The only big loser was BLU:Blue Star Capital which dropped 6%. This

wasn't a surprise after last week's 15% rise as traders took profits.

Hopefully now they are out of the way the price will recover next week.

FXPO:Ferrexpo has had a torrid time lately, but gained 5% this week.

My holding is still down by 33%in the 7 months since I bought them. I only

have 5 months for them to make up the loss before I review whether to sell,

but if they stay at this level I won't be selling, but will enjoy the big

dividend and will likely add some more.

WHR:Warehouse REIT had been slipping a bit, but put on 5% this week

to go 9% up in the 6 weeks I have owned them. Hopefully this will be a well

behaved magic formula share and stay in profit until I sell them next

September.

CAML:Central Asia Metals, CMCL:Caledonia Mining and

POLY:Polymetal all climbed 7% this week. All are around the same size

holding now I've sold a lot of my CAML shares. My ISA

POLY holding is only 1% down now, and was designed to be a short term

holding, so I'll be looking to sell those if they get to around 10% profit

so I can invest somewhere else. That might be

SBTX:SkinBioTherapeutics if the price can just drop to 50p, else it's

hard to resist topping up OPTI:Optibiotix again.

Blackrock World Gold Fund climbed 8% and went into profit, but I

only have £30 worth and only have them by accident after Hargreaves Lansdown

invested my tax rebate unexpectedly. I may sell them very soon as they're

not really worth reporting on.

JLP:Jubilee Metals has been slipping for weeks, but gained 9% this

week. I think results are due very soon which could see us back to 20p.

CEY:Centamin has been a bit of a disaster since I bought in June,

but climbed 9% this week as the gold price surged. They are only 11% down

now so I'm hopeful of getting into profit soon if the gold price stays up.

TRX:Tissue Regenix also climbed 9% this week, which was very

fortuitous as I bought some more on Monday. I decided that now medical

operations are starting up again after Covid, and given the deals they put

in place about 18 months ago, then these could reach break even soon and

that should trigger a significant re-rate. I bought 62,953 shares at 0.5715p

costing £371.73. This is less than my usual £500 minimum purchase, but I

only wanted to buy enough to take my holding to 250,000 shares. That reduced

my average price to 1.35p, and with the bid price rising to 0.6p this week,

my new shares are already in profit but my overall holding is still 57%

down. I think 2p is achievable when they become profitable, which would give

me £1,500 profit, but I'll probably hold them long term in the hope they get

bought out for significantly more.

Share of the week is PAF:Pan African Resources, which I only bought

last week. They climbed 14% and are 17% in profit which would give me £172.

However, I have to keep them until next November if I obey the magic formula

rules. There's a healthy dividend next month, so I do want to keep them

anyway.

Back above the trend line after being below it for the majority of this

year. Can we stay above it with a Santa rally?

Here's the ISA and shares portfolio after week 15 of year 7.

Potential profits up a nice even £100 now I've rounded off my JLP:Jubilee Metals holding to 25,000 shares. It was nearly a less rounded number with POLY:Polymetal getting into profit on Thursday before dropping back to £6 loss on Friday. Maybe next week...

| Weekly Change | |||

| Cash | £10.15 |

+£0 | |

| Portfolio cost | £71,348.76 | +£0 | |

| Portfolio sell value (bid price-commission) | £54,660.72 | (-23.4%) | +£1,083.66 |

| Potential profits | £2,975.09 | +£100.00 | |

| Yr 7 Dividends | £22.16 | +£0 | |

| Yr 7 Profit from sales | £3,095.94 | +£0 | |

| Yr 7 projected avg monthly profit | £897.53 | (24.5%) | -£64.11 |

| Total Dividends | £1,365.31 | +£0 | |

| Total Profit from sales | £27,219.88 | +£0 | |

| Average monthly cash profit |

£374.92 |

(10.2%) | -£1.15 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Compound performance | 64% | +0% |

Potential profits up a nice even £100 now I've rounded off my JLP:Jubilee Metals holding to 25,000 shares. It was nearly a less rounded number with POLY:Polymetal getting into profit on Thursday before dropping back to £6 loss on Friday. Maybe next week...

Overall value up by £1,083 helped by a 1p increase in

OPTI:Optibiotix which accounted for £850 of the rise. Long term

performance still above target 10% which is deeply pleasing.

Slowly does it.

A less even climb on this one as we alternate between up and down, but that has been impacted by some profit taking. Still well below the trend line so a long way to go.

Slowly does it.

A less even climb on this one as we alternate between up and down, but that has been impacted by some profit taking. Still well below the trend line so a long way to go.

The SIPP looks like this after week 311 overall and week 51 of year 6.

