I'm no longer reporting weekly movements above 5% for those shares that are

90%+ down and worthless, as they are regularly moving by 10-15% and it's only

worth pennies. The likes of BLU:Blue Star Capital, KIBO:Kibo Energy and

SAE:Simec Atlantis Energy all moved more than 5% this week and I just couldn't

be bothered with them any more, so they can do what they like - I just don't

care.

Biggest loser was PLUS:Plus 500 which dropped 6%, but most of that was from going ex-dividend, and my holding is still up by 18%.

Biggest loser was PLUS:Plus 500 which dropped 6%, but most of that was from going ex-dividend, and my holding is still up by 18%.

WHR:Warehouse REIT also dropped 6% and these are now down by 32% and one of my

worst magic formula shares. I probably ought to get some more while they are

this cheap!

EDV:Endeavour Mining has had a torrid few months and are performing worse than

WHR. They recovered 5% this week but are still 34% down.

PAF:Pan African Resources has been a very rare well-timed purchase. They rose

10% this week and my two holdings are in profit by 14% and 11%, as well as

having dished out £56 in dividends.

Share of the Week is OPTI:Optibiotix, which zoomed up 30% after a progress

update. There's growing promise of some huge Sweetbiotix orders, although the

update was mainly around Slimbiome which is starting to increase sales,

particularly in its incarnation as Leanbiome in sports nutrition. I'm still

down by £53k in my overall holding, so it will take another 100% increase to

get me to break-even. However when OPTI moves, it can really move.

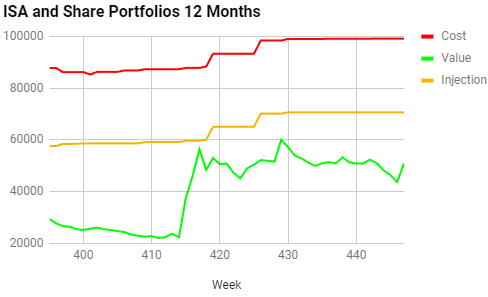

Here's the ISA and shares portfolio after week 31 of year 9.

Huge surge in value, and my cheap holding in OPTI:Optibiotix was responsible for the £1,288 increase in potential profits. I won't be selling any of my OPTI holding in my ISA. I got to change the colour of the portfolio value from crimson to orangered as it went back below 50% deficit.

Back up to where we were a few months ago.

Much of the gap to the trend line has been made up, but it would be nice to get above it.

| Weekly Change | |||

| Cash | £73.03 | +£0 | |

| Portfolio cost | £99,231.92 | +£0 | |

| Portfolio sell value (bid price-commission) |

£50,870.96 | (-48.7%) | +£7,308.67 |

| Potential profits | £2,532.17 | +£1,288.24 | |

| Yr 9 Dividends | £215.92 | +£0 | |

| Yr 9 Interest | £3.71 | +£0 | |

| Yr 9 Profit from sales | £11.13 | +£0 | |

| Yr 9 proj avg monthly profit | £25.34 | (0.4%) | -£0.84 |

| Total Dividends | £12,127.35 | +£0 | |

| Total Interest | £5.64 | +£0 | |

| Total Profit from sales | £17,309.66 | +£0 | |

| Average monthly cash profit | £281.28 | (4.8%) | -£0.63 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Compound performance | 41% | +0% |

Huge surge in value, and my cheap holding in OPTI:Optibiotix was responsible for the £1,288 increase in potential profits. I won't be selling any of my OPTI holding in my ISA. I got to change the colour of the portfolio value from crimson to orangered as it went back below 50% deficit.

Back up to where we were a few months ago.

Much of the gap to the trend line has been made up, but it would be nice to get above it.

The SIPP looks like this after week 431 overall and week 15 of year 9.

