Worst performer was KIBO:Kibo Mining which tanked 10% after announcement of a placing. Very frustrating that more money is being raised to fund a new project when the original one isn't secure yet. Just when I thought this was turning round, some doubt is sown in my mind about the motives of the directors. I'm now 25% down on this one, and with £2,635 invested it's 3.4% of my portfolio. I'm not miffed enough to sell with that loss, so will hang on in there hoping for a PPA and reasonable re-rate.

WRES:W Resources did the usual trick of noticing a rise in the share price and so announcing yet another placing, despite £35m of debt funding a great big grant from the Spanish Government. I really am keen to sell these things once they get into profit as I don't trust the CEO as far as I can throw him, and I have a bad back! They dropped 6% this week, probably as a result of the placing.

MTFB:Motif Bio was Share of the Week last week, so not too surprising there was some profit taking this week and a 5% drop. Fortunately not enough of a drop to wipe out my paper profits which are £120 (4%).

My other recent topped-up newcomer is VRS:Versarien, and that also fell 5% but is now 6% down so I bought at the wrong time again. The mistake was topping up when I got excited about prospects. I should have realised there would be a better price to do so. This is a very news dependent share so could drift for a while without any.

On to the good news shares, with OPTI:Optibiotix climbing 2p and contributing a major part of the good performance. This was despite no real news, so when that RNS finally lands, who knows what will happen?!

LGEN:Legal & General don't usually move very much, but a 5% increase this week was most welcome and puts them £544 (35%) up in my SIPP. The ex-dividend date is Thursday after next, and with an 11.05p dividend they will tank that day, but the £87 payout next month will be nice.

CAML:Central Asia Metals had a great set of results and announced a 10p final dividend worth £205 so my SIPP has some nice treats coming. Share price was up 6% at the end of the week so these are now 88% up on my purchase price making potential profit of £3,143 and having generated £647 dividends and £982 realised profit from sales. What a great company!

TRX:Tissue Regenix has mysteriously climbed 9% on no news whatsoever. I'm not sure what's driving that up, but clearly there is some serious buying going on. I'm still 55% down so there's a long way to go, but maybe a glimmer of hope.

IQE:IQE are sneaking back up very slowly. They gained 4% in my SIPP and are now only 5% underwater, whereas my ISA holding climbed 10% of purchase price and are 114% up. Hopefully they can stabilise around 140p for a while, but these have been anything but stable.

LION:Lionsgold nearly won Share of the Week after a big climb today making them 15% up for the week. They announced having made an offer to buy out 100% of TRAC (The Real Asset Company) and therefore Goldbloc, which in theory will be a crypto-currency based on buying physical gold. It may or may not take off, but is incredibly volatile so I'm hoping this will be the news that gets it to the 6p region so I can sell and start using my trading account properly.

Share of the Week is TND:Tandem Group, which climbed 15% following really strong results. I do regret buying these early on in my investment days, as it's horribly illiquid with a huge spread, which puts so many people off buying them. They are still 30% down after years and the £42 dividends are not enough to make up for that. It is almost tempting to salvage £758 and take a £325 loss just so I can do something more useful with the cash, but their p/e ratio is only 9 so I'm loathe to sell when they could so easily rise by 50% from here on relatively few purchases.

Pointing in the right direction, but a long way to go yet.

The ISA and share accounts look like this

| Weekly Change | |||

| Cash | £6.61 | -£3.75 | |

| Portfolio cost | £50,109.65 | +£0 | |

| Portfolio sell value (bid price - commission) | £42.861.16 | (-14.5%) | +£303.73 |

| Potential profits | £2,171.15 | -£13.85 | |

| Yr 3 Dividends | £44.15 | +£0 | |

| Yr 3 Profit from sales | £6,246.78 | +£0 | |

| Yr 3 Average monthly cash profit | £753.63 | (18.0%) | -£22.00 |

| Total Dividends | £1,223.20 | +£0 | |

| Total Profit from sales | £12,959.28 | +£0 | |

| Average monthly cash profit | £434.79 | (10.4%) | -£3.25 |

| (Sold stocks profit + Dividends - Fees / Months) |

Most of this week's losses were in the ISA, so potential profits are actually slightly down on the MTFB:Motif Bio drop. Rises in IQE:IQE weren't enough to offset that. Overall a small rise of £303 so it may take a while to plug the £7,000 hole.