A couple of purchases this week, with the TRX:Tissue Regenix buy already mentioned, and AJ Bell did my monthly investment in iShares Physical Gold Fund, buying 4 units at 2631.9p costing £106.78. Added to my existing holding, those are up 4% but only making £7 potential profit. I'm intending for these to be a very long term holding as I gradually move out of higher risk gold mines into this fund.

| Weekly Change | ||||

| Cash | £153.51 | -£98.51 | ||

| Portfolio cost | £79,537.07 | +£478.51 | ||

|

Portfolio sell value (bid price - commission) |

£60,749.27 | (-23.6%) | +£1,652.89 | |

| Potential profits | £561.67 | +£286.11 | ||

| Yr 6 Dividends | £1,115.28 | +£0 | ||

| Yr 6 Interest | £0 | +£0 | ||

| Yr 6 Profit from sales | £8,265.19 | +£0 | ||

| Yr 6 projected avg monthly profit | £779.93 | (19.2%) | -£15.60 | |

| Total Dividends | £3,182.36 | +£0 | ||

| Total Interest | £0.20 | +£0 | ||

| Total Profit from sales | £23,724.63 | +£0 | ||

| Average monthly cash profit | £363.46 | (8.9%) | -£1.17 | |

|

(Sold stocks profit + Dividends - Fees / Months) |

||||

| Compound performance | 53% | -1% |

A couple of purchases this week, with the TRX:Tissue Regenix buy already mentioned, and AJ Bell did my monthly investment in iShares Physical Gold Fund, buying 4 units at 2631.9p costing £106.78. Added to my existing holding, those are up 4% but only making £7 potential profit. I'm intending for these to be a very long term holding as I gradually move out of higher risk gold mines into this fund.

A great week all over the portfolio, with the 1p rise in

OPTI:Optibiotix contributing £820 meaning there were gains of over

£800 elsewhere, and potential profits up by £286 with 5 holdings in

profit.

I was meant to get a dividend from PLUS:Plus500 on Friday but it

hasn't appeared in my account yet so that will be accounted for next week,

then no more dividends due until PAF:Pan African Resources on 14th

December.

Long term performance fell just below 9% due to the increase in injection

amount, but with just one week to go of year 6, it's going to be a

barnstorming 18%+ year. I'll do a full breakdown of where the profits came

from next week.

Still closer to injection than to cost so I don't want to get carried away with joy.

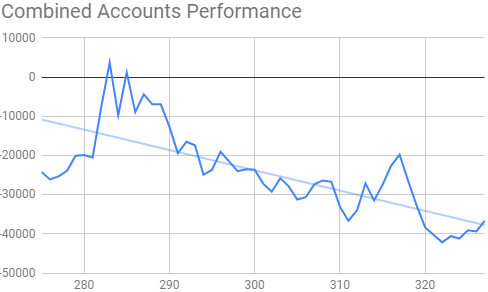

A great punch through the trend line, but it's going to take some flattening after a desperately bad year. I guess one of the reasons it's so bad is I've cashed in a lot of profit, each time damaging this chart.

Still closer to injection than to cost so I don't want to get carried away with joy.

A great punch through the trend line, but it's going to take some flattening after a desperately bad year. I guess one of the reasons it's so bad is I've cashed in a lot of profit, each time damaging this chart.

The trading account looks like this after week 277 overall and week 17 of year 6.

Virtually no change, although all the shares were up, just by very tiny amounts.

Still below the injection line, which is bad.

| Weekly Change | |||

| Cash | £259.74 | +£0 | |

| Portfolio cost | £2,374.14 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,233.03 | (-48.1%) | +£10.88 |

| Potential profits | £0.00 | +£0 | |

| Year 6 Dividends | £0.00 | +£0 | |

| Year 6 Profit | £0.00 | +£0 | |

| Yr 6 projected avg monthly profit | £0.00 | (0%) | +£0 |

| Dividends | £60.10 | +£0 | |

| Profit from sales | £937.88 | +£0 | |

| Average monthly cash profit | £15.61 | (7.9%) | -£0.06 |

|

(Sold stocks profit + Dividends - Fees / Months) |

Virtually no change, although all the shares were up, just by very tiny amounts.

Still below the injection line, which is bad.

Staying above the trend line, and with a genuine hope that DDDD:4D Pharma can break out before Christmas and HUM:Hummingbird Resources take advantage of the higher gold price, we could get a steep recovery here soon.

The performance over the next few weeks is all going to come down to news

flow. There are loads of things pending announcement from both

OPTI:Optibiotix and DDDD:4D Pharma which could easily double the

share price of both. Results for JLP:Jubilee Metals could cause a

re-rate if any money is being made from copper, and if the price of gold stays

above $1,800 then the miner rally could continue and get them into profit in

my portfolio.

A cheapish ETF 0.65% for the Gold mining might help spread some risk, but the 0.45% platform charge from H&L is a bit of a pain.

ReplyDeletehttps://www.hl.co.uk/shares/shares-search-results/l/legal-and-general-ucits-etf-gold-mining-etf/costs