Considering it's holiday season, there was some impressive volatility this week, and thankfully most of it was positive.

Biggest loser was EMH:European Metals. This was down another 14% and shows just how bad my timing was when buying back into this one. The only other double digit loser was PAF:Pan African Resources, falling 11%. Given gold is still pretty high, this seems like way too much of a drop. If I had spare cash I would buy more at this price, as the dividend is only a few months away and is huge.

JLG:John Laing Group posted very healthy interims and is up 10% this week. JLP:Jubilee Platinum is also up 10% and momentum seems to be really building on this one. Nice to see a slow, steady and hopefully sustainable increase in share price as multiple revenue streams draw closer.

ARL:Atlantis Resources was another share I bought into at completely the wrong time just before a big dip. Happy to say a 21% increase this week means it's only 7% down now, and first power generation is not far away.

IOG:Independent Oil & Gas was biggest loser last week, and I stated that I thought it had dropped too far. Fortunately I was right and it went back up by 22% this week and is 74% up altogether. Lots of good news about to drop for this one too, so anticipating more of a rise next week or the week after.

SXX:Sirius Minerals keeps making a bid for Share of the Week, often successfully, but not this week. The 31% increase was pretty impressive though, and means it's up 137% altogether. I'm really torn on this one. It has great long term potential, but with 6 years before revenue, can it sustain this sort of rise and a £1 billion market cap?

Share of the Week is TLOU:Tlou Energy, climbing 43% this week and 50% up overall. I'm very excited about this share, and will stay with it for the long haul.

Nemesis Share switched again on Friday as AFG:Aquatic Food dropped back to a £879 loss and OPTI:Optibiotix climbed to a mere £866 loss, thus passing the title back again. I really thought AFPO:African Potash would be Nemesis by now - come on chaps, a £250 rise will get you both into safety.

Here's the main portfolios performance

| Weekly Change | |||

| Portfolio cost | £40,289.13 | +£0 | |

| Portfolio sell value (bid price - commission) | £36,718.84 | (-8.9%) | +£474.81 |

| Potential profits | £2,113.23 | -£3.78 | |

| Yr 2 Dividends | £105.48 | +£105.48 | |

| Yr 2 Profit from sales | £2,205.13 | +£0 | |

| Yr 2 Average monthly cash profit | £3,337.55 | -£1,440.23 | |

| Yr 2 Avg annual % of current portfolio cost | 99.4% | ||

| Total Dividends | £773.41 | +£105.48 | |

| Total Profit from sales | £6,045.39 | +£0 | |

| Average monthly cash profit | £532.49 | -£1.39 | |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Avg annual % of current portfolio cost | 15.9% |

No new shares, so cost remains the same. Sell value up £474 yet potential profits are slightly down, so all this has been loss reduction as some of the deepest losers stage a recovery. Two dividends arrived during the week. £45.50 from AFG:Aquatic Food and £59.98 from NTBR:Northern Bear which still refuses to get into profit, but is a great long term share. Must work out how to get that into my ISA. It's just got too big a spread to bed it, so a sale and wait for dip seems like the best way. Just need it to get into profit first! The dividend is destined for my current account to help offset the £150 I uploaded for the OPTI:Optibiotix buy in my SIPP.

The year 2 average projected profit is still gibberish due to the big sales in weeks 1 and 2. It's going to take a few months for that to look even vaguely realistic. I'd rather focus on the overall profit, which only dropped £1.39 a month despite no sales, thanks to the dividends.

Flat cost line and green line narrowing the gap. Next target is getting the trend lines parallel.

The SIPP looks like this after week 39

| Weekly Change | |||

| Portfolio cost | £14,773.51 | +£240.85 | |

| Portfolio sell value (bid price - commission) | £15,801.57 | (+7%) | +£448.35 |

| Potential profits | £1,333.12 | +£225.93 | |

| Dividends | £262.15 | +£0 | |

| Profit from sales | £2,349.86 | +£0 | |

| Average monthly cash profit | £286.73 | -£7.55 | |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Avg annual % of current portfolio cost | 23.3% |

The cost went up when I naughtily bought yet more OPTI:Optibiotix while they were cheap, taking this share up to 11% of my portfolio. There's no doubt this is a jam tomorrow share, but it's such an amazing quality of jam with big chunks of fruity loveliness that I'm willing to take a risk. If it goes good, it will go very, very good. If it goes bad it could be horrid!

As with the other portfolios, there was a recovery from some of the big loss shares, particularly ARL:Atlantis Resources, but potential profits were also up £225. No dividends or sales so the projected monthly profit drops a wee bit.

Just look at that green line go! With the focus on keeping what's in the portfolio and not messing around with it, there's more chance of a sustained improvement.

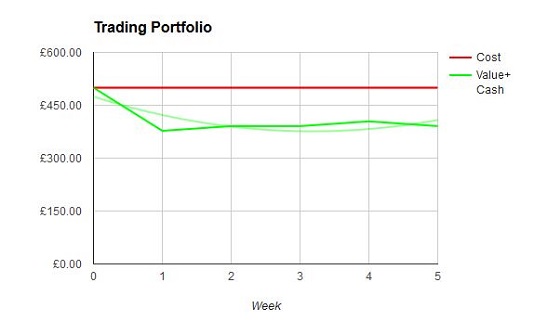

Here's the trading account after 5 weeks

| Weekly Change | |||

| Portfolio cost | £499.95 | +£0 | |

| Cash | £0.05 | +£0 | |

| Portfolio sell value (bid price - commission) | £390.95 | (-21.8%) | -£13.43 |

| Potential profits | £0 | +£0 | |

| Dividends | £0 | +£0 | |

| Profit from sales | £0 | +£0 | |

| Average monthly cash profit | £0 | +£0 | |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Avg annual % of current portfolio cost | 0% |

The one share SLP:Sylvania Platinum just can't break through the 7.5p resistance. This account was meant to be for short term holding and lots of irresponsible fun. Instead it's deadly dull. Come on Sylvania - do something exciting so I can go find some crackpot share that's about to spike for a day. I have lots of contenders!

What a rubbish graph!

It's been a good week, but I feel a little deflated because it was meant to be a great week. Thursday was a big news day, with JLG:John Laing Group, OPTI:Optibiotix and ALM:Allied Minds posting interims. JLG:John Laing Group was great, OPTI:Optibiotix was solid but said nothing new and the share price dropped, and ALM:Allied Minds was dreadful and saw a big drop back into loss after only being in profit a few days. Add to that KIBO:Kibo Mining announcing financing, which should have seen the share price soar - but nothing happened. WRES:W Resources also announced financing last week, but only a tiny improvement in share price.

Dampest squib was RED:RedT Energy whose shares have done well, but National Grid announced the successful contractors for energy storage on the grid on Friday. One of the successful companies was E.ON who have been working with RedT on battery storage, so I was hoping for some sort of announcement, but all was quiet. Maybe next week...

No comments:

Post a Comment