The biggest loser was CWR:Ceres Power who announced the end of their relationship with Bosch. The fact Bosch have pulled the plug after all these years is devastating, and predictably the shares crashed 44% and are now 65% down and I fear the worst.

FXPO:Ferrexpo have been very volatile but this week crashed 21% presumably as things are getting a bit tense over the nature of any US negotiated peace deal. It only dropped them 4% to 84% down for me though.

TRX:Tissue Regenix have been hinting at selling the company, but it hadn't impacted the share price until last week. This week the drop accelerated, falling 17% to go 68% down. Every penny it drops will increase my losses if they do sell out.

IPX:Impax Asset Management had their dividend ex-date on Thursday which wiped 10% off the share price, and it fell another 5% to go 15% down in the week. My holding is now 59% down. I should be buying more just for the 10% dividend yield.

ASHM:Ashmore Group had been recovering of late, but this week dropped 7% to go 45% down.

UKW:Greencoat UK Wind have been drifting, but the drift turned into a nose-dive this week as they dropped 6% to go 31% down.

AFC:AFC Energy , FDM:FDM Group and IHP:Integrafin all dropped 5% in a really rubbish week.

Rubbish apart from all my microbiome shares.

SBTX:SkinBioTherapeutics climbed 8% and my biggest holding is only 10% down now, but my other 2 are 43% and 48% down.

OPTI:Optibiotix launched a new product in USA which used to drive really big rises, but it managed 13% which isn't bad. Most of my holdings are at least 50% down, and my biggest is 72% down. One of my ISA holdings is only down 19% so it needs a 5p rise to get into profit.

Share of the Week is PBX:Probiotix Health which soared 28% and my smallest holding is now 41% in profit. I suspect there's a very good chance I'll sell it next week so I can buy more IHP:Integrafin. The big holdings from my free shares are still down 44%. Not sure how I'll ever sell them though, as Hargreaves Lansdown don't allow electronic trades on Aquis. I'm hoping PBX will list on AIM or LSE before I want to sell those.

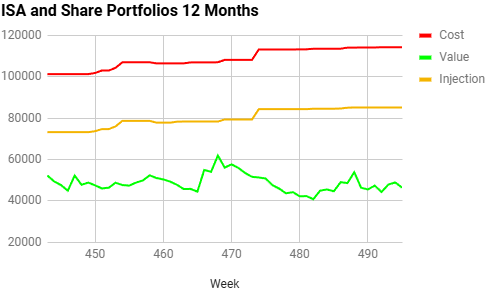

Here's the ISA and shares portfolio after week 30 of year 10.

| Weekly Change | |||

| Cash | £56.04 | +£0 | |

| Portfolio cost | £114,352.47 | +£0 | |

| Portfolio sell value (bid price-commission) | £48,326.69 | (-57.7%) | +£3,153.07 |

| Potential profits | £0 | +£0 | |

| Yr 10 Dividends | £109.23 | +£0 | |

| Yr 10 Interest | £0.82 | +£0 | |

| Yr 10 Profit from sales | £327.55 | +£0 | |

| Yr 10 proj avg monthly profit | £54.83 | (0.8%) | -£1.89 |

| Total Dividends | £12,417.18 | +£0 | |

| Total Interest | £7.62 | +£0 | |

| Total Profit from sales | £17,602.85 | +£0 | |

| Average monthly cash profit | £256.71 | (3.6%) | -£0.52 |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Compound performance | 35% | +0% |

Great rise as most of the big falls were in my SIPP.

Nice tick up.

Above the trend line!

The SIPP looks like this after week 482 overall and week 14 of year 10.

| Weekly Change | ||||

| Cash | £50.09 | -£21.33 | ||

| Portfolio cost | £125,505.95 | -£327.18 | ||

| Portfolio sell value (bid price - commission) | £69,618.63 | (-44.5%) | +£2,567.67 | |

| Potential profits | £3,718.70 | +£155.01 | ||

| Yr 10 Dividends | £351.71 | +£0 | ||

| Yr 10 Interest | £1.25 | +£0 | ||

| Yr 10 Profit from sales | £2,375.87 | -£233.44 | ||

| Yr 10 proj avg monthly profit | £825.61 | (12.0%) | -£141.32 | |

| Total Dividends | £16,468.36 | +£0 | ||

| Total Interest | £14.15 | +£0 | ||

| Total Profit from sales | £19,383.81 | -£233.44 | ||

| Average monthly cash profit | £309.48 | (4.5%) | -£2.75 | |

| (Sold stocks profit + Dividends - Fees / Months) | ||||

| Compound performance | 42% | +0% |

I got fed up with CMCL:Caledonia Mining. Every time I've owned them they have been useless, and I was sitting on a loss despite gold being at an all-time high. I sold my 218 shares at 822p for a £233.44 (11.6%) loss because I was desperate to buy back into PAF:Pan African Resources after their recent drop. I bought 4,981 shares at 35.4958p costing £1,788.84, which helped make up for the ones I sold a few months ago. Unfortunately there's no other gold mining share I'd be happy buying at the moment, so if I want gold it has to all be PAF.

Big rise in value and even a small £155 rise in potential profit as the big fallers were loss-making and a few magic formula shares sneaked a little higher. Long term performance took a little dent, but I'm hoping it will be worth it.

The gap to orange is frustratingly narrow. It would be so nice to at least get above that so I'm not behind what I originally put in.

Only just above the trend line, but better than below it as we were last week.

That's it for this week. Will the microbiome momentum continue into next week, or will profit-takers spoil the rise? Will JLP:Jubilee Metals finally see the back of the big sellers and change direction? Will I be able to sell my AJ Bell PBX:Probiotix Health shares? Can't wait to find out.

The gap to orange is frustratingly narrow. It would be so nice to at least get above that so I'm not behind what I originally put in.

Only just above the trend line, but better than below it as we were last week.

That's it for this week. Will the microbiome momentum continue into next week, or will profit-takers spoil the rise? Will JLP:Jubilee Metals finally see the back of the big sellers and change direction? Will I be able to sell my AJ Bell PBX:Probiotix Health shares? Can't wait to find out.