There were no big losers this week, which is something I virtually never get to say. The biggest drop was SBTX:SkinBioTherapeutics which lost 4%. I think some people sell this to buy OPTI:Optibiotix when it's going up, then sell and put it back in SBTX. This one quite often drops when OPTI gains and vice versa. Doesn't make sense really, because when SBTX goes up, OPTI's holding increases in value so OPTI should go up too.

IQE:IQE climbed 6% in the long slow road to recovery. Even the shares I thought I was buying dirt cheap are down by 17% and my SIPP is down by 52%.

JLP:Jubilee Metals has been creeping upwards ever so slowly. It climbed another 6% this week but is still 24% down. I'm satisfied that the prospects are better now than they were when I first bought them, so hoping they can make that push to profit in the next 12 months.

CAML:Central Asia Metals has been on a bit of a roll since the dividend date, and climbed 8% this week. The dividend lands in 9 days time and will be a nice boost to my pension pot prior to next month's £2,000 top up from my work pension.

Share of the Week for the second week in a row is OPTI:Optibiotix. The 6p rise was 10% and leaves it 19% down. There was great news on formal GRAS certification (Generally Regarded As Safe) from the FDA, and the LP-LDL production facility was certified as the required grade for pharmaceutical manufacture. Lots of potential deals have been waiting for this, so the flood gates could open now.

Trial adverts for Slimbiome have been appearing in papers as BioEnergiser step up the publicity, and a new flavouring product is about to be launched. That was a complete surprise, and shows there is much more going on behind the scenes that we're not aware of. Can't wait for the day they announce the discovery of a new strain of bacteria that does something cool.

Boing!

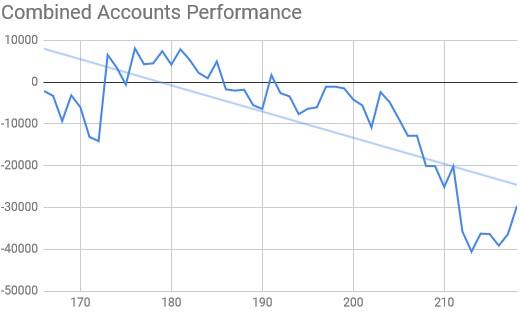

Still below the trend line but offers a glimmer of hope.

Here's the ISA and share portfolio performance

| Weekly Change | |||

| Cash | £3.24 | -£3.12 | |

| Portfolio cost | £57,768.95 | +£0 | |

| Portfolio sell value (bid price-commission) | £39,135.79 | (-32.3%) | +£3,726.69 |

| Potential profits | £0 | +£0 | |

| Yr 5 Dividends | £0.63 | +£0.63 | |

| Yr 5 Profit from sales | £-167.28 | +£0 | |

| Yr 5 Average monthly cash profit | -£75.47 | (-1.6%) | +£6.88 |

| Total Dividends | £1,342.93 | +£0.63 | |

| Total Profit from sales | £20,224.13 | +£0 | |

| Average monthly cash profit | £424.75 | (8.8%) | -£2.02 |

| (Sold stocks profit + Dividends - Fees / Months) |

Cash dropped due to £3.75 monthly charge but gained 63p from when AMYT:Amryt Pharma consolidated their shares, which I've counted as a dividend. Big boost for the portfolio value but a long way to go till break-even

Back above the injection line thank goodness

Still well below the trend line

The SIPP looks like this after week 202

| Weekly Change | ||||

| Cash | £6.17 | -£11.79 | ||

| Portfolio cost | £43,965.42 | +£0 | ||

| Portfolio sell value (bid price - commission) |

£33,961.47 | (-22.8%) | +£3,034.63 | |

| Potential profits | £598.90 | +£368.05 | ||

| Yr 4 Dividends | £361.99 | +£0 | ||

| Yr 4 Interest | £0.10 | +£0 | ||

| Yr 4 Profit from sales | £1,161.95 | +£0 | ||

| Yr 4 Average monthly cash profit | £129.81 | (3.5%) | -£4.02 | |

| Total Dividends | £1,704.24 | +£0 | ||

| Total Interest | £0.13 | +£0 | ||

| Total Profit from sales | £11,706.87 | +£0 | ||

| Average monthly cash profit | £278.52 | (7.6%) | -£1.64 | |

| (Sold stocks profit + Dividends - Fees / Months) |

Charges have reduced cash to below what I need for next month's charges, but the CAML:Central Asia Metals dividend will fix that. Great big surge in value and good increase in potential profits of £368 thanks to CAML:Central Asia Metals which mitigated the losses from the SBTX:SkinBioTherapeutics fall. Average performance well below the 10% target now, but still no prospect of selling anything.

Still closer to the orange line than the red

Nearer the trend line than with the other account

Here's the trading account after week 168

| Weekly Change | |||

| Cash | £35.04 | +£0 | |

| Portfolio cost | £2,321.29 | +£0 | |

| Portfolio sell value (bid price - commission) | £1,287.67 | (-44.5%) | +£38.28 |

| Potential profits | £0 | +£0 | |

| Year 4 Dividends | £0 | +£0 | |

| Year 4 Profit | £0 | +£0 | |

| Yr 4 Average monthly cash profit | £0 | (0%) | +£0 |

| Dividends | £34.72 | +£0 | |

| Profit from sales | -£64.29 | +£0 | |

| Average monthly cash profit | -£0.76 | (-0.4%) | +£0.01 |

| (Sold stocks profit + Dividends - Fees / Months) |

An increase, but it's less than last week's drop. Two increased and two dropped this week and none are anywhere near the point where I can sell

Nearly back above the trend line which is flattening as the higher value of 12 months ago vanishes off the left of the chart. Unfortunately the whole line needs to move up £750 just to get to zero.

Nothing expected next week so jut hope the OPTI:Optibiotix recovery will continue. Lots of announcements are expected so maybe we'll get one next week.

No comments:

Post a Comment