AFC:AFC Energy was the worst performer, dropping 17% for absolutely no reason at all. These are now 44% down after being in profit not that long ago.

SAE:Simec Atlantis Energy slipped another 10% to go 78% down.

TLOU:Tlou Energy has been a dreadfully timed purchase, as it's clear the production of electricity is still a lot further away than I thought when I bought back in. They dropped 8% to go 31% down in just a few weeks.

OPTI:Optibiotix continue to slide relentlessly, dropping another 7% this week. There's no sign of any positive news and everything is going tits up with PBX:Probiotix Health where we either sack the CEO and half the board or allow dodgy dealings to dilute 25% of the company from us. I'm down over £84,000 on OPTI, £17,000 on PBX, and £4,800 on SBTX:SkinBioTherapeutics. That's a paper loss of £105,000 just on microbiome shares, after already losing £18,700 when DDDD:4D Pharma went bust. There is no prospect of any upside anywhere. I've never felt so bad about owning shares in these bloody companies!

FXPO:Ferrexpo are very volatile. They dropped 6% and are now 91% down so I don't need to report on them any more.

JLP:Jubilee Metals went up last week for the first time in ages, and I hoped the big seller was gone. However they are still selling, and results this week were underwhelming, with a huge drop in earnings per share due to recent placings. They dropped 6% this week.

GSK:GSK are still being rubbish and dropped another 5% to go 11% down.

CMCL:Caledonia Mining did really well last week, and went up another 5% this week to make me very happy. They are now 12% in profit.

PAF:Pan African Resources went up 7% and one holding has turned purple as it's now up by 102%.

Share of the Week for the 2nd week in a row is CWR:Ceres Power, climbing another 12% to go 27% up. I really hope this isn't a short-term spike, as I'd like one ISA share to be capable of staying in the black.

Here's the ISA and shares portfolio after week 10 of year 10.

| Weekly Change | |||

| Cash | £40.35 | +£17.11 | |

| Portfolio cost | £111,188.18 | +£0 | |

| Portfolio sell value (bid price-commission) | £42,404.65 | (-61.9%) | -£2,241.42 |

| Potential profits | £415.02 | +£202.42 | |

| Yr 10 Dividends | £20.65 | +£20.65 | |

| Yr 10 Interest | £0.34 | +£0.23 | |

| Yr 10 Profit from sales | £149.75 | +£0 | |

| Yr 10 proj avg monthly profit | £65.10 | (1.0%) | +£1.02 |

| Total Dividends | £12,243.14 | +£20.65 | |

| Total Interest | £7.14 | +£0.23 | |

| Total Profit from sales | £18,027.59 | +£0 | |

| Average monthly cash profit | £270.07 | (4.0%) | -£0.41 |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Compound performance | 36% | +0% |

Big drop in portfolio value as usual. I got £9 dividend from CAPD:Capital and £11 from WHR:Warehouse REIT, and potential profits went up another £202 thanks to CWR:Ceres Power.

Still the relentless decline

I can now safely say the rise a few months ago was nothing more than a blip.

The SIPP looks like this after week 462 overall and week 46 of year 9.

| Weekly Change | ||||

| Cash | £439.04 | +£322.90 | ||

| Portfolio cost | £115,565.66 | +£0 | ||

| Portfolio sell value (bid price - commission) | £58,013.13 | (-49.8%) | -£1,444.27 | |

| Potential profits | £5,244.00 | +£209.99 | ||

| Yr 9 Dividends | £1,089.12 | +£87.72 | ||

| Yr 9 Interest | £6.35 | +£1.37 | ||

| Yr 9 Profit from sales | £5,670.64 | +£0 | ||

| Yr 9 proj avg monthly profit | £618.12 | (9.7%) | -£6.77 | |

| Total Dividends | £15,724.00 | +£87.72 | ||

| Total Interest | £12.28 | +£1.37 | ||

| Total Profit from sales | £16,506.54 | +£0 | ||

| Average monthly cash profit | £289.65 | (4.5%) | +£0.05 | |

| (Sold stocks profit + Dividends - Fees / Months) | ||||

| Compound performance | 40% | +0% |

Cash increased due to monthly investment cash being paid in, the usual big drop in portfolio value, but the usual increase in potential profits, this week by £209. Lots of dividends, with £13 from AAL:Anglo American Mining, £31 from APAX:Apax Global Alpha, £10 from CAPD:Capital and £32 from CEY:Centamin. One more bad week and I'll be down by over 50%.

Very familiar story.

Blip blippety blip.

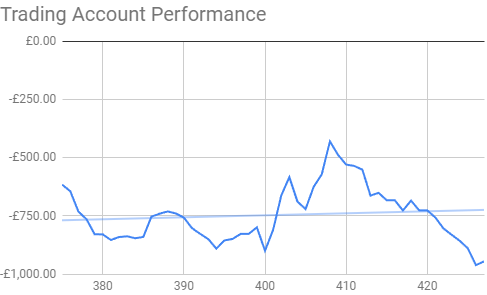

The trading account looks like this after week 428 overall and week 12 of year 9.

| Weekly Change | |||

| Cash | £63.39 | +£0 | |

| Portfolio cost | £2,073.87 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,080.39 | (-47.9%) | -£47.84 |

| Potential profits | £0 | +£0 | |

| Year 9 Dividends | £0 | +£0 | |

| Year 9 Interest | £0 | +£0 | |

| Year 9 Profit | £0 | +£0 | |

| Yr 8 proj avg monthly profit | £0 | (+0%) | +£0 |

| Dividends | £85.46 | +£0 | |

| Interest | £0.03 | +£0 | |

| Profit from sales | -£602.54 | +£0 | |

| Average monthly cash profit | -£5.23 | (-3.0%) | +£0.02 |

| (Sold stocks profit + Dividends - Fees / Months) |

Absolute carnage, with a big drop in JLP:Jubilee Metals showing I was completely wrong thinking things had turned around last week. In fact they are much worse, and it's looking like a long wait for any reversal. I'm dreading news that they are placing a load more shares to buy more copper reserves - it's going to happen at some point, which is probably one of the reasons for all the selling.

Nearly 6 months of continual decline.

If things don't turn around next week I'll have to adjust the chart axis as we'll go bellow £1,000 in the red.

I have at least written this update on time, and also completed the 2 previous weeks that I couldn't bring myself to write. Suffice to say I'm extremely miserable, and wish I'd adopted my new strategy a long time ago so I didn't have any crappy microbiome shares in my SIPP. I should be getting a £2,000 pension transfer this week, but Legal & General have become incredibly slow at processing the transfer requests recently. They always send me a questionnaire afterwards, so I think this time I'll complete it and have a moan.

I was planning to get N91:Ninety One with half the transfer, but they have gone up 15% in the last few weeks so I may have missed my chance. Having said that, they are still half what the were a few years ago and with a P/E ratio of 10, so although I've missed out on 15% I may still get them in time. Knowing my luck they will plummet the day after I buy them.

My other target purchase is POLR:Polar Capital Holdings, which I've held in the past. They pay a great dividend. They've had a bit of a drop recently, but are fairly stable with P/E ratio of 13, so no worries about buying back into them.

I'm also due my monthly investment in FOUR:4imprint where I'll buy another 4 shares. They are fractionally below what I've already paid for them, whereas a few weeks ago they were well below. As usual my monthly investment target surges just before I buy them then drop just after! I normally get the same share for 4 months to take me to £1,000, but these are leaving quite a lot of change and I'll be well under that, so I'll continue buying them for a 5th month to make sure I invest over £1,000.