Worst performer again was FXPO:Ferrexpo which is really struggling and dropped another 14% to go 92% down. They should recover once the legal issues die down, which they should do as it appears Ukraine courts are trying to use FXPO to get money owed by their previous director. In theory the worst that should happen is he is forced to sell a large number of shares. There should be no liability on FXPO to pay his personal debts.

OPTI:Optibiotix dropped 1.5p which accounted for a lot of the losses this week. That's a 6% drop and probably due to no microbiome modulator news coming out despite it being expected.

PAF:Pan African Resources has had a great few weeks, but fell 6% this week probably due to some profit taking. Gold is still holding up so these should too. They are still 19% in profit and a rare example of a well timed purchase.

Quite a few shares did well this week, with PSN:Persimmon and WHR:Warehouse REIT both climbing 5% presumably on hopes interest rates will soon drop.

AFC:AFC Energy had another good week and have gone into profit after climbing 6%.

AJB:AJ Bell did a false drop of 8% last week when the bid price was mysteriously marked down. That was sorted out this week, although the 6% gain means we are still 2% down on the week before and 1% down altogether.

CAML:Central Asia Metals had an absolutely brilliant week, being tipped in many places, mainly for their huge dividend yield. They climbed 7% and some of my holdings are now in profit.

Share of the Week was III:3i Group which gave excellent results and went up another 8% to go 69% up since I bought them. At last I have a magic formula share that I can try and hold forever and reap a huge dividend yield.

Here's the ISA and shares portfolio after week 34 of year 9.

I did what I considered last week and sold my profitable CAML:Central Asia Metals holding of 1,175 shares at 180.8p making a profit of £104.77 (5.1%). I immediately re-invested the proceeds in JLP:Jubilee Metals, buying 36,206 shares at 5.8p at a cost of £2,109.90. That fits my policy of having growth shares in the ISA rather than dividend shares.

| Weekly Change | |||

| Cash | £59.64 | -£6.68 | |

| Portfolio cost | £99,843.44 | +£611.52 | |

| Portfolio sell value (bid price-commission) |

£46,158.56 | (-53.8%) | -£1,912.35 |

| Potential profits | £1,678.61 | -£258.99 | |

| Yr 9 Dividends | £215.92 | +£0 | |

| Yr 9 Interest | £3.77 | +£0.06 | |

| Yr 9 Profit from sales | £115.91 | +£104.77 | |

| Yr 9 proj avg monthly profit | £35.61 | (0.6%) | +£12.69 |

| Total Dividends | £12,127.35 | +£0 | |

| Total Interest | £5.70 | +£0.06 | |

| Total Profit from sales | £17,414.44 | +£104.77 | |

| Average monthly cash profit | £280.35 | (4.7%) | +£0.39 |

|

(Sold stocks profit + Dividends - Fees / Months) |

|||

| Compound performance | 41% | +0% |

I did what I considered last week and sold my profitable CAML:Central Asia Metals holding of 1,175 shares at 180.8p making a profit of £104.77 (5.1%). I immediately re-invested the proceeds in JLP:Jubilee Metals, buying 36,206 shares at 5.8p at a cost of £2,109.90. That fits my policy of having growth shares in the ISA rather than dividend shares.

I also added £500 cash and bought 351 shares in CWR:Ceres Power at 142.123p costing £511.29. That more than doubled my holding and reduced my weighted average price to 213.7957p. I have always liked this company and can't believe they have fallen so far. I'll keep adding at these prices if I can get any cash.

Potential profits went down due to OPTI:Optibiotix and selling CAML:Central Asia Metals, although AFC:AFC Energy went £38 into profit, so I still have two profitable holdings in the ISA.

The sale didn't make much difference to long-term performance.

Hoping we stay above the low from a few weeks ago.

Not looking great.

Very busy! I sold my profitable 39,766 JLP:Jubilee Metals shares at 5.73p making £132.78 (6.1%) profit and in a reverse of the ISA transaction I bought 1,292 shares in CAML:Central Asia Metals at 180.96p costing £2,349.95, taking my SIPP holding to 3,760 shares at an average price of 175.1272p costing £6,632.58. They are currently up by 8% making £522 potential profit.

There was a nice dividend of £45 from IPX:Impax Asset Management, in fact it's such a good dividend I may have to get some more!

Hoping we stay above the low from a few weeks ago.

Not looking great.