| Weekly Change | ||||

| Cash | £111.23 | +£55.55 | ||

| Portfolio cost | £104,813.70 | +£0 | ||

| Portfolio sell value (bid price - commission) | £59,649.88 | (-43.1%) | +£7,079.72 | |

| Potential profits | £1,021.43 | +£159.71 | ||

| Yr 9 Dividends | £173.88 | +£55.55 | ||

| Yr 9 Interest | £1.24 | +£0 | ||

| Yr 9 Profit from sales | £3,373.97 | +£0 | ||

| Yr 9 proj avg monthly profit | £1,009.36 | (17.5%) | -£54.90 | |

| Total Dividends | £14,808.76 | +£55.55 | ||

| Total Interest | £7.17 | +£0 | ||

| Total Profit from sales | £14,209.87 | +£0 | ||

| Average monthly cash profit | £279.64 | (4.8%) | -£0.09 | |

| (Sold stocks profit + Dividends - Fees / Months) | ||||

| Compound performance | 40% | +0% |

A great week as with the ISA, and £55 dividends are made up of £21 from UKW:Greencoat UK Wind and £33 from IGG:IG Group Holdings. Potential profits only increased by £159 as none of my OPTI:Optibiotix holdings are in profit. Most of the increase was due to PAF:Pan African Resources, with III:3i Group also contributing, but a 6% drop in PLUS:Plus 500 and 3% drop in GAW:Games Workshop offset some of those gains.

As with the ISA, back to where we were a few months ago. It would be so nice to get back above the injection line.

Pretty close to the trend line, but the wrong side of it still.

The trading account looks like this after week 397 overall and week 33 of year 8.

| Weekly Change | |||

| Cash | £0.07 | +£0 | |

| Portfolio cost | £2,076.23 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,249.00 | (-39.8%) | +£21.86 |

| Potential profits | £10.38 | +£10.38 | |

| Year 8 Dividends | £8.56 | +£0 | |

| Year 8 Interest | £0 | +£0 | |

| Year 8 Profit | £283.99 | +£0 | |

| Yr 8 proj avg monthly profit | £38.42 | (+22.2%) | -£1.20 |

| Dividends | £68.66 | +£0 | |

| Interest | £0.03 | +£0 | |

| Profit from sales | -£646.70 | +£0 | |

| Average monthly cash profit | -£6.31 | (-3.6%) | +£0.02 |

| (Sold stocks profit + Dividends - Fees / Months) |

BARC:Barclays went up 4% and into potential profit! That despite them going ex-dividend. The fact I'll have had 2 dividends from them shows how long I've had to hold them to get back into profit. Now I need to decide how long to hold them before selling. In theory I should be banking 10% profit in this account, which would be another 11p on the 169p share price. I think given that banks are not famous for significant re-rates, and I also have some dividends, I shouldn't hold out for any more. Let's see what momentum we have next week. Unfortunately it's not going to eat into very much of my £646 deficit after DDDD:4D Pharma went bust, but means I can switch to something more volatile. Mind you, with my track record that could end badly! I should maybe focus on some of my hard-hit magic formula shares in this account, like EDV:Endeavour Mining.

JLP:Jubilee Metals went up 2% and has hopefully bounced of its bottom, but SBTX:SkinBioTherapeutics dropped 2%, which is a hell of a lot better than the 21% it had dropped before a late rally on Friday.

Still doesn't look great.

Really close to the trend line, but still below it and it's pointing downwards. A JLP:Jubilee Metals rally would be very welcome.

My latest pension transfer should arrive in my SIPP next week, so I'll have £2,100 to spend. I must stick to my rule of only buying dividend-paying shares, but still not settled on what to get. I was originally planning to put the whole lot on CAML:Central Asia Metals, but I'm now leaning towards putting half of it there. I'm looking towards CEY:Centamin for the rest, as they do have a gigantic pile of cash and gold is holding up. It would be nice to lower my average price for them as my current holding is 21% down, but I've had 11% of dividends. I considered EDV:Endeavour Mining but there are a few amber flags over that one after some dodgy dealings, so I don't want to increase my long-term exposure there at the moment. Potential rebound value for the trading account though.

Still doesn't look great.

Really close to the trend line, but still below it and it's pointing downwards. A JLP:Jubilee Metals rally would be very welcome.

My latest pension transfer should arrive in my SIPP next week, so I'll have £2,100 to spend. I must stick to my rule of only buying dividend-paying shares, but still not settled on what to get. I was originally planning to put the whole lot on CAML:Central Asia Metals, but I'm now leaning towards putting half of it there. I'm looking towards CEY:Centamin for the rest, as they do have a gigantic pile of cash and gold is holding up. It would be nice to lower my average price for them as my current holding is 21% down, but I've had 11% of dividends. I considered EDV:Endeavour Mining but there are a few amber flags over that one after some dodgy dealings, so I don't want to increase my long-term exposure there at the moment. Potential rebound value for the trading account though.

No comments:

Post a Comment