IKA:Ilika was the worst performer, dropping 6% after a recent mini rally. These were only a £500 punt so the fact they are 67% down isn't costing me much, and there is still hope of a turnaround if only they could get someone with half a commercial brain on the board.

RED:RedT Energy continue to slip, down another 5% along with TND:Tandem Group whose post-results markup has now been lost completely. These are trading on a p/e ratio of 6.8 which is crazy despite difficulties in the retail sector.

OPTI:Optibiotix fell 4% but that 3p drop cost £1,800 so this would have been a blue week if they had stayed still. I'm now losing £6,993 on these, so the current woes are in no small part down to the performance of this one share. Not surprising considering they make up 52% of my portfolio cost, even after recent re-investment substantially increasing total portfolio cost to £77,471. It's OK though - once they move upwards they will move fast, and that will come when there's some inkling of revenues.

Very few positive performers this week. KIBO:Kibo Mining is doing very well as news of the PPA comes closer. That ought to see a significant re-rate. This climbed 7% and is now only 7% down on my weighted average purchase. With 38,000 shares this could rapidly move into healthy profit, and there may be some free KAT:Katoro Mining shares due. However, with the recent announcement that the KAT:Katoro Mining gold project is unlikely to be economically viable, I'm rather glad I didn't invest independently of the potential free handout.

Share of the Week is N4P:N4 Pharma which climbed 10% and is only 93p in the red, so spread and commission are almost covered, and the momentum seems to be up after the initial dip. Hopefully I almost bought at the bottom of the dip, which would be much better than my usual performance.

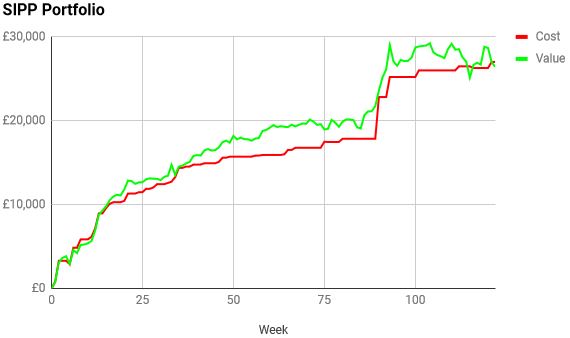

The widest gap there has ever been between the lines.

The ISA and share accounts look like this

| Weekly Change | |||

| Cash | £10.36 | +£0 | |

| Portfolio cost | £50,109.65 | +£0 | |

| Portfolio sell value (bid price - commission) | £41.553.32 | (-17.1%) | -£740.20 |

| Potential profits | £2,210.12 | +£106.33 | |

| Yr 3 Dividends | £44.15 | +£0 | |

| Yr 3 Profit from sales | £6,246.78 | +£0 | |

| Yr 3 Average monthly cash profit | £798.44 | (19.1%) | -£24.19 |

| Total Dividends | £1,223.20 | +£0 | |

| Total Profit from sales | £12,959.28 | +£0 | |

| Average monthly cash profit | £441.21 | (10.6%) | -£3.22 |

| (Sold stocks profit + Dividends - Fees / Months) |

Potential profits were actually up this week, with small increases in my only profitable shares IQE:IQE and VRS:Versarien. IQE:IQE now comprises only 8% of my portfolio cost and 9.1% of my portfolio value, both well under the 10% maximum but on a slightly depressed share price so I have no ambition to add more. VRS:Versarien only make up 4.6% of portfolio cost and 5.2% of portfolio value, so I'm looking to double my holding to get to 10% as I really like the prospects - it's the nearest thing I have to OPTI:Optibiotix for global potential as leaders in a rapidly growing market.

Average monthly profits of 10.6% of my higher portfolio cost is comfortably above target, so despite the dip in paper performance, I'm above target for real income and have been able to build positions in some really exciting new companies.

Pretty bad, but not the worst it's been lately and hopefully ripe for a bounce.

The SIPP looks like this after week 122

| Weekly Change | |||

| Cash | £30.10 | +£0 | |

| Portfolio cost | £27,016.24 | +£0 | |

| Portfolio sell value (bid price - commission) | £26,375.82 | (-2.4%) | -£589.47 |

| Potential profits | £3,402.29 | +£18.88 | |

| Yr 3 Dividends | £0 | +£0 | |

| Yr 3 Profit from sales | £1,023.84 | +£0 | |

| Yr 3 Average monthly cash profit | £236.53 | (10.5%) | -£13.91 |

| Total Dividends | £916.10 | +£0 | |

| Total Profit from sales | £9,949.03 | +£0 | |

| Average monthly cash profit | £379.20 | (16.8%) | -£3.14 |

| (Sold stocks profit + Dividends - Fees / Months) |

Potential profits were just about up in here too, with LGEN:Legal & General making a small recovery tempered by a very small drop in CAML:Central Asia Metals. OPTI:Optibiotix is mostly responsible for the drop in value. Long term average monthly profits are very similar to the other account, dropping by around £3 a week with no sales. The 6.8% buffer I have over my target income of 10% means I'm under no pressure to sell for a long time.

The drop was enough to take the portfolio back into the red, but only just.

The trading portfolio looks like this after 88 dismal weeks

| Weekly Change | |||

| Cash | £0.03 | +£0 | |

| Portfolio cost | £345.65 | +£0 | |

| Portfolio sell value (bid price - commission) | £161.74 | (-53.2%) | -£14.78 |

| Potential profits | £0 | +£0 | |

| Year 2 Dividends | £0 | +£0 | |

| Year 2 Profit | -£218.50 | +£0 | |

| Yr 2 Average monthly cash profit | -£26.30 | (-91.3%) | +£0.75 |

| Dividends | £1.15 | +£0 | |

| Profit from sales | -£241.35 | +£0 | |

| Average monthly cash profit | -£11.83 | (-41.1%) | +£0.13 |

| (Sold stocks profit + Dividends - Fees / Months) |

The last few weeks this has bounced up and down by £14, but it needs to bounce up a hell of a lot further before I can get rid and start using this account properly.

Yuck!

I've not reviewed Nemesis Share contenders for a while. Clearly OPTI:Optibiotix is winning hands down with losses of £6,993, but who's next? For a long time my contenders were losing around £800 but it's worse than that now.

In second place is JLP:Jubilee Metals which has dived from almost being in profit to £1,985 paper loss thanks to shareholders losing trust in the directors. There's still a great deal of promise here, but even loyal long term holders are feeling pretty fed up at the moment.

In third place is TRX:Tissue Regenix which is losing £1,107 in my SIPP as I kept buying at around 18.5p, convinced it had a great global future. The problem is the cash burn is far greater than the revenue coming in, and there's no sign of that changing, so this is going to have to be a long term holding with the hope that a big company will buy them out and teach them how to make a profit.

Apart from BLOC:Block Commodities (ex AFPO:African Potash) which appears to be just a bandwagon-following mechanism for directors to earn a living using shareholders cash, and is losing £714, everything else is losing between £100 and £500 so nothing too serious, just lots and lots of small losses but with reasonable chance of moving to profit for quite a few of them.

So although a certain amount of doom and gloom with the current portfolio value, I'm optimistic things will get better as news filters through over the next few months.

No comments:

Post a Comment