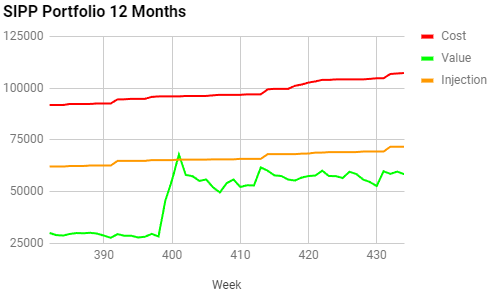

The SIPP looks like this after week 434 overall and week 18 of year 9.

| Weekly Change | ||||

| Cash | £146.19 | +£24.83 | ||

| Portfolio cost | £107,351.61 | +£216.10 | ||

| Portfolio sell value (bid price - commission) | £58,223.86 | (-45.8%) | -£1,476.46 | |

| Potential profits | £1,891.83 | +£326.89 | ||

| Yr 9 Dividends | £219.22 | +£45.34 | ||

| Yr 9 Interest | £1.54 | +£0.30 | ||

| Yr 9 Profit from sales | £3,506.75 | +£132.78 | ||

| Yr 9 proj avg monthly profit | £879.62 | (14.7%) | -£6.26 | |

| Total Dividends | £14,854.10 | +£45.34 | ||

| Total Interest | £7.47 | +£0.30 | ||

| Total Profit from sales | £14,342.65 | +£132.78 | ||

| Average monthly cash profit | £279.30 | (4.7%) | +£1.14 | |

| (Sold stocks profit + Dividends - Fees / Months) | ||||

| Compound performance | 39% | +0% |

There was a nice dividend of £45 from IPX:Impax Asset Management, in fact it's such a good dividend I may have to get some more!

Potential profits went up thanks to CAML:Central Asia Metals and III:3i Group, but the gain was reduced by PAF:Pan African Resources dropping 6%.

Not as bad as the ISA

The 8-month trend doesn't look very good.

The trading account looks like this after week 400 overall and week 36 of year 8.

I sold my 317 BARC:Barclays shares at 179.9371p making £44.16 (9.7%) profit. That will be above 10% when the 2 dividends are included. I bought 8,532 shares in JLP:Jubilee Metals at 5.86p costing £511.93 which left £46 in cash. Three of my trading holdings are now in JLP:Jubilee Metals so I'm hoping that doesn't completely curse the company!

Not great as despite the green line including cash, JLP:Jubilee Metals dropped 4% this week.

Profit taking always has a dramatic downer on this chart.

Not as bad as the ISA

The 8-month trend doesn't look very good.

The trading account looks like this after week 400 overall and week 36 of year 8.

| Weekly Change | |||

| Cash | £46.59 | +£46.52 | |

| Portfolio cost | £2,073.87 | -£2.36 | |

| Portfolio sell value (bid price - commission) | £1,173.85 | (-43.4%) | -£103.32 |

| Potential profits | £0 | -£37.51 | |

| Year 8 Dividends | £8.56 | +£0 | |

| Year 8 Interest | £0 | +£0 | |

| Year 8 Profit | £328.15 | +£44.16 | |

| Yr 8 proj avg monthly profit | £40.53 | (+23.5%) | +£4.31 |

| Dividends | £68.66 | +£0 | |

| Interest | £0.03 | +£0 | |

| Profit from sales | -£602.54 | +£44.16 | |

| Average monthly cash profit | -£5.78 | (-3.3%) | +£0.50 |

| (Sold stocks profit + Dividends - Fees / Months) |

I sold my 317 BARC:Barclays shares at 179.9371p making £44.16 (9.7%) profit. That will be above 10% when the 2 dividends are included. I bought 8,532 shares in JLP:Jubilee Metals at 5.86p costing £511.93 which left £46 in cash. Three of my trading holdings are now in JLP:Jubilee Metals so I'm hoping that doesn't completely curse the company!

Not great as despite the green line including cash, JLP:Jubilee Metals dropped 4% this week.

Profit taking always has a dramatic downer on this chart.

I enjoyed doing the switcheroo on CAML:Central Asia Metals and JLP:Jubilee Metals in my SIPP and ISA. It didn't cost me anything, I registered a few small profits, and I started my gradual differentiation of the two accounts so in future they won't just track each other as they currently have nearly all the same shares.

If I do follow this strategy then I will need to buy some more OPTI:Optibiotix in the ISA to replace the ones I sell in the SIPP, as I don't want to reduce my holding.

Meanwhile I still wait patiently for news from my biggest holdings in the hope I can improve my dreadful performance.

Meanwhile I still wait patiently for news from my biggest holdings in the hope I can improve my dreadful performance.

No comments:

Post a Comment