobbered by the Covid-19 drop, but which

hasn't really recovered yet and pays a very healthy dividend. This seemed like

a perfect SIPP share, so I bought 695 at 143.7569p costing £1,011.06.

I've decided with the "magic formula" shares I'll buy £1,000 worth not

including commission, so most costs will be about £1,011. They haven't really

moved since and the bid price is 141.8p, so with spread and commission they

are down by £37 (4%).

Meanwhile we have the unprecedented situation of 3 different shares all being

in profit this week. FXPO:Ferrexpo is up 6% making £59,

JLP:Jubilee Metals is up 5% making £24, and

SBTX:SkinBioTherapeutics is up 1% making £24. I'm still planning to

sell SBTX:SkinBioTherapeutics when they hit 19.5p as I really need to

improve my performance on this account, and most of my holdings are long

term. I want to increase my SBTX holding, and I think the best chance

will be to trade them and hope I don't miss the re-rate.

The drop in portfolio value was all down to OPTI:Optibiotix

A complex chart! Injection increased a small amount, cost went up again, and

value dropped despite this.

Only a few more weeks until this account will have been in the red for a year.

The trading account looks like this after week 202

| Weekly Change | |||

| Cash | £186.37 | +£186.28 | |

| Portfolio cost | £2,354.11 | -£136.10 | |

| Portfolio sell value (bid price - commission) | £1,438.10 | (-38.9%) | -£19.52 |

| Potential profits | £0 | -£65.01 | |

| Year 4 Dividends | £13.20 | +£0 | |

| Year 4 Profit | £320.95 | +£200.18 | |

| Yr 4 Average monthly cash profit | £31.48 | (16%) | +£18.58 |

| Dividends | £47.92 | +£0 | |

| Profit from sales | £256.66 | +£200.18 | |

| Average monthly cash profit | £6.53 | (3.3%) | +£4.28 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Performance/Injection | 3.6% | +2.4% | |

| Compound performance | 14% | +9% |

Quite a lot to pull apart here. I sold JLP:Jubilee Metals at 3.8p after

buying at 2.81p and made £200.19 (30.3%) profit. I then removed £150 from the

account to reduce the injection amount, and bought 3,361 shares in

SBTX:SkinBioTherapeutics at 14.875p costing £511.90, as I believe they

are about to go on a sprint to 19.5p.

I saved the excess cash, as I think it was a mistake to pay more than £500

when I bought JLP:Jubilee Metals, as I need some cash buffer in the

account to ensure I can afford to sell something at a loss and still have

enough to invest £500 with the proceeds.

So although I wiped out my potential profits, my actual profits for the year

went up significantly and are now a respectable 16% with only 6 weeks of this

trading year to go. My long term performance improved by £4 a month, but is

still only 3.3%. However, after the disastrous start, this isn't too bad, and

still better than building society interest.

So it means I only really have one holding I can trade with, as the others are

losing so much money I'm not prepared to sell them. It means I have to be

very, very careful with this one, and only go for shares that are clearly on

an upwards trajectory. Easier said than done! I have been learning a lot about

trading, so will be using those learnings for future purchases. I didn't

really need to with SBTX:SkinBioTherapeutics, as it's clear the recent

drop was due to OPTI:Optibiotix dumping 4.5 million shares. Those are

already being snapped up, so I think this is a reasonable bet. It means I'll

be attempting to trade these in both my trading account and my SIPP. This one

will be with the aim of making money, the SIPP one will be with the aim of

increasing my holding.

It's been a long time since I was able to further my plan of extracting the

whole £2,500 injection from this account. The £150 withdrawn this week has

given a welcome dip to the orange line.

So in real terms there was a slight dip, but I did remove £200 profit and £186 is being held in cash, so it's

not really a surprise. Most of the portfolio had a good week. It's not often I

have felt happy about the trading account.

Last week the virtual magic formula portfolio was down by 15.2%, and this week

it's only down by 10.76%, so a 4.44% gain. PLUS:Plus 500 had a bad week,

dropping about 10%, but is still the best performer at 44% up.

FXPO:Ferrexpo is next best at 31% up, which is nice now I'm a holder.

IGG:IG Group are up 13% so also doing quite well. Then

BHP:BHP Group, DGOC:Diversified Oil & Gas,

KETL:Strix Group, MONY:MoneySupermarket and

PSN:Persimmon are all in profit, having recovered form the Coronavirus

crash.

Many of them are still dreadful though. CARD:Card Factory is down 45%

and VTY:Vistry Group are down 41%, with ITV:ITV down 38% and

REDD:Redde Northgate down 30%.

On my newly updated spreadsheet POLR:Polar Capital Holdings were next

in line to be bought. They are similar to APAX:Apax Global Alpha in

that they are a managed fund, and are still cheap following the crash. They

only need to make up 13% to get back where they were before the crash, whereas

APAX are still 22% down so were better value. I suspect by the time I

get my next pension transfer it will all be different. However, if I can make

a quick profit on JLP:Jubilee Metals to get up to £1,000, then I'll be

putting it in POLR:Polar Capital Holdings.

So, next week's wish list is a re-rate of JLP:Jubilee Metals, a

recovery to 19.5p of SBTX:SkinBioTherapeutics, and some Sweetbiotix

news from OPTI:Optibitix that takes us back to 70p...

No comments:

Post a Comment