The gap is still very wide and the rise very shallow

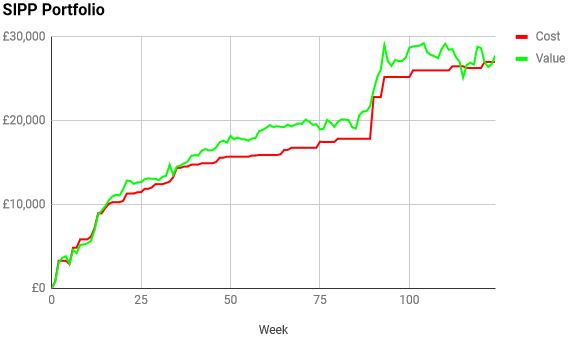

The SIPP looks like this after week 124

| Weekly Change | |||

| Cash | £19.97 | -£10.13 | |

| Portfolio cost | £27,016.24 | +£0 | |

| Portfolio sell value (bid price - commission) | £27,768.83 | (2.8%) | +£1,023.99 |

| Potential profits | £3,744.24 | +£273.17 | |

| Yr 3 Dividends | £0 | +£0 | |

| Yr 3 Profit from sales | £1,023.84 | +£0 | |

| Yr 3 Average monthly cash profit | £210.68 | (9.4%) | -£13.40 |

| Total Dividends | £916.10 | +£0 | |

| Total Profit from sales | £9,949.03 | +£0 | |

| Average monthly cash profit | £372.73 | (16.6%) | -£3.39 |

| (Sold stocks profit + Dividends - Fees / Months) |

The reduction in cash was due to monthly charges, but everything else very positive. Everything was up except ARL:Atlantis Resources which is still suspended and has been for four months today. The other faller was N4P:N4 Pharma which is highly volatile, but fortunately still 5% up on purchase price. Everything else was up.

Back into the black!

Here;s the trading portfolio after week 90

| Weekly Change | |||

| Cash | £0.03 | +£0 | |

| Portfolio cost | £345.65 | +£0 | |

| Portfolio sell value (bid price - commission) | £209.78 | (-39.3%) | +£59.13 |

| Potential profits | £0 | +£0 | |

| Year 2 Dividends | £0 | +£0 | |

| Year 2 Profit | -£218.50 | +£0 | |

| Yr 2 Average monthly cash profit | -£24.92 | (-86.5%) | +£0.67 |

| Dividends | £1.15 | +£0 | |

| Profit from sales | -£241.35 | +£0 | |

| Average monthly cash profit | -£11.57 | (-40.2%) | +£0.13 |

| (Sold stocks profit + Dividends - Fees / Months) |

At last some movement upwards in LION:Lionsgold. Next week will either see a spike so I can sell or a re-trace as traders take their profits before I do. Seeing as this portfolio is cursed, I suspect the latter!

Woohoo!

I had some troubling news this week. It had been six months since I put plans in motion to transfer my pension fund, which is about the maximum I should have been expected to wait, so I contacted my Financial Advisor who seemed shocked. He had requested a new transfer quote on my behalf as the last one had expired, but I didn't know this and it never arrived. He thought I'd decided not to proceed! Given I've not had a pay rise this year and the valuation is based on salary, I've effectively lost 6 months of potential interest. Not happy!

It's going to be warm and sunny next week, so I can be easily distracted from peering at my portfolio - the garden beckons...

No comments:

Post a Comment