Just as I thought things might be about to turn around, Russia invades Ukraine

and there's a huge crash. The deficit between cost and value grew by £8,899 to

a record £66,280 and total portfolio value fell to £90,354.

Not surprisingly my biggest fallers were my two Ukrainian stocks.

FXPO:Ferrexpo fell 27% and POLY:Polymetal fell 25% and

both are going to be in the red for a long time, and that's assuming they even

get to keep their assets.

BLU:Blue Star Capital fell 12%, but I wouldn't read anything into that

as it's all over the place at the moment.

JLP:Jubilee Metals fell 9% after a big fall last week, so the hoped-for

re-rate has gone into reverse.

PLUS:Plus500 fell 8% which is a mystery given they usually do well

during periods of stock market volatility.

OPTI:Optibiotix fell 4p which is 7% and accounted for £7,000 of the

losses this week. I'm only glad the trading update was delayed, as this would

have been a dreadful week to announce anything.

SBTX:SkinBioTherapeutics did almost as bad, dropping 6%, but I think a

lot of that was profit taking after last week's 25% climb.

ASHM:Ashmore Group was my dreadfully timed purchase last week when they fell 6% and added to the misery by falling another 5% this week to go 11% down in 2 weeks, unlike PAF:Pan African Resources which is flying since I sold them.

Miraculously we have a Share of the Week, with

IES:Invinity Energy rising 5% after announcing a big government grant

funded order. A few more of these and I may claw back some of my 77% losses

on this share.

Not surprising that we've bombed below the injection line. Turns out the mattress would have been a better place for my money.

A new all-time low performance.

Here's the ISA and shares portfolio after week 30 of year 7.

Massive drop in value. Fortunately a small drop in potential profit as 9% of my JLP:Jubilee Metals purchase price isn't that much, but SBTX:SkinBioTherapeutics went back to loss. Not much else happened.

Well below the injection line. Very, very disappointing.

All-time low and failing miserably to get back above the trend line.

| Weekly Change | |||

| Cash | £29.55 |

+£0 | |

| Portfolio cost | £72,195.21 | +£0 | |

| Portfolio sell value (bid price-commission) | £41,734.73 | (-42.2%) | -£4,170.17 |

| Potential profits | £2,215.29 | -£114.40 | |

| Yr 7 Dividends | £22.16 | +£0 | |

| Yr 7 Profit from sales | £3,664.29 | +£0 | |

| Yr 7 projected avg monthly profit | £529.24 | (14.4%) | -£18.25 |

| Total Dividends | £1,365.31 | +£0 | |

| Total Profit from sales | £27,788.23 | +£0 | |

| Average monthly cash profit |

£365.54 |

(9.9%) | -£1.07 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Compound performance | 65% | +0% |

Massive drop in value. Fortunately a small drop in potential profit as 9% of my JLP:Jubilee Metals purchase price isn't that much, but SBTX:SkinBioTherapeutics went back to loss. Not much else happened.

Well below the injection line. Very, very disappointing.

All-time low and failing miserably to get back above the trend line.

The SIPP looks like this after week 326 overall and week 14 of year 7.

Same story as the ISA only worse, as FXPO:Ferrexpo and POLY:Polymetal are my 2 Ukrainian based companies and were hammered.

| Weekly Change | ||||

| Cash | £333.55 | +£121.69 | ||

| Portfolio cost | £81,443.18 | -£90.00 | ||

|

Portfolio sell value (bid price - commission) |

£47,222.94 | (-42.0%) | -£4,779.24 | |

| Potential profits | £55.47 | -£92.83 | ||

| Yr 7 Dividends | £81.54 | +£0 | ||

| Yr 7 Interest | £0 | +£0 | ||

| Yr 7 Profit from sales | £526.48 | +£1.69 | ||

| Yr 7 projected avg monthly profit | £172.48 | (4.1%) | -£12.70 | |

| Total Dividends | £3,285.93 | +£0 | ||

| Total Interest | £0.20 | +£0 | ||

| Total Profit from sales | £24,250.85 | +£1.69 | ||

| Average monthly cash profit | £354.43 | (8.5%) | -£1.07 | |

|

(Sold stocks profit + Dividends - Fees / Months) |

||||

| Compound performance | 53% | +0% |

Same story as the ISA only worse, as FXPO:Ferrexpo and POLY:Polymetal are my 2 Ukrainian based companies and were hammered.

There was a glimpse of hope, as I received a £30 tax rebate and finally

flogged my Blackrock World Gold fund which I never wanted in the

first place but the tax rebates were auto-invested. Although this only

made £1.69p profit, it liberated the £90 that I wanted to invest elsewhere

so I can add that to may £2,200 pension transfer when it arrives. The

money still hasn't come out of the pension yet so I may not get it until

the week after next.

Potential profit was hammered with the drop of SBTX:SkinBioTherapeutics, but it is still in the black by £32 and my iShares Physical Gold fund is also £22 up.

As with the ISA, the tragic site of this account going below the injection line.

Potential profit was hammered with the drop of SBTX:SkinBioTherapeutics, but it is still in the black by £32 and my iShares Physical Gold fund is also £22 up.

As with the ISA, the tragic site of this account going below the injection line.

Just as we'd got clear of the trend line, we're now well below it. A whole

year of losses - it's utterly depressing.

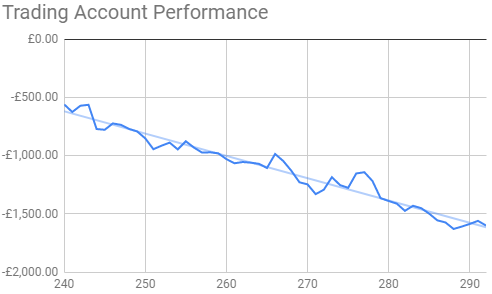

The trading account looks like this after week 292 overall and week 32 of year 6.

Not surprising that this dropped £40 given the carnage everywhere else. To think last week I was feeling optimistic...

The only crumb of comfort is that it's not the lowest ever.

| Weekly Change | |||

| Cash | £259.74 | +£0 | |

| Portfolio cost | £2,374.14 | +£0 | |

| Portfolio sell value (bid price - commission) | £774.21 | (-67.4%) | -£40.34 |

| Potential profits | £0.00 | +£0 | |

| Year 6 Dividends | £0.00 | +£0 | |

| Year 6 Profit | £0.00 | +£0 | |

| Yr 6 projected avg monthly profit | £0.00 | (0%) | +£0 |

| Dividends | £60.10 | +£0 | |

| Profit from sales | £937.88 | +£0 | |

| Average monthly cash profit | £14.81 | (7.5%) | -£0.05 |

|

(Sold stocks profit + Dividends - Fees / Months) |

Not surprising that this dropped £40 given the carnage everywhere else. To think last week I was feeling optimistic...

The only crumb of comfort is that it's not the lowest ever.

Bang on the trend line as we continue the downward trajectory.

I'm not going to moan too bitterly about this week's drop, as there are

people losing much more than a few thousand quid in Ukraine. It's really sad

that this happened, and a genuine concern for world peace. Let's hope enough

people within Russia are repulsed by the actions and step up to put a stop

to it.

I do have one thing to look forward to next week. IGG:IG Group pay

out their dividend. Aside from that there's nothing but anxiety and concern,

so next week's write up risks being a repeat of this one.

No comments:

Post a Comment