This would have been a positive week if I hadn't banked some profit, despite

OPTI:Optibiotix dropping 1p which costs me £1,700. Thankfully an epic

recovery from DDDD:4D Pharma erased that loss and the gap between cost

and value only widened by £311 to £39,354 but total portfolio value went up to

£113,947 mainly thanks to a pension transfer injection.

FXPO:Ferrexpo was hit by the same problem, dropping 6%.

BLU:Blue Star Capital nearly won Share of the Week after climbing 15%

on news that SatoshiPay might actually end up worth something. Things could

move quite quickly here now, but my holding is still 70% down so a long way to

go.

Share of the Week is DDDD:4D Pharma which shot up 15% on news that a

new clinical trial is due to start soon. It hasn't started, but the fact the

trial has appeared on the registration website got everyone excited. I suspect

most of the rise was people closing their short positions. I'm still 32% down

so a long way from breakeven, but as this is my 2nd largest holding it negated

the 1p drop in OPTI:Optibiotix.

The pension fund injection and re-invested profits caused quite a spike in the cost, with value continuing the same very slow upwards momentum.

This chart reveals the truth. A slight tick downwards and still below the trend line.

Here's the ISA and shares portfolio after week 14 of year 7.

I sold 7,253 shares in JLP:Jubilee Metals making £850.87 (262.5%) profit and re-invested in OPTI:Optibiotix, buying 2,394 shares at 48.37p costing £1,169.93. That brought my average price in the ISA down to 59.7p. Seems a long time since my average was 84p! My JLP holding is down to 25,000 shares from 150,000 before I started selling. I have however banked £10,152 profit, so although I'll never make a huge amount if these really take off, it's been my most profitable share ever, and I intend to hold the last 25,000. I just couldn't resist another OPTI top-up at these crazy prices when news is so close.

| Weekly Change | |||

| Cash | £10.15 |

-£10.64 | |

| Portfolio cost | £71,348.76 | +£857.76 | |

| Portfolio sell value (bid price-commission) | £53,577.06 | (-24.9%) | -£563.96 |

| Potential profits | £2,875.09 | -£873.31 | |

| Yr 7 Dividends | £22.16 | +£0 | |

| Yr 7 Profit from sales | £3,095.94 | +£850.87 | |

| Yr 7 projected avg monthly profit | £961.64 | (26.3%) | +£208.40 |

| Total Dividends | £1,365.31 | +£0 | |

| Total Profit from sales | £27,219.88 | +£850.87 | |

| Average monthly cash profit |

£376.07 |

(10.3%) | +£10.13 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Compound performance | 64% | +2% |

I sold 7,253 shares in JLP:Jubilee Metals making £850.87 (262.5%) profit and re-invested in OPTI:Optibiotix, buying 2,394 shares at 48.37p costing £1,169.93. That brought my average price in the ISA down to 59.7p. Seems a long time since my average was 84p! My JLP holding is down to 25,000 shares from 150,000 before I started selling. I have however banked £10,152 profit, so although I'll never make a huge amount if these really take off, it's been my most profitable share ever, and I intend to hold the last 25,000. I just couldn't resist another OPTI top-up at these crazy prices when news is so close.

Portfolio value only dropped £563 so would have been slightly up if I hadn't

sold. Massive boost to year 7 performance and long term performance is above

10% target.

Still an alarming way below the cost line

Still well below the trend line.

Still an alarming way below the cost line

Still well below the trend line.

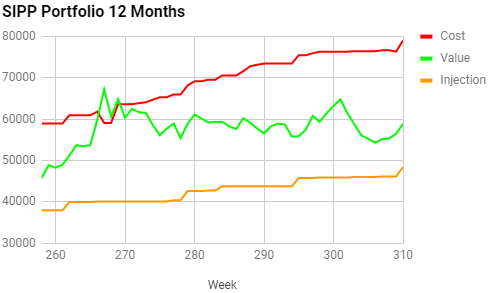

The SIPP looks like this after week 310 overall and week 50 of year 6.

I received my £2,200 pension transfer, and with the cash from recent sales had £2,700 to re-invest. I started off sensibly, adding a new magic formula share with gold miner PAF:Pan African Resources. This is a company I have owned before and like a lot, although I was nervous about potential workforce unrest when I last sold them, but that seems to have been resolved. I bought 6,062 shares at 16.4936p costing £1,016.79. Happy to say they went up to 17.52p in a few days and are already 3% up with potential profit of £33.

