For the second week in a row there were no big losers.

SBTX:SkinBioTherapeutics climbed 5% and is now 49% down so I only need 100% increase from here to break even.

SBTX:SkinBioTherapeutics climbed 5% and is now 49% down so I only need 100% increase from here to break even.

IGG:IG Group has finally got above the 800p barrier by climbing 6% and

is just 7% down, and I'm happy to say is 1% up if you include the dividends.

AJB:AJ Bell has been on a mega roll lately and climbed another 8% this

week to go 17% up and making potential profit of £170. My 12 month review date

isn't until July 2023 but I've set a flag at 7% so if it drops more than 10%

from here I will sell. I'll maintain that virtual trailing stop-loss at 10% if

it goes any higher.

FXPO:Ferrexpo also climbed 8%. This one desperately needs the war in

Ukraine to be over, after which it should recover, but is still 68% down.

OPTI:Optibiotix went up 1.5p which accounts for £3,000 of the gains. For my main

holding that's only 3%, but for my short term holding it's 8%, and I'm

delirious to say that this holding is in profit!

CEY:Centamin has been staging a major recovery lately and is up by 9%

this week and is only 11% down now. With dividends it's only 4% down so may

even get profitable soon.

Share of the Week is CAML:Central Asia Metals which went up by 10%

just after I increased my holding by 30%. Normally my timing is rubbish, but

this time it worked out, and my holding is making £378 profit and is 11% up,

or 16% if you include the dividend.

I so hope this continues, as the last 12 months have been really bad.

Above the trend line, but not that far above.

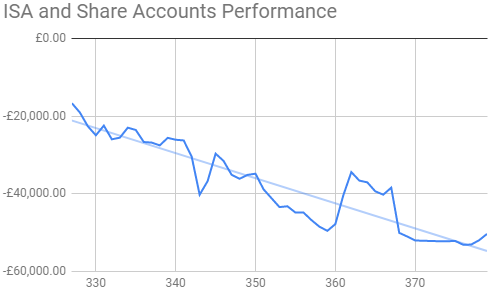

Here's the ISA and shares portfolio after week 15 of year 8.

Cash dropped thanks to monthly fees, and value up by £1,646, but most exciting of all is the £14 potential profit thanks to OPTI:Optibiotix and the fact I didn't add the shares I bought with my JLP:Jubilee Metals profits to my main holding but kept them separate to sell when I want to buy back into JLP.

| Weekly Change | |||

| Cash | £52.67 |

-£3.75 | |

| Portfolio cost | £82,003.25 | +£0 | |

| Portfolio sell value (bid price-commission) | £31,589.35 | (-61.5%) | +£1,646.58 |

| Potential profits | £14.74 | +£14.74 | |

| Yr 8 Dividends | £0 | +£0 | |

| Yr 8 Interest | £0.02 | +£0 | |

| Yr 8 Profit from sales | -£995.63 | +£0 | |

| Yr 8 projected avg monthly profit | -£290.87 | (-7.9%) | +£20.78 |

| Total Dividends | £11,768.92 | +£0 | |

| Total Interest | £0.02 | +£0 | |

| Total Profit from sales | £27,098.43 | +£0 | |

| Average monthly cash profit |

£440.53 |

(11.9%) | -£1.17 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Compound performance | 87% | +0% |

Cash dropped thanks to monthly fees, and value up by £1,646, but most exciting of all is the £14 potential profit thanks to OPTI:Optibiotix and the fact I didn't add the shares I bought with my JLP:Jubilee Metals profits to my main holding but kept them separate to sell when I want to buy back into JLP.

At the moment there is still a big JLP seller, which I suspect is

someone with warrants. Unfortunately there are 63 million warrants at around

3p outstanding that expire in January 2023, so I suspect they will be

exercised and most likely sold at the current 11p+ for instant 300% profit.

If that happens I'll wait until after they are sold to buy back, as the

share price may wait until then to re-rate.

It's a very gradual climb - and very slow.

Still above the trend line but £30k below where it was a year ago.

It's a very gradual climb - and very slow.

Still above the trend line but £30k below where it was a year ago.

The SIPP looks like this after week 363 overall and week 51 of year 7.

