Joint biggest loser was IQE:IQE, dropping 14% despite the shorters jumping at the chance to close their positions.

Also dropping 14% were JLP:Jubilee Metals which has gone from almost in profit to 50% down, and MMX:Minds + Machines which has also gone from almost in profit, but to 33% down.

WRES:W Resources dropped 12% but I've hardly got any and I wrote them off years ago.

IKA:Ilika were almost in profit and dropped 9% this week to go 27% down. I've also got the misery of having signed up for some more shares on open offer at 40p when I could buy them for 35p now. However, there's no commission on the open offer so given the small number of shares available, it's still cheaper paying 40p.

SBTX:SkinBioTherapeutics dropped 10% in my SIPP and 8% in my ISA to go 56% and 68% down. Can't believe I was planning to trade these thinking I was getting a bargain. It's not been terribly successful, although I shouldn't complain at the £2,425 profit I've made from trading SBTX up till now. It might just be a while before I get to do it again! My aim has always been to trade them with a view to increasing my holding, as I think they have a great future and should be profitable within 2 years.

CAML:Central Asia Metals dropped 7% this week and has gone from my only profitable share to 31% down within a month. I'm determined to take advantage of this to increase my SIPP holding to 5,000 shares and reap a massive annual dividend.

TRMR:Tremor fell another 5% this week and are now 67% down, but I still think their fundamentals are good. It was however meant to be a quick win in my trading account.

OPTI:Optibiotix only dropped 1p this week, but that cost me £1,100 and puts my biggest holding 50% down, just 4 weeks after nearly going into profit and despite announcing 3 big new deals since then.

I'm happy to say that we do have a Share of the Week, as one company increased in value. TEK:Tekcapital climbed 6% after news one of its holdings is developing a home testing kit for Covid-19. They are still 70% down on my purchase price though.

I've given up caring any more.

Yeah, whatever

Here's the ISA and shares portfolios

| Weekly Change | |||

| Cash | £55.48 | +£0 | |

| Portfolio cost | £59,787.80 | +£0 | |

| Portfolio sell value (bid price-commission) | £24,620.91 | (-58.8%) | -£1,864.01 |

| Potential profits | £0 | +£0 | |

| Yr 5 Dividends | £0.63 | +£0 | |

| Yr 5 Profit from sales | £-167.28 | +£0 | |

| Yr 5 Average monthly cash profit | -£25.33 | (-0.5%) | +£0.79 |

| Total Dividends | £1,342.93 | +£0 | |

| Total Profit from sales | £20,224.13 | +£0 | |

| Average monthly cash profit | £383.87 | (7.7%) | -£1.60 |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Performance/Injection | 11.7% | -0.1% | |

| Compound performance | 54% | +0% |

Pretty uneventful apart from losing loads more money, but that's become the norm now.

I'm still happy with my OPTI:Optibiotix purchase at 42p last week. They may only cost 34p now, but 42p is still insanely cheap. 34p is madness!

£35,000 in the red - ooh goody.

The SIPP looks like this after week 225

| Weekly Change | ||||

| Cash | £48.51 | +£0 | ||

| Portfolio cost | £49,176.17 | +£0 | ||

| Portfolio sell value (bid price - commission) |

£23,143.03 | (-52.9%) | -£1,612.62 | |

| Potential profits | £0 | +£0 | ||

| Yr 5 Dividends | £0 | +£0 | ||

| Yr 5 Interest | £0.03 | +£0 | ||

| Yr 5 Profit from sales | £0 | +£0 | ||

| Yr 5 Average monthly cash profit | -£14.17 | (-0.3%) | -£0.89 | |

| Total Dividends | £1,899.24 | +£0 | ||

| Total Interest | £0.20 | +£0 | ||

| Total Profit from sales | £12,549.10 | +£0 | ||

| Average monthly cash profit | £268.66 | (6.6%) | -£1.20 | |

| (Sold stocks profit + Dividends - Fees / Months) | ||||

| Performance/Injection | 10.1% | -0.1% | ||

| Compound performance | 44% | +0% |

Same story as the ISA.

I never thought I'd see this account in such a bad way.

£25,000 in the red. My only consolation is that if it can drop that far that quickly, it ought to be able to climb almost as quickly when the madness ends.

The trading account looks like this after week 191

| Weekly Change | |||

| Cash | £48.24 | +£0 | |

| Portfolio cost | £2,321.29 | +£0 | |

| Portfolio sell value (bid price - commission) | £839.05 | (-63.9%) | -£73.82 |

| Potential profits | £0 | +£0 | |

| Year 4 Dividends | £13.20 | +£0 | |

| Year 4 Profit | £0 | +£0 | |

| Yr 4 Average monthly cash profit | £1.63 | (0.8%) | -£0.05 |

| Dividends | £47.92 | +£0 | |

| Profit from sales | -£64.29 | +£0 | |

| Average monthly cash profit | -£0.37 | (-0.2%) | +£0 |

| (Sold stocks profit + Dividends - Fees / Months) | |||

| Performance/Injection | -0.2% | +0% | |

| Compound performance | -1% | +0% |

Yet another big dip. 191 weeks of abject failure where I've made an average loss of 37p a month. You could say that's cheap for the lessons I've learned while doing it. Will I ever get any good at it though? Not looking too promising at the moment.

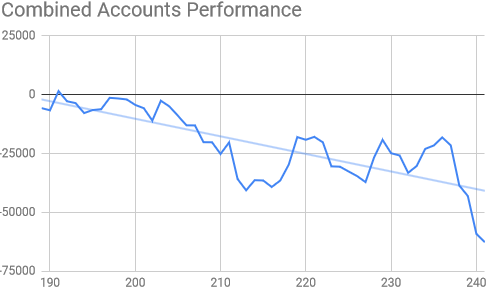

A picture tells a thousand words

I am going to have to adjust the lower chart range if we get another negative week.

One teensy ray of sunshine in the misery is that my March pension contribution got paid in, and because my pension is in a bonds fund it hasn't been too badly affected by the crash. There was £2,300 in the account which was enough for me to put in a £2,000 transfer request to my SIPP.

I'm still planning to top up my CAML:Central Asia Metals holding to 5,000 shares with half of it, even if I have to add a few hundred quid of my own money, and although massively tempted to get more OPTI:Optibiotix shares at this price, I have to start buying dividend-paying shares, so I'm sticking with FXPO:Ferrexpo for the other £1,000. Their recent results were good and they are way ahead of all other shares in my ranking spreadsheet. They have postponed making a dividend announcement, but have massive free cash flow, so I think there will be a boost to the share price once this is announced. Their share price climbed a little following the results, but should double in short time, resulting in a stunning dividend yield for many years to come. My only fear is that it will take 10 days for the transfer to come through and they may not be so cheap then.

No comments:

Post a Comment