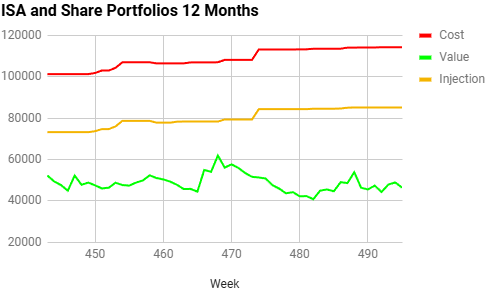

There were more shares down than up this week, but the ones that were up were well up. However a big drop in JLP:Jubilee Metals and a drop in OPTI:Optibiotix meant the deficit between cost and value widened by £3,856 to £125,651 and the deficit between injection amount and value widened to £53,461. Total portfolio value dropped to £113,701.

Biggest loser was FDM:FDM Group, which plummeted 16% after a trading update. This magic formula share has been a monumental disaster, dropping 28% in just the few weeks I have owned it. I think they are suffering the same problems as PAGE:Pagegroup, in that companies are not hiring staff. However if inflation and interest rates come down, I'd expect them to recover, and these are a long term investment.

TLOU:Tlou Energy dropped 15% and I suspect will continue to do so until they start selling electricity.

JLP:Jubilee Metals dropped 11%, which is particularly distressing given the number I bought over the last few weeks when I was convinced the recovery had begun. The institutional sellers seem to have finished, but someone is still selling. We need news of full coper production starting at Roan.

AAL:Anglo American Mining dropped 6% after it was confirmed BHP:BHP Group were no longer interested in buying them.

ALPH:Alpha Group has been a better behaved magic formula share, climbing 5% in my first full week and now 2% in profit.

CWR:Ceres Power also climbed 5%, but I suspect this won't last as they are so volatile.

FOUR:4imprint went up 5% and are now 10% in profit.

FXPO:Ferrexpo climbed 5% and are now only 76% down, so I may get to change their colour to crimson from red soon.

SAE:Simec Atlantis Energy went up 5% after completing a milestone at the Uskmouth energy storage site.

SCT:Softcat has been slipping lately, but went up 5% this week and is now only 2% down.

ARBB:Arbuthnot Banking had a reversal of fortunes and went up 6%, so these are now 14% down. They are outside my top 50 magic formula companies now, so I will sell them as soon as they are remotely profitable.

IPX:Impax Asset Management took a hammering after St James's Place withdrew one of their funds from management by IPX, but recovered 8% of the losses this week to win Share of the Week. They are still 51% down though.

Here's the ISA and shares portfolio after week 27 of year 10.

| Weekly Change | |||

| Cash | £64.23 | +£0.05 | |

| Portfolio cost | £114,352.47 | +£0 | |

| Portfolio sell value (bid price-commission) | £46,303.34 | (-59.5%) | -£2,478.79 |

| Potential profits | £0 | +£0 | |

| Yr 10 Dividends | £109.23 | +£0.05 | |

| Yr 10 Interest | £0.82 | +£0 | |

| Yr 10 Profit from sales | £327.55 | +£0 | |

| Yr 10 proj avg monthly profit | £62.23 | (0.9%) | -£2.39 |

| Total Dividends | £12,417.18 | +£0.05 | |

| Total Interest | £7.62 | +£0 | |

| Total Profit from sales | £17,602.85 | +£0 | |

| Average monthly cash profit | £258.34 | (3.6%) | -£0.52 |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Compound performance | 35% | +0% |

Very little change. The 5p dividend was from the BLU:Blue Star Capital consolidation from leftover shares. Big drop in value due to high exposure to JLP:Jubilee Metals.

I thought it would be too good to be true that things had started moving upwards.

Still just above the trend line

The SIPP looks like this after week 479 overall and week 11 of year 10.

| Weekly Change | ||||

| Cash | £82.48 | +£22.75 | ||

| Portfolio cost | £124,853.36 | +£0 | ||

| Portfolio sell value (bid price - commission) | £67,251.36 | (-46.1%) | -£1,377.25 | |

| Potential profits | £4,339.01 | -£52.49 | ||

| Yr 10 Dividends | £315.69 | +£22.75 | ||

| Yr 10 Interest | £1.25 | +£0 | ||

| Yr 10 Profit from sales | £1,906.90 | +£0 | ||

| Yr 10 proj avg monthly profit | £859.61 | (12.6%) | -£76.10 | |

| Total Dividends | £16,432.34 | +£22.75 | ||

| Total Interest | £14.15 | +£0 | ||

| Total Profit from sales | £18,914.84 | +£0 | ||

| Average monthly cash profit | £307.03 | (4.5%) | -£0.43 | |

| (Sold stocks profit + Dividends - Fees / Months) | ||||

| Compound performance | 41% | +0% |

I god a £22 dividend from IHP:Integrafin, and potential profits only dropped a little at £52 as the big drop in JLP:Jubileee Metals which wiped out all its potential profit was offset by rises in many of my profitable magic formula shares.

I'm still moderately encouraged that the green line isn't that far below orange.

I'm much less encouraged by dropping below the trend line

Still doing better than a year ago, but really need to flog those JLP:Jubilee Metals shares to give this a kick.

It still takes me by surprise that I'm finished at this point, as I still expect to have to do the trading account. Good riddance to that!

I was hoping JLP:Jubilee Metals was about to motor upwards and unlock all sorts of excitement in the SIPP, but it looks like my dreams have been dashed. I guess I should have known if I bought a load more at 4.7p it would be back at 4p by the following week! If all goes to plan I'll make £6,000 profit and liberate £16,600 for magic formula shares. It's just a shame nothing ever seems to go to plan.

No comments:

Post a Comment