Next week sees the completion of year 7 of the SIPP, so I'll review the annual performance then. My £130 monthly savings went in and I bought 57 shares in EMG:Man Group at 215.3p costing £124.22. The cash went up by the left-over £5.78. I now hold 371 shares at an average of 236.79p and costing £894.45, so one more month savings will take me to £1,000 and I can find a new magic formula share to invest in monthly. It's a nice way to build a stake in a company.

| Weekly Change | ||||

| Cash | £36.62 | +£5.78 | ||

| Portfolio cost | £98,772.58 | +£124.22 | ||

|

Portfolio sell value (bid price - commission) |

£46,686.19 | (-52.7%) | +£2,414.11 | |

| Potential profits | £713.54 | +£434.89 | ||

| Yr 7 Dividends | £10,911.87 | +£0 | ||

| Yr 7 Interest | £0.01 | +£0 | ||

| Yr 7 Profit from sales | -£3,290.88 | +£0 | ||

| Yr 7 projected avg monthly profit | £632.80 | (12.8%) | -£12.66 | |

| Total Dividends | £14,116.26 | +£0 | ||

| Total Interest | £0.21 | +£0 | ||

| Total Profit from sales | £20,433.75 | +£0 | ||

| Average monthly cash profit | £400.56 | (8.1%) | -£1.11 | |

|

(Sold stocks profit + Dividends - Fees / Months) |

||||

| Compound performance | 57% | +0% |

Next week sees the completion of year 7 of the SIPP, so I'll review the annual performance then. My £130 monthly savings went in and I bought 57 shares in EMG:Man Group at 215.3p costing £124.22. The cash went up by the left-over £5.78. I now hold 371 shares at an average of 236.79p and costing £894.45, so one more month savings will take me to £1,000 and I can find a new magic formula share to invest in monthly. It's a nice way to build a stake in a company.

Potential profits are up an impressive £434 after big rises for

AJB:AJ Bell and CAML:Central Asia Metals.

PLUS:Plus500 climbed less than a percent but also contributed to the

rise.

This is actually getting reasonably close to the injection line.

As with the ISA, we're above the trend line but over £30k down on last year.

This is actually getting reasonably close to the injection line.

As with the ISA, we're above the trend line but over £30k down on last year.

The trading account looks like this after week 329 overall and week 17 of year 7.

OPTI:Optibiotix is the only share not suspended and went up this week to give a £37 increase. It's still 3% down but only needs 1p to get into profit. I have owned OPTI once before in this account and made £65 profit so I hope to better that. I need to make £900 to get back level to my injection amount after recent losses, and have to assume that my currently suspended shares will never come back. This account really has been a disaster.

Slow and steady - but very, very slow.

| Weekly Change | |||

| Cash | £0.10 | +£0 | |

| Portfolio cost | £1,849.21 | +£0 | |

| Portfolio sell value (bid price - commission) | £732.92 | (-60.4%) | +£37.03 |

| Potential profits | £0.00 | +£0 | |

| Year 7 Dividends | £0.00 | +£0 | |

| Year 7 Interests | £0.01 | +£0 | |

| Year 7 Profit | -£71.73 | +£0 | |

| Yr 7 projected avg monthly profit | -£18.28 | (-11.9%) | +£1.15 |

| Dividends | £60.10 | +£0 | |

| Interest | £0.01 | +£0 | |

| Profit from sales | £154.87 | +£0 | |

| Average monthly cash profit | £2.83 | (1.8%) | -£0.01 |

|

(Sold stocks profit + Dividends - Fees / Months) |

OPTI:Optibiotix is the only share not suspended and went up this week to give a £37 increase. It's still 3% down but only needs 1p to get into profit. I have owned OPTI once before in this account and made £65 profit so I hope to better that. I need to make £900 to get back level to my injection amount after recent losses, and have to assume that my currently suspended shares will never come back. This account really has been a disaster.

Slow and steady - but very, very slow.

Just staying above the upward pointing trend line.

There's an OPTI:Optibiotix Investor Meet presentation on Thursday, so a great deal of hope that we will get a commercial update RNS some time before that. I'm really nervous about what it's going to say. It needs to be positive or I'm going to be losing most of my savings for a long time to come.

No comments:

Post a Comment