| Weekly Change | ||||

| Cash | £252.02 | -£409.61 | ||

| Portfolio cost | £79,058.56 | +£2,703.78 | ||

|

Portfolio sell value (bid price - commission) |

£58,617.87 | (-25.9%) | +£129.34 | |

| Potential profits | £275.56 | -£100.49 | ||

| Yr 6 Dividends | £1,115.28 | +£20.94 | ||

| Yr 6 Interest | £0 | +£0 | ||

| Yr 6 Profit from sales | £8,265.19 | +£0 | ||

| Yr 6 projected avg monthly profit | £795.53 | (19.7%) | -£15.87 | |

| Total Dividends | £3,182.36 | +£20.94 | ||

| Total Interest | £0.20 | +£0 | ||

| Total Profit from sales | £23,724.63 | +£0 | ||

| Average monthly cash profit | £364.63 | (9.0%) | -£1.12 | |

|

(Sold stocks profit + Dividends - Fees / Months) |

||||

| Compound performance | 54% | -3% |

I received my £2,200 pension transfer, and with the cash from recent sales had £2,700 to re-invest. I started off sensibly, adding a new magic formula share with gold miner PAF:Pan African Resources. This is a company I have owned before and like a lot, although I was nervous about potential workforce unrest when I last sold them, but that seems to have been resolved. I bought 6,062 shares at 16.4936p costing £1,016.79. Happy to say they went up to 17.52p in a few days and are already 3% up with potential profit of £33.

I spent the rest on OPTI:Optibiotix, buying 3,468 shares at 48.3p

costing £1,686.99. That brings my SIPP average price down to 60.3p so I'm

still 22% down. My total OPTI holding is now 171,405 costing a truly

shocking £103,322. I remember vowing to stop buying after 100,000, and I would

have done if the price had returned to a more sensible level, but the longer

it stays this low, the longer I will keep buying more. I often moan about the

share price, but if it hadn't been so low I wouldn't have anywhere near this

many shares.

If the share price hits 584p, my holding will be worth £1 million. I think

that's readily achievable. At that price a 5% dividend will be worth £50,000 a

year and I can retire on this holding alone.

Meanwhile I got a £20 dividend from ASY:Andrews Sykes Group and the

increase in injection value dropped my long term performance down to 9%, a

whole percent off target so I need my magic formula shares to turn themselves

around before I sell them next summer.

All three lines lifting together.

Pretty much flat but on the trend line so can we get above it next week and start pulling it in the other direction?

All three lines lifting together.

Pretty much flat but on the trend line so can we get above it next week and start pulling it in the other direction?

The trading account looks like this after week 276 overall and week 16 of year 6.

A great week, with value increasing by £123 and getting back above 50% loss. The main question now is how far DDDD:4D Pharma can go. Sometimes when the momentum strikes pharma companies they re-rate very quickly. If that happens I'll be able to sell 2 out of 5 of my trading account holdings and get things moving again here.

Lots of celebrating the big rise, but back down to earth that the value is still below the injection line.

A massive boost to the morale to get above the trend line. Lets hope it's for longer than last time.

| Weekly Change | |||

| Cash | £259.74 | +£0 | |

| Portfolio cost | £2,374.14 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,222.15 | (-48.5%) | +£123.51 |

| Potential profits | £0.00 | +£0 | |

| Year 6 Dividends | £0.00 | +£0 | |

| Year 6 Profit | £0.00 | +£0 | |

| Yr 6 projected avg monthly profit | £0.00 | (0%) | +£0 |

| Dividends | £60.10 | +£0 | |

| Profit from sales | £937.88 | +£0 | |

| Average monthly cash profit | £15.67 | (7.9%) | -£0.06 |

|

(Sold stocks profit + Dividends - Fees / Months) |

A great week, with value increasing by £123 and getting back above 50% loss. The main question now is how far DDDD:4D Pharma can go. Sometimes when the momentum strikes pharma companies they re-rate very quickly. If that happens I'll be able to sell 2 out of 5 of my trading account holdings and get things moving again here.

Lots of celebrating the big rise, but back down to earth that the value is still below the injection line.

A massive boost to the morale to get above the trend line. Lets hope it's for longer than last time.

I enjoy writing up the blog when there's been lots of buying and selling, but

need to face the fact that we're in for a fairly dull time for the next few

months, as I've sold down my JLP:Jubilee Metals and

CAML:Central Asia Metals shares as far as I'm prepared to. They are

both pretty much back at the level of a magic formula share with a £1,000

cost. I do worry that my need to see some tangible profit will prevent me

holding shares long enough to appreciate their true value. It's not a mistake

I intend to make with OPTI:Optibiotix because I need that gigantic

dividend for my retirement plans, so the more shares I own, the greater the

dividend. I'm also still counting on an allocation of

SBTX:SkinBioTherapeutics shares or cash based on the size of my

OPTI holding. If they get dished out even at 1 share for every 10

OPTI shares, that still gives me 17,000 worth £10,000, and it could be

even more than that potentially.

All eyes will be on DDDD:4D Pharma next week, as the Nasdaq shares

carried on upwards on Friday, so we may get another 10% rise early doors, and

then see if the momentum continues. If Friday was mainly closing shorts, then

maybe the genuine buyers will come in during the week.

No comments:

Post a Comment